by Calculated Risk on 7/10/2022 08:19:00 PM

Sunday, July 10, 2022

Sunday Night Futures

Weekend:

• Schedule for Week of July 10, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $104.79 per barrel and Brent at $107.02 per barrel. A year ago, WTI was at $75, and Brent was at $77 - so WTI oil prices are up 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.67 per gallon. A year ago, prices were at $3.12 per gallon, so gasoline prices are up $1.55 per gallon year-over-year.

Hotels: Occupancy Rate Up 2.9% Compared to Same Week in 2019

by Calculated Risk on 7/10/2022 08:11:00 AM

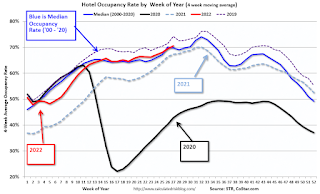

U.S. hotel performance dipped from the previous week, while indexed comparisons against 2019 improved on the favorable side of a holiday calendar shift, according to STR‘s latest data through July 2.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

June 26 to July 2, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 67.3% (+2.9%)

• Average daily rate (ADR): $153.32 (+19.7%)

• Revenue per available room (RevPAR): $103.24 (+23.1%)

Given historical trends, the week-over-week decline in demand was normal given the holiday. Since 2000, the Fourth of July or the observance of the holiday (federal holiday) has fallen on a Monday seven times, including last year and in 2016. In every case, occupancy in the week before the holiday fell by more than four percentage points with most of the losses beginning on Wednesday and continuing into the weekend. Occupancy and demand are likely to fall again for this current week before strengthening in the remaining weeks of July.

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, July 09, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/09/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• House Price Declines: How Long for Real Prices to Recover?

• 30-Year Mortgage Rates Decrease to 5.50%

• Black Knight Mortgage Monitor: "Early signs of cooling in the housing market"

• 1st Look at Local Housing Markets in June

• Apartment Vacancy Rate Declined in Q2

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

AAR: June Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 7/09/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

In June, total U.S. carloads fell 1.5% from last year, their third consecutive monthly decline. ...

U.S intermodal originations in June were down 4.6% from last year, their fifth decline in 2022’s first six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

U.S. railroads originated 1.16 million total carloads in June 2022, down 1.5% from June 2021. It’s the third consecutive year-over-year decline and the fourth in the first six months of 2022. In 2022’s second quarter, total carloads were down 2.7% from last year; in the first half, they were down 0.1%. Since 1988, when our data begin, only 2020 had fewer first-half carloads than 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S railroads also originated 1.32 million intermodal units in June, down 4.6% from last year. It’s the fifth decline in 2022’s first six months and the 10th in the past 11 months. Intermodal originations averaged 264,624 per week in June 2022, the fewest in four months.

Schedule for Week of July 10, 2022

by Calculated Risk on 7/09/2022 08:11:00 AM

The key reports this week are June CPI and retail sales.

For manufacturing, the June Industrial Production report and the July New York Fed manufacturing survey will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 1.1% increase in CPI, and a 0.6% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 5.8% YoY.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand down from 235 thousand last week.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.5% increase in core PPI.

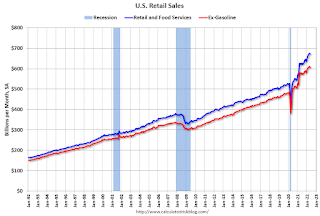

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in May.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -2.6, down from -1.2.

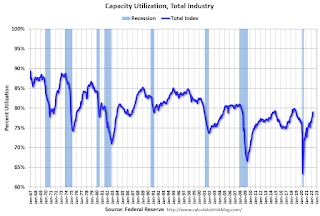

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a no change in Industrial Production, and for Capacity Utilization to decrease to 80.4%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

Friday, July 08, 2022

COVID July 8, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/08/2022 09:27:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 67.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.5 | --- | ≥2321 | |

| New Cases per Day3 | 106,021 | 112,330 | ≤5,0002 | |

| Hospitalized3🚩 | 29,327 | 27,322 | ≤3,0002 | |

| Deaths per Day3 | 277 | 341 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Used Vehicle Wholesale Prices Decreased 1.3% in June

by Calculated Risk on 7/08/2022 03:23:00 PM

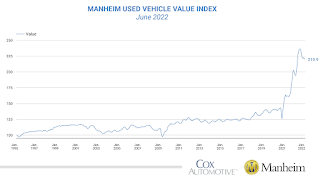

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in June from Seasonal Adjustment

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 1.3% in June from May. The Manheim Used Vehicle Value Index declined to 219.9, up 9.7% from a year ago. The non-adjusted price change in June decreased 1.8% compared to May, leaving the unadjusted average price up 10.7% year over year.

In June, Manheim Market Report (MMR) values saw larger declines over the last two weeks than the prior two weeks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Apartment Vacancy Rate Declined in Q2

by Calculated Risk on 7/08/2022 01:25:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Apartment Vacancy Rate Declined in Q2

A brief excerpt:

Moody’s Analytics Reis reported that the apartment vacancy rate was at 4.5% in Q2 2022, down from 4.7% in Q1, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Moody’s Analytics is just for large cities. ...

Click on graph for larger image.

Moody’s Analytics also reported the effective rents were up 2.8% in Q2 from Q1, and up 17.5% year-over-year. Last week, I posted a graph of the year-over-year change for various measures of rent. The Zillow measure is up 15.9% YoY in May, down from 16.6% YoY in April. This is down from a peak of 17.2% YoY in February. The ApartmentList measure is up 14.1% YoY as of June, down from 15.4% in May. This is down from the peak of 17.8% YoY last December.

Q2 GDP Forecasts: Slightly Negative

by Calculated Risk on 7/08/2022 12:22:00 PM

Note: We've seen two consecutive quarters of negative GDP before without a recession (that isn't the definition). If Q2 is negative, it will mostly be due to inventory and trade issues. No worries. My view is the US economy is not currently in a recession, see: Predicting the Next Recession

From BofA:

We are now tracking -1.2% qoq saar growth for 2Q, down from 0.0% qoq saar previously.From Goldman:

It is reasonable to dismiss some of the signal from the GDP declines that may have taken place in the first two quarters of the year on account of the large negative contributions from net trade and inventories. In addition, there is a larger-than-normal gap between GDP and GDI which, historically, has been resolved by GDP getting revised toward GDI, suggesting that some of the as-reported weakness in activity may get revised away over time. [July 8 estimate]

emphasis added

We left our Q2 GDP tracking estimate unchanged at +0.7% (qoq ar). [July 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.2 percent on July 8, up from -1.9 percent on July 7. [July 8 estimate]

Comments on June Employment Report

by Calculated Risk on 7/08/2022 09:27:00 AM

The headline jobs number in the June employment report was above expectations, however employment for the previous two months was revised down by 74,000. The participation rate and the employment-population ratio both decreased slightly, and the unemployment rate was unchanged at 3.6%.

In June, the year-over-year employment change was 6.3 million jobs.

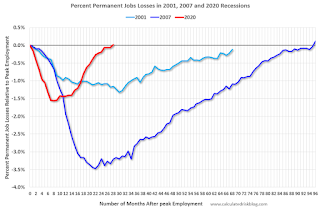

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In June, the number of permanent job losers declined to 1.273 million from 1.386 million in the previous month.

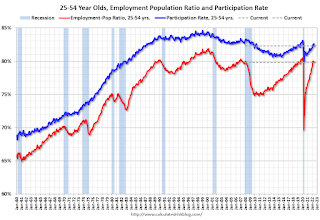

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate decreased in June to 82.3% from 82.6% in May, and the 25 to 54 employment population ratio decreased to 79.8% from 80.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons declined by 707,000 to 3.6 million in June and is below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in June to 3.621 million from 4.328 million in May. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.7% from 7.1% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is lower than the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.336 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.356 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; however, the previous two months were revised down by 74,000 combined.