by Calculated Risk on 7/11/2022 11:00:00 AM

Monday, July 11, 2022

Homebuilder Comments in June: “Someone turned out the lights on our sales in June!"

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in June: “Someone turned out the lights on our sales in June!""

A brief excerpt:

Read these builder comments from around the country. Sales have declined sharply in June.There many more comments in the article. You can subscribe at https://calculatedrisk.substack.com/

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

#Atlanta builder: “Someone turned out the lights on our sales in June!”

#Austin builder: “Sales have fallen off a cliff. We’re selling 1/3 of what we sold in March and April. Trades are more willing to negotiate pricing since market has adjusted significantly past 60 days.”

#Birmingham builder: “Sales have fallen 75% the last two months in a further out community.”

#Boise builder: “Sales have slowed tremendously. Builders are dropping prices and halting new starts. Seeing prices drop on labor due to slowing of home starts. Expecting 15% to 20% reduction in most costs.”

Housing Inventory July 11th Update: Up 32% Year-over-year

by Calculated Risk on 7/11/2022 10:15:00 AM

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 104% since then. More than double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 25.0% according to Altos)

4. Inventory up compared to 2019 (currently down 48.9%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/11/2022 08:30:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 10th.

Click on graph for larger image.

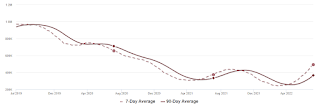

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 14.4% from the same day in 2019 (85.6% of 2019). (Dashed line)

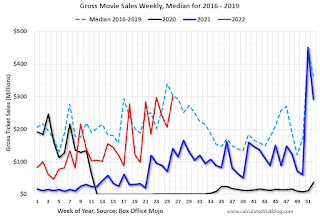

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $206 million last week, down about 39% from the median for the week.

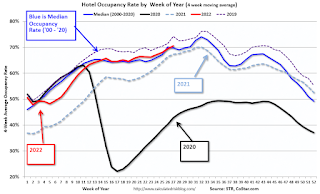

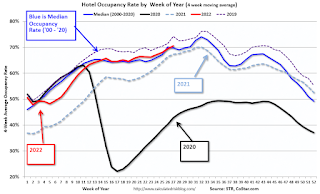

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 2nd. The occupancy rate was up 2.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 1st, gasoline supplied was down 0.8% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

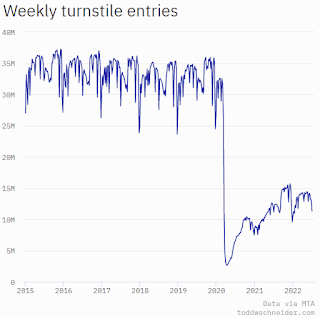

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 8th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 10, 2022

Sunday Night Futures

by Calculated Risk on 7/10/2022 08:19:00 PM

Weekend:

• Schedule for Week of July 10, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $104.79 per barrel and Brent at $107.02 per barrel. A year ago, WTI was at $75, and Brent was at $77 - so WTI oil prices are up 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.67 per gallon. A year ago, prices were at $3.12 per gallon, so gasoline prices are up $1.55 per gallon year-over-year.

Hotels: Occupancy Rate Up 2.9% Compared to Same Week in 2019

by Calculated Risk on 7/10/2022 08:11:00 AM

U.S. hotel performance dipped from the previous week, while indexed comparisons against 2019 improved on the favorable side of a holiday calendar shift, according to STR‘s latest data through July 2.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

June 26 to July 2, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 67.3% (+2.9%)

• Average daily rate (ADR): $153.32 (+19.7%)

• Revenue per available room (RevPAR): $103.24 (+23.1%)

Given historical trends, the week-over-week decline in demand was normal given the holiday. Since 2000, the Fourth of July or the observance of the holiday (federal holiday) has fallen on a Monday seven times, including last year and in 2016. In every case, occupancy in the week before the holiday fell by more than four percentage points with most of the losses beginning on Wednesday and continuing into the weekend. Occupancy and demand are likely to fall again for this current week before strengthening in the remaining weeks of July.

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, July 09, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/09/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• House Price Declines: How Long for Real Prices to Recover?

• 30-Year Mortgage Rates Decrease to 5.50%

• Black Knight Mortgage Monitor: "Early signs of cooling in the housing market"

• 1st Look at Local Housing Markets in June

• Apartment Vacancy Rate Declined in Q2

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

AAR: June Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 7/09/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

In June, total U.S. carloads fell 1.5% from last year, their third consecutive monthly decline. ...

U.S intermodal originations in June were down 4.6% from last year, their fifth decline in 2022’s first six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

U.S. railroads originated 1.16 million total carloads in June 2022, down 1.5% from June 2021. It’s the third consecutive year-over-year decline and the fourth in the first six months of 2022. In 2022’s second quarter, total carloads were down 2.7% from last year; in the first half, they were down 0.1%. Since 1988, when our data begin, only 2020 had fewer first-half carloads than 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S railroads also originated 1.32 million intermodal units in June, down 4.6% from last year. It’s the fifth decline in 2022’s first six months and the 10th in the past 11 months. Intermodal originations averaged 264,624 per week in June 2022, the fewest in four months.

Schedule for Week of July 10, 2022

by Calculated Risk on 7/09/2022 08:11:00 AM

The key reports this week are June CPI and retail sales.

For manufacturing, the June Industrial Production report and the July New York Fed manufacturing survey will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 1.1% increase in CPI, and a 0.6% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 5.8% YoY.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand down from 235 thousand last week.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.5% increase in core PPI.

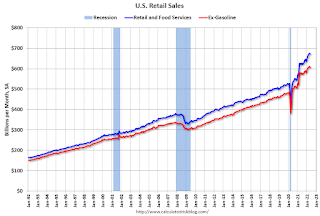

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in May.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -2.6, down from -1.2.

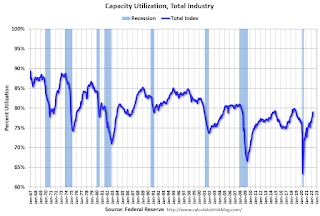

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a no change in Industrial Production, and for Capacity Utilization to decrease to 80.4%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

Friday, July 08, 2022

COVID July 8, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/08/2022 09:27:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 67.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.5 | --- | ≥2321 | |

| New Cases per Day3 | 106,021 | 112,330 | ≤5,0002 | |

| Hospitalized3🚩 | 29,327 | 27,322 | ≤3,0002 | |

| Deaths per Day3 | 277 | 341 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

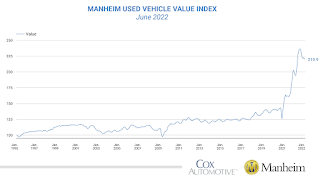

Used Vehicle Wholesale Prices Decreased 1.3% in June

by Calculated Risk on 7/08/2022 03:23:00 PM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in June from Seasonal Adjustment

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 1.3% in June from May. The Manheim Used Vehicle Value Index declined to 219.9, up 9.7% from a year ago. The non-adjusted price change in June decreased 1.8% compared to May, leaving the unadjusted average price up 10.7% year over year.

In June, Manheim Market Report (MMR) values saw larger declines over the last two weeks than the prior two weeks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.