by Calculated Risk on 8/01/2022 12:39:00 PM

Monday, August 01, 2022

Construction Spending Decreased 1.1% in June

From the Census Bureau reported that overall construction spending increased:

Construction spending during June 2022 was estimated at a seasonally adjusted annual rate of $1,762.3 billion, 1.1 percent below the revised May estimate of $1,781.9 billion. The June figure is 8.3 percent above the June 2021 estimate of $1,628.0 billion.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,416.4 billion, 1.3 percent below the revised May estimate of $1,434.4 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $345.9 billion, 0.5 percent below the revised May estimate of $347.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 36% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 19% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 6% above the peak in March 2009.

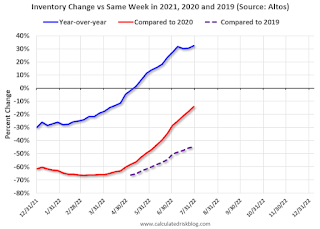

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 15.5%. Non-residential spending is up 1.7% year-over-year. Public spending is up 0.4% year-over-year.

ISM® Manufacturing index Decreased to 52.8% in July

by Calculated Risk on 8/01/2022 12:14:00 PM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 52.8% in July, down from 53.0% in June. The employment index was at 49.9%, up from 47.3% last month, and the new orders index was at 48.0%, down from 49.2%.

From ISM: Manufacturing PMI® at 52.8% July 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in July, with the overall economy achieving a 26th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slower pace in July than in June. This was above the consensus forecast, however the employment index was weak again in July.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The July Manufacturing PMI® registered 52.8 percent, down 0.2 percentage point from the reading of 53 percent in June. This figure indicates expansion in the overall economy for the 26th month in a row after a contraction in April and May 2020. This is the lowest Manufacturing PMI® figure since June 2020, when it registered 52.4 percent. The New Orders Index registered 48 percent, 1.2 percentage points lower than the 49.2 percent recorded in June. The Production Index reading of 53.5 percent is a 1.4-percentage point decrease compared to June’s figure of 54.9 percent. The Prices Index registered 60 percent, down 18.5 percentage points compared to the June figure of 78.5 percent; this is the index’s lowest reading since August 2020 (59.5 percent). The Backlog of Orders Index registered 51.3 percent, 1.9 percentage points below the June reading of 53.2 percent. The Employment Index contracted for a third straight month at 49.9 percent, 2.6 percentage points higher than the 47.3 percent recorded in June. The Supplier Deliveries Index reading of 55.2 percent is 2.1 percentage points lower than the June figure of 57.3 percent. The Inventories Index registered 57.3 percent, 1.3 percentage points higher than the June reading of 56 percent. The New Export Orders Index reading of 52.6 percent is up 1.9 percentage points compared to June’s figure of 50.7 percent. The Imports Index grew again in July, up 3.7 percentage points to 54.4 percent from 50.7 percent in June.”

emphasis added

Black Knight Mortgage Monitor: "Record-Setting Slowdown in Home Price Growth"

by Calculated Risk on 8/01/2022 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Record-Setting Slowdown in Home Price Growth"

A brief excerpt:

The first graph shows Black Knight’s estimate of monthly house price increases and the year-over-year change in prices.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• The annual home price growth rate fell by nearly two full percentage points to 17.3% in June, from 19.3% in the prior month – a 66% stronger deceleration than in the prior month

• June's slowdown surpassed by 50% the 134 BPS plunge precipitated by Volcker-era rate hikes in the early 1980s and was the most significant drop since at least the early 1970s

• Even after hitting the brakes historically in June, it would take six more months of equivalent slowing to bring the annual growth rate down to 5%, more in line with the long-term average

Housing Inventory August 1st Update: Up 32.3% Year-over-year

by Calculated Risk on 8/01/2022 10:14:00 AM

Inventory is still increasing rapidly, but the inventory build has slowed somewhat over the last few weeks. Still, inventory is increasing much faster than normal for this time of year (both in percentage terms and in total inventory added). Here are the same week inventory changes for the last four years:

Click on graph for larger image.

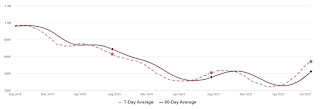

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 14.0% according to Altos)

4. Inventory up compared to 2019 (currently down 44.6%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 8/01/2022 08:18:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 31st.

Click on graph for larger image.

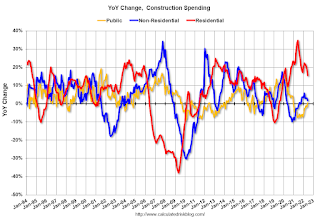

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 11.1% from the same day in 2019 (88.9% of 2019). (Dashed line)

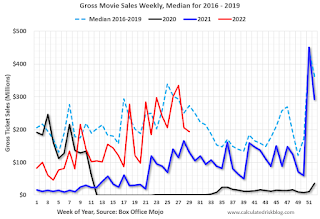

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $194 million last week, down about 29% from the median for the week.

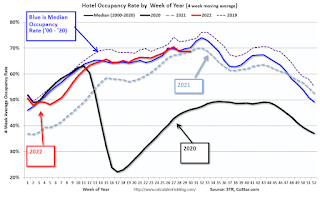

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 23rd. The occupancy rate was down 6.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 22nd, gasoline supplied was down 4.4% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

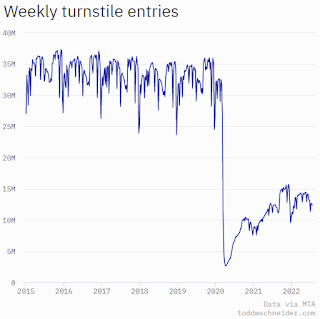

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 29th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 31, 2022

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 7/31/2022 09:02:00 PM

Weekend:

• Schedule for Week of July 31, 2022

Monday:

• (likely, might be Tuesday) At 8:00 AM ET, Corelogic House Price index for June

• 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 52.0, down from 53.0 in June.

• 10:00 AM, Construction Spending for June. The consensus is for a 0.2% increase in construction spending.

• 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 15 and DOW futures are down 112 (fair value).

Oil prices were mixed over the last week with WTI futures at $98.62 per barrel and Brent at $103.97 per barrel. A year ago, WTI was at $74, and Brent was at $78 - so WTI oil prices are up 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.18 per gallon. A year ago, prices were at $3.16 per gallon, so gasoline prices are up $1.02 per gallon year-over-year.

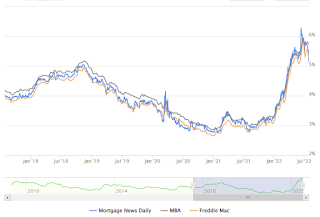

30-Year Mortgage Rates Decrease to 5.13%

by Calculated Risk on 7/31/2022 10:51:00 AM

After reaching 6.28% on June 14th, 30-year mortgage rates decreased to 5.13% on Friday according to Mortgagenewsdaily.com. The 10-year Treasury yield has fallen to 2.66%, likely due to the weaker economy.

Saturday, July 30, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/30/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction

• Case-Shiller National Index up 19.7% Year-over-year in May

• Will Housing Inventory Follow the Normal Seasonal Pattern?

• Real House Prices and Price-to-Rent Ratio in May

• Median vs Repeat Sales Index House Prices

• Rent Increases Up Sharply Year-over-year, Pace Continues to Slow

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of July 31, 2022

by Calculated Risk on 7/30/2022 08:11:00 AM

The key report this week is the July employment report.

Other key reports include ISM manufacturing and services indexes, July vehicle sales, and the Trade deficit for June.

8:00 AM ET: Corelogic House Price index for June

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 52.0, down from 53.0 in June.

10:00 AM: Construction Spending for June. The consensus is for a 0.2% increase in construction spending.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for July.

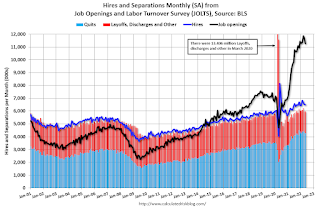

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in May to 11.254 million from 11.681 million in April.

The number of job openings (yellow) were up 17% year-over-year and Quits were up 11% year-over-year.

10:00 AM: the Q2 2022 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

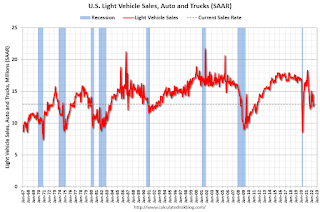

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 13.5 million SAAR in July, up from 13.0 million in June (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 13.5 million SAAR in July, up from 13.0 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: the ISM Services Index for July. The consensus is for a reading of 53.5, down from 55.3.

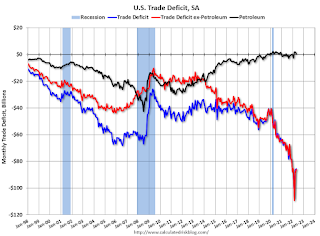

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $80.1 billion. The U.S. trade deficit was at $85.5 Billion the previous month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand up from 256 thousand last week.

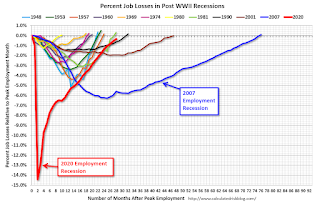

8:30 AM: Employment Report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 372,000 jobs added in June, and the unemployment rate was at 3.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 28 months after the onset, has recovered quicker than the previous two recessions.

Friday, July 29, 2022

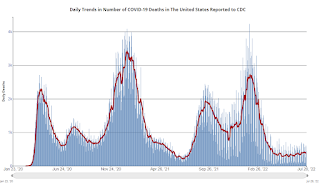

COVID July 29, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/29/2022 09:01:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 125,355 | 128,981 | ≤5,0001 | |

| Hospitalized2🚩 | 37,013 | 35,853 | ≤3,0001 | |

| Deaths per Day2 | 373 | 396 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.