by Calculated Risk on 8/22/2022 12:32:00 PM

Monday, August 22, 2022

Final Look at Local Housing Markets in July

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in July

A brief excerpt:

And a table of July sales. Sales in these areas were down 22.8% YoY, Not Seasonally Adjusted (NSA). Contracts for sales in July were mostly signed in May and June, and we are seeing the impact of higher mortgage rates on July closings.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In June, all local markets I track were down 15.9% YoY, NSA. So, this was another step down in sales, although there was one less selling day in July this year than in July 2021. The NAR reported July sales down 22.4% YoY NSA, and down 20.2% Seasonally Adjusted (SA).

Looking ahead: In August 2022, there is one more selling day than in August 2021, so the SA decline in sales will be larger than the NSA decline.

Here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely.

Housing Inventory August 22nd Update: Growth has Slowed

by Calculated Risk on 8/22/2022 09:18:00 AM

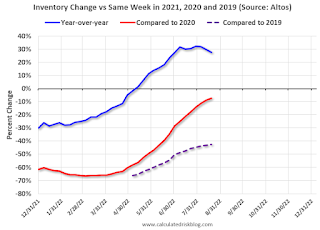

Inventory is still increasing, but the inventory build has slowed over the last month. Still, inventory is increasing faster than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 7.1% according to Altos)

4. Inventory up compared to 2019 (currently down 42.6%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 8/22/2022 08:25:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of August 21st.

Click on graph for larger image.

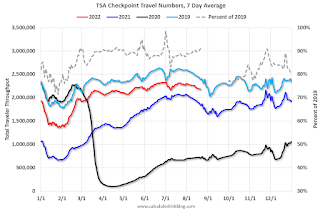

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.1% from the same day in 2019 (90.9% of 2019). (Dashed line)

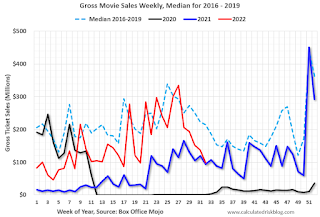

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $99 million last week, down about 54% from the median for the week.

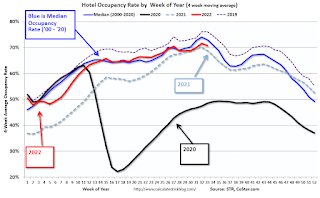

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 13th. The occupancy rate was down 4.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

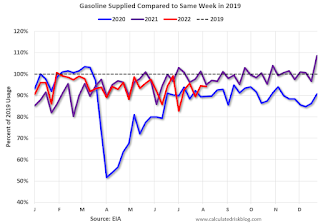

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 12th, gasoline supplied was down 5.9% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 and 2021 levels.

Sunday, August 21, 2022

Sunday Night Futures

by Calculated Risk on 8/21/2022 07:03:00 PM

Weekend:

• Schedule for Week of August 21, 2022

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 63 (fair value).

Oil prices were down over the last week with WTI futures at $89.62 per barrel and Brent at $95.60 per barrel. A year ago, WTI was at $62, and Brent was at $66 - so WTI oil prices are up 45% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.86 per gallon. A year ago, prices were at $3.14 per gallon, so gasoline prices are up $0.72 per gallon year-over-year.

Used Vehicle Wholesale Prices Decreased 3.6% in First Half of August; Goldman Sees Sharp Decline in User Car PCE Inflation

by Calculated Risk on 8/21/2022 11:01:00 AM

First, from Goldman Sachs economists:

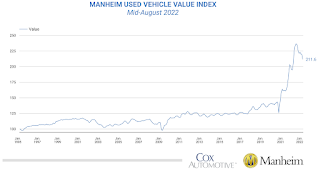

One wildcard for the core goods outlook is used car prices—particularly after the 3.6% drop in Manheim used car auction prices in the first half of August (mom sa). Coupled with the July rebound in auto production to late 2020 levels, we now expect used car PCE inflation to fall from +4% in June to -11% year-on-year in DecemberFrom Manheim Consulting: Wholesale Used-Vehicle Prices Decline in First Half of August

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 3.6% from July in the first 15 days of August. The Manheim Used Vehicle Value Index fell to 211.6, which was up 8.8% from August 2021. The non-adjusted price change in the first half of August was a decline of 2.0% compared to July, leaving the unadjusted average price up 6.6% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Saturday, August 20, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 8/20/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• July Housing Starts: Units Under Construction Declined Slightly

• NAR: Existing-Home Sales Decreased to 4.81 million SAAR in July

• 4th Look at Local Housing Markets in July, California Sales off 31%, July Forecast

• Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

• 3rd Look at Local Housing Markets in July, Sales Down Sharply

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of August 21, 2022

by Calculated Risk on 8/20/2022 08:11:00 AM

The key reports this week are the second estimate of Q2 GDP, July New Home sales, and Personal Income and Outlays for July.

For manufacturing, the August Richmond and Kansas City Fed surveys will be released.

Fed Chair Jerome Powell will speak on the "Economic Outlook" at the Jackson Hole Symposium on Friday.

The BLS will release the preliminary employment benchmark revision on Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 575 thousand SAAR, down from 590 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 3.8% decrease in the index.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the 2022 Preliminary Benchmark Revision to Establishment Survey Data.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

8:30 AM: Gross Domestic Product, 2nd quarter 2022 (second estimate). The consensus is that real GDP decreased 0.8% annualized in Q2, up from the advance estimate of -0.9% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 253 thousand from 250 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM ET: Personal Income and Outlays, July 2022. The consensus is for a 0.6% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 4.7% YoY.

10:00 AM: Speech, Fed Chair Jerome Powell, Economic Outlook, At the Jackson Hole Economic Policy Symposium

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 55.1.

Friday, August 19, 2022

COVID August 19, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 8/19/2022 09:03:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 93,741 | 105,118 | ≤5,0001 | |

| Hospitalized2 | 34,740 | 36,762 | ≤3,0001 | |

| Deaths per Day2 | 392 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

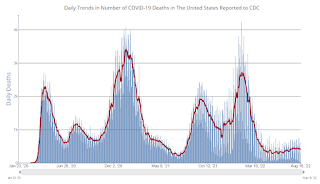

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Realtor.com Reports Weekly Inventory Up 27% Year-over-year; New Listings Down 15%

by Calculated Risk on 8/19/2022 02:20:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Aug 13, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, but the pace slipped to 27% above one year ago. The rate of improvement actually slipped again this week as the number of new listings continues to come in lower

...

• New listings–a measure of sellers putting homes up for sale–were again down 15% from one year ago. This week marks a sixth straight week of year over year declines in the number of new listings coming up for sale, suggesting that homeowners are less eager to list homes for sale compared to last year even though today’s median listing price is more than 13% higher.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

by Calculated Risk on 8/19/2022 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

A brief excerpt:

The following data is courtesy of David Arbit, Director of Research at the Minneapolis Area REALTORS® and NorthstarMLS (posted with permission). Here is a link to their data.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022. The 7-day average showings (red) are currently off 22% from 2019.

...

Click on graph for larger image.

In the existing home sales report for July released yesterday, closed sales, not seasonally adjusted (NSA) were down 22.4% year-over-year. July sales were mostly for contracts signed in May and June. May showings were only down about 13% year-over-year.

This slowdown in showings suggests further declines in closed sales in August - since August sales will be mostly for contracts signed in June and July when showings were down sharply. This early data for August might suggest that September closed sales will see a similar year-over-year decline as in August.