by Calculated Risk on 8/29/2022 03:59:00 PM

Monday, August 29, 2022

30-Year Mortgage Rates Pushing 6% Again

Today, in the Calculated Risk Real Estate Newsletter: 30-Year Mortgage Rates Pushing 6% Again

Excerpt:

After reaching 6.28% on June 14th, 30-year mortgage rates decreased to a low of 5.05% on August 1st according to Mortgagenewsdaily.com. Since then, rates have been moving up, and rates increased today to 5.95%, probably due to Fed Chair Powell’s speech on Friday.

... Not only was Powell suggesting that a 75bp rate hike was possible in September (although most analysts expect 50bp), but he also cautioned against the view of a “pivot” in 2023 with the Fed cutting rates.

Update: Framing Lumber Prices Up Slightly Year-over-year

by Calculated Risk on 8/29/2022 12:28:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through August 29th.

Prices are still up sharply from the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.Prices are near the lows for 2021, and it is unlikely we will see a runup in prices as happened at the end of last year.

Housing Inventory August 29th Update

by Calculated Risk on 8/29/2022 09:31:00 AM

Inventory is still increasing, but the inventory build has slowed over the last two months. Still, inventory is increasing faster than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 6.2% according to Altos)

4. Inventory up compared to 2019 (currently down 42.4%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 8/29/2022 08:22:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

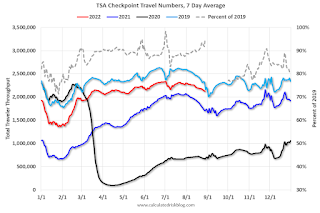

The TSA is providing daily travel numbers.

This data is as of August 28th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 4.9% from the same day in 2019 (90.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $109 million last week, down about 41% from the median for the week.

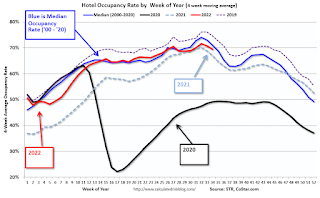

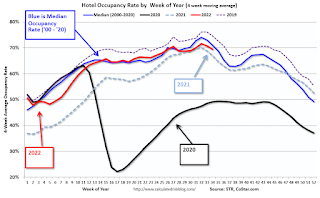

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 20th. The occupancy rate was down 2.8% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

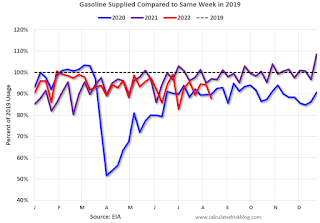

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 19th, gasoline supplied was down 12.4% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 and 2021 levels - and sometimes below 2020.

Sunday, August 28, 2022

Sunday Night Futures

by Calculated Risk on 8/28/2022 08:03:00 PM

Weekend:

• Schedule for Week of August 28, 2022

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 48 and DOW futures are down 308 (fair value).

Oil prices were up over the last week with WTI futures at $93.06 per barrel and Brent at $100.99 per barrel. A year ago, WTI was at $69, and Brent was at $72 - so WTI oil prices are up 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.82 per gallon. A year ago, prices were at $3.12 per gallon, so gasoline prices are up $0.70 per gallon year-over-year.

Hotels: Occupancy Rate Down 2.8% Compared to Same Week in 2019

by Calculated Risk on 8/28/2022 08:31:00 AM

Occupancy for the week ending Aug. 20 was 67.3%, 1.2 percentage points lower than the previous week. Nominal average daily rate fell 1.1% week over week to $151, which is 17% higher than in 2019 and 10% greater than a year ago. Nominal revenue per available room contracted 2.8% week over week to $102, but remained ahead of 2019 by 12% and was up 17% from a year ago. Inflation-adjusted, or real, ADR was ahead of 2019 levels by 1%, whereas real RevPAR was below that benchmark by 3%.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

...

While hotel demand — the number of room nights sold — has decreased week over week, it is only 1% lower than 2019 levels. Occupancy is 2.8 percentage points lower than in the comparable week of 2019 and 3.7 percentage points higher than a year ago. The difference between the demand and occupancy comparisons to 2019 is supply, which has increased by 2.6%. emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, August 27, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 8/27/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction

• The Sellers Strike and Housing Inventory

• Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

• Final Look at Local Housing Markets in July

• Black Knight: Median House Prices Declined in July; First Decline in 32 Months

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of August 28, 2022

by Calculated Risk on 8/27/2022 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing index, August auto sales, and Case-Shiller house prices for June.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 20.6% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS.

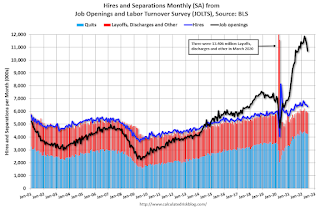

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in June to 10.698 million from 11.303 million in May.

The number of job openings (black) were up 9% year-over-year and Quits were up 5% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). This is the first release of a new methodology.

9:45 AM: Chicago Purchasing Managers Index for August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 250 thousand from 243 thousand last week.

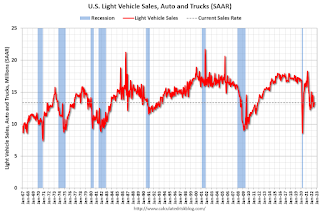

All Day: Light vehicle sales for August. The consensus is for light vehicle sales to be 13.6 million SAAR in August, up from 13.34 million in July (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for August. The consensus is for light vehicle sales to be 13.6 million SAAR in August, up from 13.34 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 52,1, down from 52.8 in July.

10:00 AM: Construction Spending for July. The consensus is for a 0.1% decrease in construction spending.

8:30 AM: Employment Report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

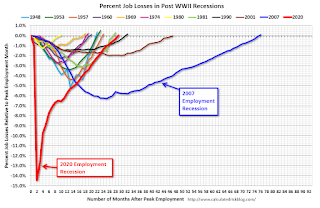

8:30 AM: Employment Report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.There were 528,000 jobs added in July, and the unemployment rate was at 3.5%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, 29 months after the onset of the current employment recession, all of the jobs have returned.

Friday, August 26, 2022

COVID August 26, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 8/26/2022 09:16:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

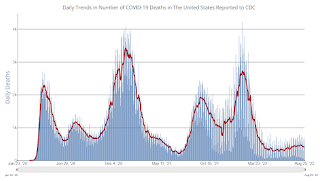

| New Cases per Day2 | 88,594 | 95,609 | ≤5,0001 | |

| Hospitalized2 | 32,403 | 35,061 | ≤3,0001 | |

| Deaths per Day2 | 392 | 438 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Black Knight: Median House Prices Declined in July; First Decline in 32 Months

by Calculated Risk on 8/26/2022 03:12:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight: Median House Prices Declined in July; First Decline in 32 Months

A brief excerpt:

Important caveats: In normal times, median house prices flatten or decline seasonally in the 2nd half of the year. So, a decline in July isn’t unusual.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Also, the median price is distorted by the mix of homes sold. The repeat sales indexes - like Case-Shiller and FHFA - are better measures of house price movements, but median prices can be a leading indicator of price changes.

...

From Andy Walden at Black Knight: Something Had to Give: Home Prices Down for First Time In 32 Months

Annual home price growth still clocked in at 14.3% – more than three times the long-run average – but most of that appreciation occurred in the last months of 2021 and earlier this year. Such strong annual growth rates can hide underlying weakness. Month-over-month data gives us a much clearer picture of just how much – and how quickly – the housing market has shifted.

The median home price fell by 0.77% in July, the largest single-month drop since January 2011. On a seasonally adjusted basis, July’s dip ranked among the 10 largest monthly declines on record, dating back more than 30 years.