by Calculated Risk on 7/29/2022 05:39:00 PM

Friday, July 29, 2022

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in June

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.81% in June from 0.87% in May. The serious delinquency rate is down from 2.08% in June 2021. This is almost back to pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.75% are seriously delinquent (down from 2.86% in May).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Rent Increases Up Sharply Year-over-year, Pace Continues to Slow

by Calculated Risk on 7/29/2022 12:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rent Increases Up Sharply Year-over-year, Pace Continues to Slow

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through June 2022 (Apartment List through July 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

...

The Zillow measure is up 14.8% YoY in June, down from 16.0% YoY in May. This is down from a peak of 17.2% YoY in February.

The ApartmentList measure is up 12.4% YoY as of July, down from 14.1% in June. This is down from the peak of 18.0% YoY last December.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 5.5% YoY in June, from 5.1% YoY in May - and will likely increase further in the coming months.

My suspicion is rent increases will slow over the coming months as the pace of household formation slows, and more supply comes on the market.

Q2 2022 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 7/29/2022 11:16:00 AM

The BEA released the underlying details for the Q2 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 11.7% annual pace in Q2.

Investment in petroleum and natural gas structures increased in Q2 compared to Q1 and was up 31% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q2 and was up 5.7% year-over-year. (Still declining as a percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up about 10% year-over-year in Q2 - from a very low level. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased slightly in Q2 compared to Q1, and lodging investment was down 2% year-over-year.

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Even though investment in single family structures has increased from the bottom, single family investment is just approaching normal levels as a percent of GDP.

Investment in single family structures was $473 billion (SAAR) (about 1.9% of GDP), and up 17% year-over-year.

Investment in multi-family structures was unchanged in Q2 from Q1.

Investment in home improvement was at a $347 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.4% of GDP). Home improvement spending was strong during the pandemic.

Hotels: Occupancy Rate Down 6.0% Compared to Same Week in 2019

by Calculated Risk on 7/29/2022 10:26:00 AM

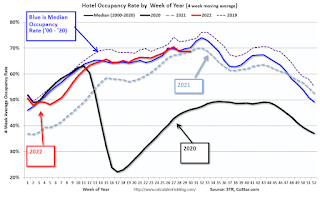

U.S. hotel performance increased from the previous week, according to STR‘s latest data through July 23.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 17-23, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 72.8% (-6.0%)

• Average daily rate (ADR): $158.79 (+16.4%)

• Revenue per available room (RevPAR): $115.59 (+9.3%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Personal Income increased 0.6% in June; Spending increased 1.1%

by Calculated Risk on 7/29/2022 08:37:00 AM

The BEA released the Personal Income and Outlays report for June:

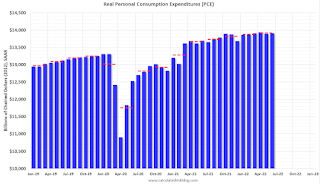

Personal income increased $133.5 billion (0.6 percent) in June, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $120.4 billion (0.7 percent) and personal consumption expenditures (PCE) increased $181.1 billion (1.1 percent).The June PCE price index increased 6.8 percent year-over-year (YoY), up from 6.3 percent YoY in May.

The PCE price index increased 1.0 percent. Excluding food and energy, the PCE price index increased 0.6 percent. Real DPI decreased 0.3 percent in June and real PCE increased 0.1 percent; goods increased 0.1 percent and services increased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through June 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and the increase in PCE were both above expectations.

Thursday, July 28, 2022

Friday: June Personal Income and Outlays

by Calculated Risk on 7/28/2022 09:01:00 PM

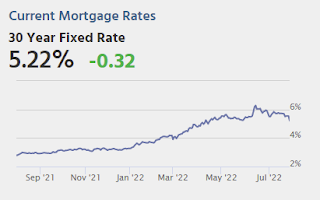

• At 8:30 AM ET, Personal Income and Outlays, June 2022. The consensus is for a 0.5% increase in personal income, and for a 0.9% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.6% YoY, and core PCE prices up 4.7% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 51.1.

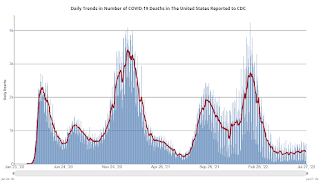

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 126,272 | 127,478 | ≤5,0001 | |

| Hospitalized2🚩 | 37,069 | 35,500 | ≤3,0001 | |

| Deaths per Day2 | 364 | 382 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

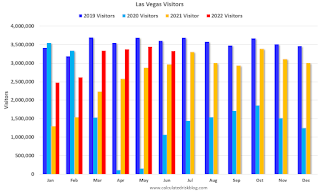

Las Vegas June 2022: Visitor Traffic Down 7.8% Compared to 2019

by Calculated Risk on 7/28/2022 03:18:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: May 2022 Las Vegas Visitor Statistics

Las Vegas saw another strong month of visitation in June as the destination hosted over 3.3M visitors, about 12% ahead of last June but approx. 8% behind June 2019.

With room inventory reflecting the net impacts of the openings of the Virgin Hotel Las Vegas and Resorts World since the middle of last year, overall hotel occupancy reached 82.7%, 6.8 pts ahead of last June but down 9.0 pts vs. June 2019. Weekend occupancy welcomed a fourth consecutive month at or above 90% and Midweek occupancy reached 80% for the first time since February 2020 (up 9.1 pts YoY but down 9.7 pts vs. June 2019).

ADR approached $157, 22.7% ahead of last June and over 30% above June 2019 while RevPAR neared $130 for the month, +33.7% YoY and +17.5% over June 2019.

Click on graph for larger image.

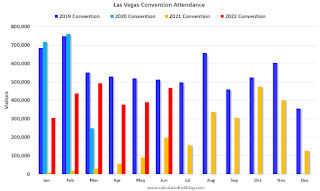

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 7.8% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Median vs Repeat Sales Index House Prices

by Calculated Risk on 7/28/2022 01:14:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Median vs Repeat Sales Index House Prices

Excerpt:

Perhaps the timeliest house price report for existing homes is the monthly existing home sales report from the National Association of Realtors® (NAR). Each month the NAR reports the median prices for closed sales. Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

But even the median price is lagged. For example, the recently released June report was mostly for contracts signed in April and May.

Here is a graph comparing the YoY change in the NAR median prices vs the Case-Shiller National Index:

The YoY change in the median price peaked at 25.2% in May 2021 and slowed to 13.3% in June (still very strong increase in YoY prices). The median price is not seasonally adjusted, and typically declines in July, and I expect a larger than normal decline this July.

In general, the median price leads the Case-Shiller index, and I expect the Case-Shiller to show significantly slower YoY growth over the next several months.

A Few Comments on Q2 GDP and Investment

by Calculated Risk on 7/28/2022 10:00:00 AM

Note: The second graph - residential investment as a percent of GDP - is useful in predicting a Fed induced recession. RI as a percent of GDP usually turns down well in advance of a recession. This will be something to watch.

Earlier from the BEA: Gross Domestic Product, Second Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. ...The advance Q2 GDP report, at -0.9% annualized, was below expectations, primarily due to a negative impact from a decrease in inventories.

The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Personal consumption expenditures (PCE) increased at a 1.0% annualized rate in Q2.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern didn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 14.0% annual rate in Q2. Equipment investment decreased at a 2.7% annual rate, and investment in non-residential structures decreased at a 11.7% annual rate.

On a 3-quarter trailing average basis, RI (red) is down, equipment (green) is up, and nonresidential structures (blue) is still down.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q2.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

BEA: Real GDP decreased at 0.9% Annualized Rate in Q2

by Calculated Risk on 7/28/2022 08:38:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. ...PCE increased at a 1.0% rate, and residential investment decreased at a 14.0% rate. Change in private inventories was a huge drag in Q2, subtracting 2.01 percentage points. The advance Q2 GDP report, with 0.9% annualized decline, was below expectations.

The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

I'll have more later ...