by Calculated Risk on 8/17/2022 02:10:00 PM

Wednesday, August 17, 2022

FOMC Minutes "Participants anticipated that this slowdown in housing activity would continue"

From the Fed: Minutes of the Federal Open Market Committee, July 26-27, 2022. Excerpt on housing and policy:

Participants also observed that housing activity had weakened notably, reflecting the impact of higher mortgage interest rates and house prices on home affordability. Participants anticipated that this slowdown in housing activity would continue and also expected higher borrowing costs to lead to a slowing in other interest-sensitive household expenditures, such as purchases of durable goods.

...

In their assessment of the policy outlook, market participants expected significant policy tightening in coming meetings as the Committee continued to respond to the current elevated level of inflation. Nearly all respondents to the Desk survey anticipated a 75 basis point increase in the target range at the current meeting, and most expected a 50 basis point increase in September to follow.

emphasis added

4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

by Calculated Risk on 8/17/2022 12:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

A brief excerpt:

California Home Sales Down 31% in July, Prices DeclineThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 295,460 in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. … July’s sales pace was down 14.4 percent on a monthly basis from 344,970 in June and down 31.1 percent from a year ago, when 428,980 homes were sold on an annualized basis. July marked the fourth consecutive monthly decline and the 13th straight annual decline....

...

California’s median home price declined 3.5 percent in July to $833,910 from the $863,790 recorded in June. The July price was 2.8 percent higher than the $811,170 recorded last July and was the smallest year-over-year price gain in more than two years.

And a table of July sales. Sales in these areas were down 24.3% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in July were mostly signed in May and June, and we are seeing the impact of higher mortgage rates on July closings.

Last month, all local markets I track were down 15.9% YoY, NSA. This appears to be another step down in sales, although there was one less selling day in July this year than in July 2021.

...

More local markets to come!

Retail Sales "Unchanged" in July

by Calculated Risk on 8/17/2022 08:39:00 AM

On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 10.3 percent from July 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $682.8 billion, virtually unchanged from the previous month, but 10.3 percent above July 2021. ... The May 2022 to June 2022 percent change was revised from up 1.0 percent to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in July.

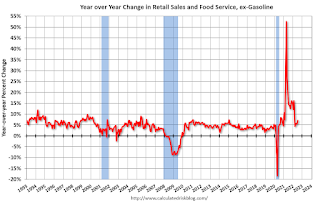

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 7.1% on a YoY basis.

Sales in July were slightly below expectations, and sales in May and June were revised down, combined.

Sales in July were slightly below expectations, and sales in May and June were revised down, combined.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/17/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 12, 2022.

... The Refinance Index decreased 5 percent from the previous week and was 82 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“Mortgage application activity was lower last week, with overall applications declining over two percent to their lowest level since 2000. Home purchase applications continued to be held down by rapidly drying up demand, as high mortgage rates, challenging affordability, and a gloomier outlook of the economy kept buyers on the sidelines,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “However, if home price growth slows more significantly and mortgage rates move lower, we might see some purchase activity return later in the year. The 30-year fixed rate stayed more than two percentage points higher than a year ago at 5.45 percent but was down over 50 basis points from the June 2020 high of 5.98 percent, providing some relief for buyers in the market. The refinance index, however, fell five percent to its lowest level since November 2000, driven by a six percent drop in conventional refinance applications.”

Added Kan, “Refinance applications increased over three percent but remained more than 80 percent lower than a year ago in this higher rate environment.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.45 percent from 5.47 percent, with points decreasing to 0.57 from 0.80 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 16, 2022

Wednesday: Retail Sales, FOMC Minutes

by Calculated Risk on 8/16/2022 08:57:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for July is scheduled to be released. The consensus is for 0.1% increase in retail sales.

• At 2:00 PM, FOMC Minutes, Meeting of July 26-27, 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 98,229 | 111,892 | ≤5,0001 | |

| Hospitalized2 | 35,139 | 37,284 | ≤3,0001 | |

| Deaths per Day2 | 415 | 422 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/16/2022 01:18:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.90 million in July, down 4.3% from June’s preliminary pace and down 18.7% from last July’s seasonally adjusted pace. Unadjusted sales should show a larger YOY % decline, reflecting the lower business day count this July compared to last July. While virtually all markets saw a significant YOY decline in sales last month, the West region saw an especially large drop -- about 33% (NSA) by my estimate.

Local realtor reports, as well as reports from national inventory trackers, suggest that the inventory of existing homes for sale last month was up substantially from a year earlier. However, the NAR’s estimate may not show the same increase as these reports suggest, as most of these reports exclude listings with pending contracts. E.g., the Realtor.com report for July showed that listings excluding those with pending contracts were up 30.7% from last July, while listings including pending contracts were up just 3.5% YOY. (Pending listings in the Realtor.com report were down 19.4% from last July.) The NAR’s inventory estimate has tracked the Realtor.com total inventory measure more closely that the “ex-pendings” inventory measure. (Note also that the Realtor.com inventory number reflects average listings during the month, while the NAR inventory number is an end-of-month estimate.) Just as the NAR inventory number understated the decline in “effective” homes for sale during most of last year, it is now significantly understating the increase in effective inventory.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 10.6% from last July, a marked YOY deceleration from earlier this year.

CR Note: The National Association of Realtors (NAR) is scheduled to release July existing home sales on Thursday, August 18, 2022, at 10:00 AM ET. The consensus is for 4.88 million SAAR.

July Housing Starts: Units Under Construction Declined Slightly

by Calculated Risk on 8/16/2022 10:47:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: July Housing Starts: Units Under Construction Declined Slightly

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 816 thousand single family units under construction (SA). This is just below the previous three months, and 12 thousand below the peak in April and May. Single family units under construction have peaked since single family starts are now declining. The reason there are so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 862 thousand multi-family units under construction. This is the highest level since March 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.678 million units under construction. This is just below the all-time record set last month of 1.680 million units that were under construction.

Industrial Production Increased 0.6 Percent in July

by Calculated Risk on 8/16/2022 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

In July, total industrial production increased 0.6 percent. Manufacturing output gained 0.7 percent after having fallen 0.4 percent in each of the two previous months. The production of motor vehicles and parts rose 6.6 percent, while factory output elsewhere moved up 0.3 percent. The index for mining increased 0.7 percent, while the index for utilities decreased 0.8 percent. At 104.8 percent of its 2017 average, total industrial production in July was 3.9 percent above its year-earlier level. Capacity utilization moved up 0.4 percentage point in July to 80.3 percent, a rate that is 0.7 percentage point above its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

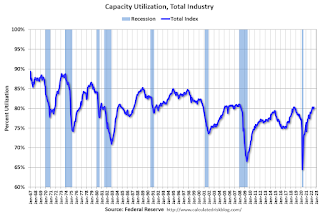

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 80.3% is 0.7% above the average from 1972 to 2021. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

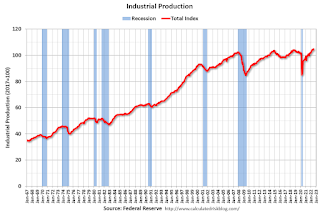

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in June to 104.8. This is above the pre-pandemic level.

The change in industrial production was above consensus expectations.

Housing Starts Decreased to 1.446 million Annual Rate in July

by Calculated Risk on 8/16/2022 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in July were at a seasonally adjusted annual rate of 1,446,000. This is 9.6 percent below the revised June estimate of 1,599,000 and is 8.1 percent below the July 2021 rate of 1,573,000. Single‐family housing starts in July were at a rate of 916,000; this is 10.1 percent below the revised June figure of 1,019,000. The July rate for units in buildings with five units or more was 514,000.

Building Permits:

Privately‐owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,674,000. This is 1.3 percent below the revised June rate of 1,696,000, but is 1.1 percent above the July 2021 rate of 1,655,000. Single‐family authorizations in July were at a rate of 928,000; this is 4.3 percent below the revised June figure of 970,000. Authorizations of units in buildings with five units or more were at a rate of 693,000 in July.

emphasis added

Click on graph for larger image.

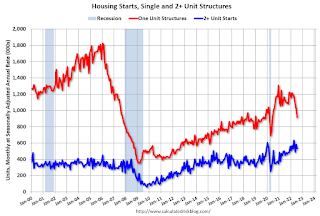

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in July compared to June. Multi-family starts were up 18.0% year-over-year in July.

Single-family starts (red) decreased in July and were down 18.5% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery.

Total housing starts in July were below expectations, however, starts in May and June were revised up slightly, combined.

I'll have more later …

Monday, August 15, 2022

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 8/15/2022 08:42:00 PM

After rising above 6% in June and falling briefly below 5% by August 1st, mortgage rates have been calming down and staying slightly flatter in the big picture. Last week's highest levels were seen on Thursday afternoon or Friday morning depending on the lender. Today's rates are back down to the levels seen earlier in the week. [30 year fixed 5.25%]Tuesday:

emphasis added

• At 8:30 AM ET: Housing Starts for July. The consensus is for 1.540 million SAAR, down from 1.559 million SAAR in June.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 80.1%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 95,209 | 114,409 | ≤5,0001 | |

| Hospitalized2 | 32,099 | 37,287 | ≤3,0001 | |

| Deaths per Day2 | 411 | 4369 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.