by Calculated Risk on 7/28/2022 08:34:00 AM

Thursday, July 28, 2022

Weekly Initial Unemployment Claims at 256,000

The DOL reported:

In the week ending July 23, the advance figure for seasonally adjusted initial claims was 256,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 10,000 from 251,000 to 261,000. The 4-week moving average was 249,250, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 2,500 from 240,500 to 243,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 249,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, July 27, 2022

Thursday: Q2 GDP, Unemployment Claims

by Calculated Risk on 7/27/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 248 thousand down from 251 thousand last week.

• Also, at 8:30 AM, Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 0.4% annualized in Q2, up from -1.6% in Q1.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

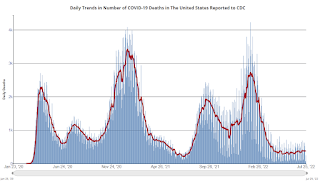

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 127,786 | 126,610 | ≤5,0001 | |

| Hospitalized2🚩 | 36,909 | 35,126 | ≤3,0001 | |

| Deaths per Day2 | 366 | 391 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

FOMC Statement: Raise Rates 75 bp; "Ongoing increases appropriate"

by Calculated Risk on 7/27/2022 02:02:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller.

emphasis added

Real House Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/27/2022 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices and Price-to-Rent Ratio in May

Excerpt:

It has been over 16 years since the bubble peak. In the Case-Shiller release yesterday, the seasonally adjusted National Index (SA), was reported as being 65% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 16% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 7% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). As an example, if a house price was $200,000 in January 2000, the price would be almost $334,000 today adjusted for inflation (67% increase). That is why the second graph below is important - this shows "real" prices (adjusted for inflation). ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is 16.0% above the bubble peak, and the Composite 20 index is 7.4% above the bubble peak in early 2006.In real terms, house prices are now above the previous peak levels. There is an upward slope to real house prices, and it has been over 16 years since the previous peak, but real prices appear historically high (Of course interest rates had been very low).

NAR: Pending Home Sales Decreased 8.6% in June

by Calculated Risk on 7/27/2022 10:07:00 AM

From the NAR: Pending Home Sales Fell 8.6% in June

Pending home sales decreased in June, following a slight increase in May, according to the National Association of REALTORS®. All four major regions posted month-over-month and year-over-year pullbacks, the largest of which occurred in the West.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, dipped 8.6% to 91.0 in June. Year-over-year, transactions shrank 20.0%. An index of 100 is equal to the level of contract activity in 2001.

"Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date," said NAR Chief Economist Lawrence Yun. "There are indications that mortgage rates may be topping or very close to a cyclical high in July. If so, pending contracts should also begin to stabilize."

According to NAR, buying a home in June was about 80% more expensive than in June 2019. Nearly a quarter of buyers who purchased a home three years ago would be unable to do so now because they no longer earn the qualifying income to buy a median-priced home today.

...

The Northeast PHSI slid 6.7% compared to last month to 80.9, down 17.6% from June 2021. The Midwest index dropped 3.8% to 93.7 in June, a 13.4% decline from a year ago.

The South PHSI slipped 8.9% to 108.3 in June, a decrease of 19.2% from the previous year. The West index slumped 15.9% in June to 68.7, down 30.9% from June 2021.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/27/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 22, 2022.

... The Refinance Index decreased 4 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 0.4 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage applications declined for the fourth consecutive week to the lowest level of activity since February 2000. Increased economic uncertainty and prevalent affordability challenges are dissuading households from entering the market, leading to declining purchase activity that is close to lows last seen at the onset of the pandemic,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Weakening purchase applications trends in recent months have been consistent with data showing a slowdown in sales for newly constructed homes and existing homes. A potential silver lining for the housing market is that stabilizing mortgage rates and increases in for-sale inventory may bring some buyers back to the market during the second half of the year.”

Added Kan, “With mortgage rates remaining well over 5 percent, refinance applications are now 83 percent below last year’s pace.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.74 percent from 5.82 percent, with points decreasing to 0.61 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 26, 2022

Wednesday: FOMC Statement, Durable Goods, Pending Home Sales

by Calculated Risk on 7/26/2022 09:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 3.7% decrease in the index.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise rates 75 bps, increasing the target range for the federal funds rate to 2‑1/4 to 2-1/2 percent.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 124,549 | 127,314 | ≤5,0001 | |

| Hospitalized2🚩 | 36,312 | 34,737 | ≤3,0001 | |

| Deaths per Day2 | 367 | 384 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

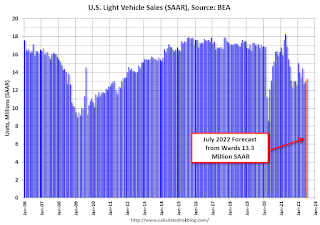

July Vehicle Sales Forecast: Increase to 13.3 million SAAR

by Calculated Risk on 7/26/2022 04:42:00 PM

From WardsAuto: Not a Surge but July U.S. Light-Vehicle Sales Tracking Above Past Two Months (pay content). Brief excerpt:

"Wards Intelligence partner LMC Automotive is pegging the entire year at 14.3 million units, meaning the second-half SAAR will have to total 14.8 million units, up from first-half 2022’s 13.7 million ..."

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for July (Red).

The Wards forecast of 13.3 million SAAR, would be up about 2% from last month, and down 9% from a year ago (sales were starting to weaken in mid-2021, due to supply chain issues).

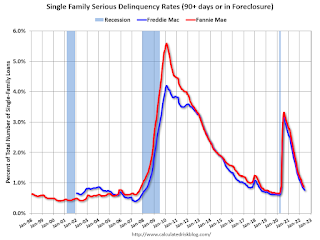

Freddie Mac: Mortgage Serious Delinquency Rate decreased in June

by Calculated Risk on 7/26/2022 02:59:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in June was 0.76%, down from 0.80% May. Freddie's rate is down year-over-year from 1.86% in June 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction

by Calculated Risk on 7/26/2022 11:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are just over 0.83 months of completed supply (red line). This is about two-thirds of the normal level.

The inventory of new homes under construction is at 6.22 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints. This is the all-time record; above the previous record set in 1980.

And a record 110 thousand homes have not been started - about 2.24 months of supply (grey line) - more than double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.