by Calculated Risk on 7/18/2022 08:54:00 AM

Monday, July 18, 2022

Housing Inventory July 18th Update: Up 30% Year-over-year

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 110% since then. More than double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 21.4% according to Altos)

4. Inventory up compared to 2019 (currently down 47.6%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/18/2022 08:31:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 17th.

Click on graph for larger image.

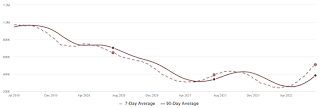

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.3% from the same day in 2019 (87.7% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $334 million last week, up about 14% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 9th. The occupancy rate was down 14.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

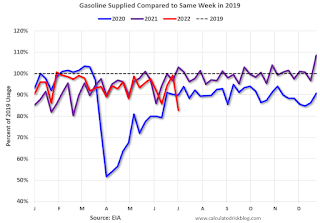

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 8th, gasoline supplied was down 17.3% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

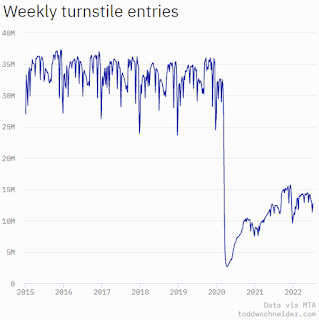

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 15th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 17, 2022

Monday: Homebuilder Survey

by Calculated Risk on 7/17/2022 08:15:00 PM

Weekend:

• Schedule for Week of July 17, 2022

Monday:

• At 10:00 AM ET, The July NAHB homebuilder survey. The consensus is for a reading of 66, down from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 50 (fair value).

Oil prices were down over the last week with WTI futures at $97.26 per barrel and Brent at $100.85 per barrel. A year ago, WTI was at $72, and Brent was at $74 - so WTI oil prices are up 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.50 per gallon. A year ago, prices were at $3.15 per gallon, so gasoline prices are up $1.35 per gallon year-over-year.

Record Single Family Investor Buying in Q1, Possible evidence of Slowdown in Q2

by Calculated Risk on 7/17/2022 09:58:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Record Single Family Investor Buying in Q1, Possible evidence of Slowdown in Q2

A brief excerpt:

Housing economist Tom Lawler discusses the CoreLogic data: CoreLogic: Share of SF Homes Purchased by Investors Hit Record High in Q1/2022; Non-Investor Home Purchases Down Significantly YOYThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In its quarterly report on “investor” home buying activity, CoreLogic reported that SF homes purchased by “investors – defined as entities (individual or corporate) who retained at least three properties simultaneously within the last 10 years – increased to a record high of 27.6% in the first quarter of 2022, up from 24.8% in the fourth quarter of 2021 and 19.2% from the first quarter of 2021.

...

CR Notes: Investors pulling back could be a factor in less housing demand. Housing analyst Ivy Zelman said last week about non-primary buyers (edited slightly for clarity):

And we think about non-primary for those that you know, might not appreciate what that includes: second home buyers, private investors, institutional investors and the institutional investors could also incorporate what we call the intermediaries. Liquidity providers; iBuyers. So, there's been tremendous speculation and aggregate that number or the latest sort of first Q - we don't have two Q yet - aggregated to about 24% of transactions, and we think that's even understating it …

...

[We are seeing less] demand and seasonally worse than normal activity and increasing [cancellations] … And I do think the non-primary is a big factor.

Saturday, July 16, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/16/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Early Read on Existing Home Sales in June

• Current State of the Housing Market

• Lawler on Demographics: Observations and Updated Population Projections

• 2nd Look at Local Housing Markets in June

• Homebuilder Comments in June: “Someone turned out the lights on our sales in June!

• Apartment Vacancy Rate Declined in Q2

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of July 17, 2022

by Calculated Risk on 7/16/2022 08:11:00 AM

The key reports this week are June Housing Starts and Existing Home Sales.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 66, down from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

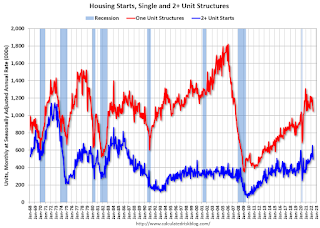

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and total housing starts since 1968.

The consensus is for 1.586 million SAAR, up from 1.549 million SAAR in May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

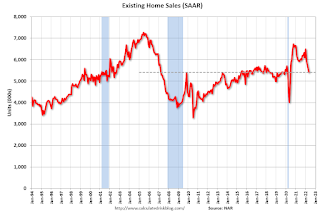

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, down from 5.41 million last month.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, down from 5.41 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.12 million SAAR for June.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand down from 244 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.5, up from -3.1.

10:00 AM: State Employment and Unemployment (Monthly) for June 2022

Friday, July 15, 2022

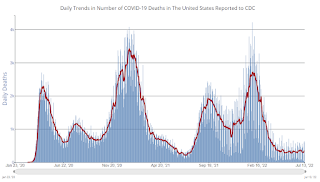

COVID July 15, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/15/2022 09:48:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 126,023 | 107,572 | ≤5,0001 | |

| Hospitalized2🚩 | 32,824 | 29,574 | ≤3,0001 | |

| Deaths per Day2🚩 | 348 | 320 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Early Read on Existing Home Sales in June

by Calculated Risk on 7/15/2022 03:42:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Early Read on Existing Home Sales in June

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.12 million in June, down 5.4% from May’s preliminary pace and down 14.2% from last June’s seasonally adjusted pace.

...

CR Notes:

With a new holiday this year in June, Juneteenth, it is possible the seasonal adjustment will be off a little. However, the local markets I track suggest a significant year-over-year decline in NSA sales for June.

The National Association of Realtors® (NAR) is schedule to release June existing home sales on Wednesday, July 20th at 10:00 AM ET. The consensus is for 5.40 million SAAR, down from 5.41 million last month. Based on Tom Lawler’s estimate, we should expect a large negative surprise.

Q2 GDP Forecasts: Slightly Negative

by Calculated Risk on 7/15/2022 12:28:00 PM

Note: We've seen two consecutive quarters of negative GDP before without a recession (that isn't the definition). If Q2 is negative, it will mostly be due to inventory and trade issues. No worries. My view is the US economy is not currently in a recession, see: Predicting the Next Recession

From BofA:

Incoming data pushed our tracking estimate for 2Q growth lower by 0.3pp to -1.4% qoq saar [July 15 estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +0.7% (qoq ar). [July 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.5 percent on July 15, down from -1.2 percent on July 8. [July 15 estimate]

Industrial Production Decreased 0.2 Percent in June

by Calculated Risk on 7/15/2022 09:21:00 AM

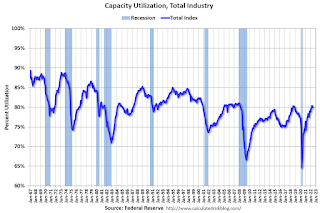

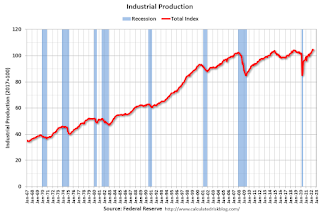

From the Fed: Industrial Production and Capacity Utilization

Total industrial production moved down 0.2 percent in June but advanced at an annual rate of 6.1 percent for the second quarter as a whole. Manufacturing output declined 0.5 percent for a second consecutive month in June; even so, it rose at an annual rate of 4.2 percent in the second quarter. In June, the index for mining advanced 1.7 percent, while the index for utilities fell 1.4 percent. At 104.4 percent of its 2017 average, total industrial production in June was 4.2 percent above its year-earlier level. Capacity utilization decreased 0.3 percentage point in June to 80.0 percent, a rate that is 0.4 percentage point above its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 80.0% is 0.4% above the average from 1972 to 2021. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in June to 105.7. This is above the pre-pandemic level.

The change in industrial production was below consensus expectations.