by Calculated Risk on 8/08/2022 08:13:00 AM

Monday, August 08, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of August 7th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 11.0% from the same day in 2019 (89.0% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $151 million last week, down about 40% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 30th. The occupancy rate was down 3.8% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 29th, gasoline supplied was down 10.6% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

Sunday, August 07, 2022

Sunday Night Futures

by Calculated Risk on 8/07/2022 08:01:00 PM

Weekend:

• Schedule for Week of August 7, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 70 (fair value).

Oil prices were down over the last week with WTI futures at $89.01 per barrel and Brent at $94.92 per barrel. A year ago, WTI was at $68, and Brent was at $71 - so WTI oil prices are up 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.03 per gallon. A year ago, prices were at $3.16 per gallon, so gasoline prices are up $0.87 per gallon year-over-year.

AAR: July Rail Carloads Up Slightly Year-over-year, Intermodal Down

by Calculated Risk on 8/07/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Rail traffic in July was evenly balanced between commodities with carload gains and those with declines. As such, it doesn’t provide definitive evidence regarding the state of the overall economy. Moreover, the traffic category historically most highly correlated with GDP is “industrial products,” a combination of seven other categories. Carloads of industrial products have fallen for four straight months, but the declines have all been extremely small.

emphasis added

Click on graph for larger image.

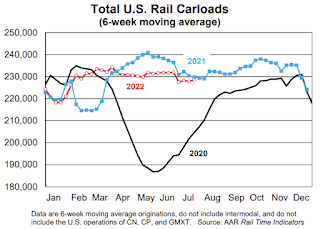

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

In July 2022, U.S. railroads originated 906,903 total carloads — up 0.2% (2,213 carloads) over July 2021. The year-over-year gain was not large, but it was the first gain of any size in four months. Intermodal is not included in carload totals.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S railroads also originated 1.03 million intermodal containers and trailers in July 2022, down 3.0% (32,094 units) from last year. July marked the 11th decline in the past 12 months, but it’s also the smallest percentage decline in those 11 months.

Saturday, August 06, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 8/06/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Cancellations increased Sharply in Q2

• Denver Real Estate in July: Sales Off 31.6% YoY, Inventory Up 81.5%

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2023?

• Will 5% Mortgage Rates Cushion the Housing Market?

• Black Knight Mortgage Monitor: "Record-Setting Slowdown in Home Price Growth

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of August 7, 2022

by Calculated Risk on 8/06/2022 08:11:00 AM

The key report this week is July CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for July.

12:00 PM: (expected) MBA Q2 National Delinquency Survey

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 6.1% YoY.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 263 thousand up from 260 thousand last week.

8:30 AM: The Producer Price Index for July from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August).

Friday, August 05, 2022

COVID August 5, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 8/05/2022 09:09:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 114,830 | 125,797 | ≤5,0001 | |

| Hospitalized2 | 37,112 | 37,573 | ≤3,0001 | |

| Deaths per Day2 | 393 | 405 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

New Home Cancellations increased Sharply in Q2

by Calculated Risk on 8/05/2022 02:06:00 PM

Today, in the Calculated Risk Real Estate Newsletter: New Home Cancellations increased Sharply in Q2

A brief excerpt:

First, a few quotes from some Q2 SEC filings:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/"We believe the recent increases in interest rates during 2022 have caused buyer apprehension, affordability concerns, and an increase in cancellations.", Taylor Morrison Q2 SEC Filing

"The magnitude and speed of these recent rate increases has caused many buyers to pause and reconsider a home purchase, resulting in lower gross demand and higher cancellations during the second quarter.”, MDC Holdings Q2 SEC Filing

"New orders weakened during the second quarter of 2022 in many of our markets and we experienced a higher than normal cancellation rate during the second quarter of 2022", LGI Homes Q2 SEC Filing

emphasis addedHere is a table of selected public builders and the currently reported cancellation rate (I’m still gathering data). There is some seasonality to cancellation rates.

Disclaimer: the cancellation rates are from SEC filings only, and while deemed to be reliable is not guaranteed.

Cancellation rates clearly increased in Q2.

Used Vehicle Wholesale Prices Decreased 0.1% in July

by Calculated Risk on 8/05/2022 01:45:00 PM

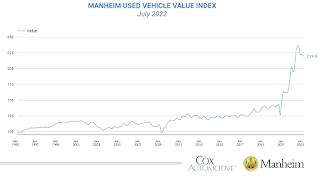

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease Minimally in July From Seasonal Adjustment

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.1% in July from June. The Manheim Used Vehicle Value Index declined to 219.6, up 12.5% from a year ago. The non-adjusted price change in July decreased 3.2% compared to June, leaving the unadjusted average price up 10.2% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Comments on July Employment Report

by Calculated Risk on 8/05/2022 10:38:00 AM

Today we celebrate the recovery of all the jobs lost in 2020, and the unemployment rate matching the lowest level since 1969.

The headline jobs number in the July employment report was well above expectations, and employment for the previous two months was revised up by 28,000, combined. The participation rate decreased slightly, and the employment-population ratio increased slightly. The unemployment rate declined to 3.5%.

In July, the year-over-year employment change was 6.15 million jobs.

Prime (25 to 54 Years Old) Participation

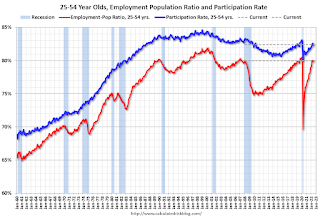

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in July to 82.4% from 82.3% in June, and the 25 to 54 employment population ratio increased to 80.0% from 79.8% the previous month.

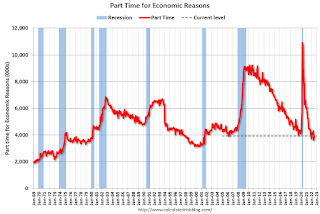

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 303,000 to 3.9 million in July. This rise reflected an increase in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in July to 3.924 million from 3.621 million in June. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 6.7% from 6.7% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is lower than the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.067 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.336 million the previous month.

This is back to pre-pandemic lows.

Summary:

The headline monthly jobs number was well above expectations and employment for the previous two months was revised up by 28,000, combined.

July Employment Report: 528 thousand Jobs, 3.5% Unemployment Rate

by Calculated Risk on 8/05/2022 08:43:00 AM

From the BLS:

Total nonfarm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Both total nonfarm employment and the unemployment rate have returned to their February 2020 pre-pandemic levels.

...

The change in total nonfarm payroll employment for May was revised up by 2,000, from +384,000 to +386,000, and the change for June was revised up by 26,000, from +372,000 to +398,000. With these revisions, employment in May and June combined is 28,000 higher than previously reported.

emphasis added

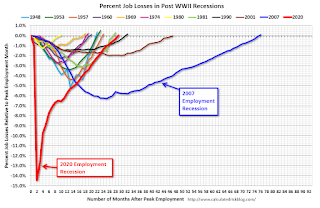

Click on graph for larger image.

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 6.15 million jobs. This was up significantly year-over-year.

Total payrolls increased by 528 thousand in July. Private payrolls increased by 471 thousand, and public payrolls increased 57 thousand.

Payrolls for May and June were revised up 28 thousand, combined.

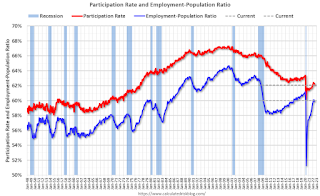

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.1% in July, from 62.2% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.1% in July, from 62.2% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.0% from 59.9% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was decreased in July to 3.5% from 3.6% in June.

This was well above consensus expectations; and May and June payrolls were revised up by 28,000 combined.