by Calculated Risk on 7/26/2022 10:09:00 AM

Tuesday, July 26, 2022

New Home Sales Decrease Sharply to 590,000 Annual Rate in June

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 590 thousand.

The previous three months were revised down significantly.

Sales of new single‐family houses in June 2022 were at a seasonally adjusted annual rate of 590,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.1 percent below the revised May rate of 642,000 and is 17.4 percent below the June 2021 estimate of 714,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now below pre-pandemic levels.

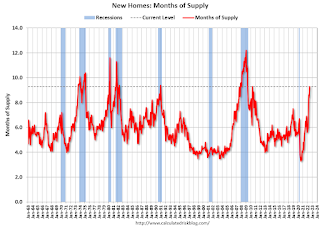

The second graph shows New Home Months of Supply.

The months of supply increased in June to 9.3 months from 8.4 months in May.

The months of supply increased in June to 9.3 months from 8.4 months in May. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of June was 457,000. This represents a supply of 9.3 months at the current sales rate."

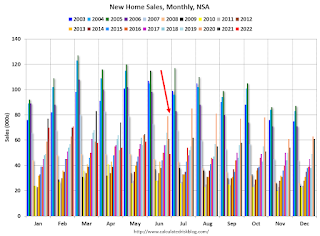

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2022 (red column), 49 thousand new homes were sold (NSA). Last year, 61 thousand homes were sold in June.

The all-time high for June was 115 thousand in 2005, and the all-time low for June was 28 thousand in 2010 and in 2011.

This was well below expectations, and sales in the three previous months were revised down significantly. I'll have more later today.

Comments on May Case-Shiller and FHFA House Price Increases

by Calculated Risk on 7/26/2022 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 19.7% Year-over-year in May

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for May were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for “May” is a 3-month average of March, April and May closing prices. May closing prices include some contracts signed in January, so there is a significant lag to this data.

The MoM increase in Case-Shiller was at 1.04%. This was the smallest MoM increase since July 2020, and since this includes closings in March and April, this suggests price growth has slowed sharply.

Case-Shiller: National House Price Index increased 19.7% year-over-year in May

by Calculated Risk on 7/26/2022 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports Annual Home Price Gain Of 19.7% In May

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.7% annual gain in May, down from 20.6% in the previous month. The 10-City Composite annual increase came in at 19.0%, down from 19.6% in the previous month. The 20-City Composite posted a 20.5% year-over-year gain, down from 21.2% in the previous month.

Tampa, Miami, and Dallas reported the highest year-over-year gains among the 20 cities in May. Tampa led the way with a 36.1% year-over-year price increase, followed by Miami with a 34.0% increase, and Dallas with a 30.8% increase. Four of the 20 cities reported higher price increases in the year ending May 2022 versus the year ending April 2022.

...

Before seasonal adjustment, the U.S. National Index posted a 1.5% month-over-month increase in May, while the 10-City and 20-City Composites posted increases of 1.4% and 1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.0%, and the 10-City and 20-City Composites both posted increases of 1.3%.

In May, all 20 cities reported increases before and after seasonal adjustments.

“Housing data for May 2022 continued strong, as price gains decelerated slightly from very high levels,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index rose by 19.7% for the 12 months ended May, down from April’s 20.6% year-over-year gain. We see a similar pattern in the 10-City Composite (up 19.0% in May vs. 19.6% in April) and in the 20-City Composite (+20.5% vs. +21.2%). Despite this deceleration, growth rates are still extremely robust, with all three composites at or above the 98th percentile historically

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.3% in May (SA).

The Composite 20 index is up 1.3% (SA) in May.

The National index is 60% above the bubble peak (SA), and up 1.0% (SA) in May. The National index is up 119% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 19.0% year-over-year. The Composite 20 SA is up 20.5% year-over-year.

The National index SA is up 19.7% year-over-year.

Price increases were slightly lower than expectations. I'll have more later.

Monday, July 25, 2022

Tuesday: New Home Sales, Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 7/25/2022 08:55:00 PM

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. The consensus is for a 21.0% year-over-year increase in the Comp 20 index for May.

• Also at 9:00 AM, FHFA House Price Index for May. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 666 thousand SAAR, down from 696 thousand in May.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 120,032 | 129,355 | ≤5,0001 | |

| Hospitalized2 | 33,226 | 34,347 | ≤3,0001 | |

| Deaths per Day2 | 365 | 380 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

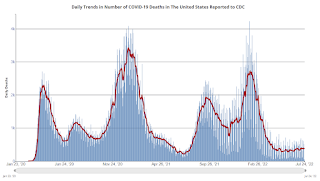

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Will Housing Inventory Follow the Normal Seasonal Pattern?

by Calculated Risk on 7/25/2022 03:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Will Housing Inventory Follow the Normal Seasonal Pattern?

A brief excerpt:

The next couple of months will be important for housing inventory. Will inventory follow the normal seasonal pattern and peak in the summer? Or will inventory peak later in the year (like October or November)?There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

My current outlook on house prices assumes that inventory will continue to increase into the Fall.

...

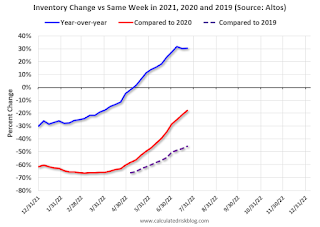

The second graph uses the Altos inventory data and shows the trend comparing to the same week in 2020 and 2019. The dotted red line is the recent trend compared to 2020 - and at the current pace, inventory will be up compared to 2020 in late August. The dashed grey line is comparing to 2019, and based on the current trend, it is possible inventory will be back to 2019 levels by the beginning of 2023.

Black Knight: Mortgage Delinquency Rate increased in June; Remains Well below Pre-Pandemic Levels

by Calculated Risk on 7/25/2022 11:19:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies and Foreclosure Starts Edge Higher in June but Remain Well Below Pre-Pandemic Levels

• The national delinquency rate rose nine basis points from May to reach 2.84% after hitting consecutive record lows in each of the prior three monthsAccording to Black Knight's First Look report, the percent of loans delinquent increased 3.3% in June compared to May and decreased 35% year-over-year.

• Increases were broad-based – the number of borrowers a single payment past due rose 5%, while 90-day delinquencies broke a 21-month streak of improvement with a modest 1% uptick from the prior month

• Foreclosure starts were also up 27% in June – still 40% below pre-pandemic levels – marking a 441% year-over-year increase, a significant rise from pandemic-driven lows

• Starts also represented the highest share (4%) of serious delinquencies since March 2020, but less than half the rate in the years leading up to the pandemic

• Active foreclosure inventory rose by 16K in the month as volumes continue to slowly come off the record lows brought on by widespread moratoriums and forbearance protections in 2020/21

• Prepayment activity was down another 7% in June with prepays now down by 64% from the same time last year as rising rates put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.84% in June, up from 2.75% in May.

The percent of loans in the foreclosure process increased in June to 0.53%, from 0.50% in May. This is increasing from very low levels due to the foreclosure moratoriums.

The number of delinquent properties, but not in foreclosure, is down 809,000 properties year-over-year, and the number of properties in the foreclosure process is up 45,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2022 | May 2022 | June 2021 | June 2020 | |

| Delinquent | 2.84% | 2.75% | 4.37% | 7.59% |

| In Foreclosure | 0.53% | 0.50% | 0.27% | 0.36% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,511,000 | 1,461,000 | 2,320,000 | 4,034,000 |

| Number of properties in foreclosure pre-sale inventory: | 190,000 | 174,000 | 145,000 | 192,000 |

| Total Properties | 1,700,000 | 1,635,000 | 2,466,000 | 4,226,000 |

Housing Inventory July 25th Update: Up 30.5% Year-over-year

by Calculated Risk on 7/25/2022 09:05:00 AM

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 118% since then. More than double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 17.9% according to Altos)

4. Inventory up compared to 2019 (currently down 45.8%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/25/2022 08:16:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 24th.

Click on graph for larger image.

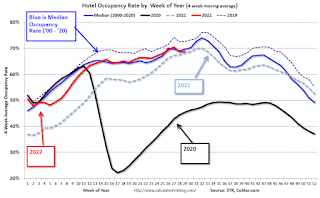

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.1% from the same day in 2019 (87.9% of 2019). (Dashed line)

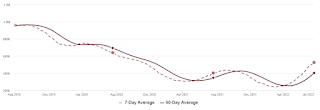

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $206 million last week, down about 18% from the median for the week.

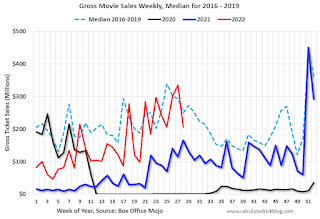

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 16th. The occupancy rate was down 7.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 15th, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 22nd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 24, 2022

Sunday Night Futures

by Calculated Risk on 7/24/2022 06:41:00 PM

Weekend:

• Schedule for Week of July 24, 2022

• FOMC Preview: 75bp Hike

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $95.51 per barrel and Brent at $104.18 per barrel. A year ago, WTI was at $72, and Brent was at $74 - so WTI oil prices are up 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.33 per gallon. A year ago, prices were at $3.15 per gallon, so gasoline prices are up $1.18 per gallon year-over-year.

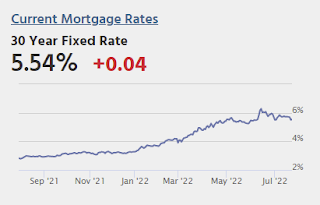

FOMC Preview: 75bp Hike

by Calculated Risk on 7/24/2022 09:46:00 AM

Expectations are the FOMC will announce a 75bp rate increase in the federal funds rate at the meeting this week.

"We look for the Fed to lift the target range for the federal funds rate by 75bp to 2.25-2.5% while keeping its balance sheet normalization policies in place. ... We look for Chair Powell to repeat similar messages from the June FOMC meeting; namely that inflation is too high, the Fed is committed to restoring price stability, and some pain may be needed to bring inflation lower. Looking ahead, we expect another 50bp increase in September and two additional 25bp rate hikes by year end, which would bring the target range for the federal funds rate to 3.25-3.50%."From Goldman Sachs:

"We expect a 75bp rate hike at the July FOMC meeting next week. ... The key question for next week is what guidance Chair Powell will give about the size of a likely rate hike in September. We expect that Fed officials will want to keep their options open and will avoid any strong guidance. ... We continue to expect a 50bp hike in September and 25bp hikes in November and December to a terminal rate of 3.25-3.5%."

Wall Street forecasts have been revised down further since June due to the ongoing negative impacts from the pandemic. the war in Ukraine and financial tightening. For example, from BofA:

"We now forecast 1.1% GDP growth for 2022 and expect growth to slow to -0.2% in 2023"

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.6% in June. So far, the economic slowdown has not pushed up the unemployment rate.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

As of May 2022, PCE inflation was up 6.3% from May 2021. This was below the cycle high of 6.6% YoY in March. Analysts are expecting inflation to decline slowly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

PCE core inflation was up 4.7% in May year-over-year. This was below the cycle high of 5.3% YoY in February.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |