by Calculated Risk on 8/26/2022 10:06:00 AM

Friday, August 26, 2022

Fed Chair Powell: "Higher interest rates ... will also bring some pain to households and businesses"

From Fed Chair Powell: Monetary Policy and Price Stability (watch on YouTube here)

Excerpt:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

...

July's increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.

Personal Income increased 0.2% in July; Spending increased 0.1%

by Calculated Risk on 8/26/2022 08:36:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $47.0 billion (0.2 percent) in July, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $37.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $23.7 billion (0.1 percent).The July PCE price index increased 6.3 percent year-over-year (YoY), down from 6.8 percent YoY in June.

The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI increased 0.3 percent in July and real PCE increased 0.2 percent; goods increased 0.2 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through July 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were below expectations.

Thursday, August 25, 2022

Friday: Personal Income & Outlays, Fed Chair Powell

by Calculated Risk on 8/25/2022 09:08:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2022. The consensus is for a 0.6% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 4.7% YoY.

• At 10:00 AM, Speech, Fed Chair Jerome Powell, Economic Outlook, At the Jackson Hole Economic Policy Symposium

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 55.1.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 90,675 | 97,183 | ≤5,0001 | |

| Hospitalized2 | 32,903 | 35,314 | ≤3,0001 | |

| Deaths per Day2 | 389 | 441 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

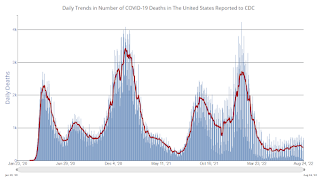

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in July

by Calculated Risk on 8/25/2022 07:31:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.73%, down from 0.76% June. Freddie's rate is down year-over-year from 1.74% in July 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

The Sellers Strike and Housing Inventory

by Calculated Risk on 8/25/2022 01:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Sellers Strike and Housing Inventory

A brief excerpt:

Starting in July, new listings declined year-over-year according to my local market data, and also Realtor.com and Redfin. Realtor.com economist Jiayi Xu noted today:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/New listings–a measure of sellers putting homes up for sale–were again down 12% from one year ago. This week marks a seventh straight week of year over year declines in the number of new listings coming up for sale and a second consecutive week with double digit declines, suggesting that homeowners are less eager to list homes for sale compared to last year, even though today’s median listing price is more than 14% higher.And from Redfin: Housing Market Update: Slowdown Starts to Ease as Drop in New Listings Hampers Supply

emphasis added

...

The bottom line is inventory is still increasing due to less demand, but inventory growth has slowed due to fewer new listings.

This could delay the return to more normal inventory levels (I’ve been comparing to 2019). As always, I’ll be watching inventory closely.

August Vehicle Sales Forecast: Unchanged at 13.3 million SAAR

by Calculated Risk on 8/25/2022 10:37:00 AM

From WardsAuto: August U.S. Light-Vehicle Sales Running Flat with July; Inventory Set to Increase (pay content). Brief excerpt:

"The overriding factor is that even without headwinds such as higher interest rates, low consumer confidence, elevated fuel prices and an inventory mix favoring more expensive models, the general lack of availability of new vehicles would keep sales from being significantly stronger."

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for August (Red).

The Wards forecast of 13.3 million SAAR, would be mostly unchanged from last month, and up 2% from a year ago (sales started to weaken in mid-2021, due to supply chain issues).

Q2 GDP Growth Revised Up to minus 0.6% Annual Rate

by Calculated Risk on 8/25/2022 08:41:00 AM

From the BEA: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), Second Quarter 2022

Real gross domestic product (GDP) decreased at an annual rate of 0.6 percent in the second quarter of 2022, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 1.0% to 1.5%. Residential investment was revised down from -14.0% to -16.2%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 0.9 percent. The update primarily reflects upward revisions to consumer spending and private inventory investment that were partly offset by a downward revision to residential fixed investment

...

Real gross domestic income (GDI) increased 1.4 percent in the second quarter, compared with an increase of 1.8 percent in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.4 percent in the second quarter, compared with an increase of 0.1 percent in the first quarter.

emphasis added

Weekly Initial Unemployment Claims decrease to 243,000

by Calculated Risk on 8/25/2022 08:34:00 AM

The DOL reported:

In the week ending August 20, the advance figure for seasonally adjusted initial claims was 243,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 250,000 to 245,000. The 4-week moving average was 247,000, an increase of 1,500 from the previous week's revised average. The previous week's average was revised down by 1,250 from 246,750 to 245,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 247,000.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, August 24, 2022

Thursday: GDP, Unemployment Claims

by Calculated Risk on 8/24/2022 08:58:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2022 (second estimate). The consensus is that real GDP decreased 0.8% annualized in Q2, up from the advance estimate of -0.9% in Q2.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an increase to 253 thousand from 250 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 89,698 | 99,736 | ≤5,0001 | |

| Hospitalized2 | 33,247 | 35,597 | ≤3,0001 | |

| Deaths per Day2 | 390 | 443 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

by Calculated Risk on 8/24/2022 01:22:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

A brief excerpt:

Even as housing starts slow, there will be a sharp increase in new supply in 2022 (and into 2023) including both single family homes and apartments.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows total housing completions and placements since 1968 with an estimate for 2022. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

My current estimate is total completions (single family, multi-family, manufactured homes) will increase about 10% in 2022 to almost 1.6 million. If correct, this would be the same level of completions as in 2007.