by Calculated Risk on 9/01/2022 10:17:00 AM

Thursday, September 01, 2022

Construction Spending Decreased 0.4% in July

From the Census Bureau reported that overall construction spending increased:

Construction spending during July 2022 was estimated at a seasonally adjusted annual rate of $1,777.3 billion, 0.4 percent below the revised June estimate of $1,784.3 billion. The July figure is 8.5 percent above the July 2021 estimate of $1,637.3 billion.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,424.2 billion, 0.8 percent below the revised June estimate of $1,436.4 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $353.1 billion, 1.5 percent above the revised June estimate of $347.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 36% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 21% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 8% above the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 14.1%. Non-residential spending is up 3.1% year-over-year. Public spending is up 3.3% year-over-year.

ISM® Manufacturing index Unchanged at 52.8% in August

by Calculated Risk on 9/01/2022 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 52.8% in August, unchanged from 52.8% in July. The employment index was at 54.2%, up from 49.9% last month, and the new orders index was at 51.3%, up from 48.0%.

From ISM: Manufacturing PMI® at 52.8% August 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in August, with the overall economy achieving a 27th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at the same pace in August as in July. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The August Manufacturing PMI® registered 52.8 percent, the same reading as recorded in July. This figure indicates expansion in the overall economy for the 27th month in a row after contraction in April and May 2020. For a second straight month, the Manufacturing PMI® figure is the lowest since June 2020, when it registered 52.4 percent. The New Orders Index registered 51.3 percent, 3.3 percentage points higher than the 48 percent recorded in July. The Production Index reading of 50.4 percent is a 3.1-percentage point decrease compared to July’s figure of 53.5 percent. The Prices Index registered 52.5 percent, down 7.5 percentage points compared to the July figure of 60 percent; this is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 53 percent, 1.7 percentage points above the July reading of 51.3 percent. After three straight months of contraction, the Employment Index expanded at 54.2 percent, 4.3 percentage points higher than the 49.9 percent recorded in July. The Supplier Deliveries Index reading of 55.1 percent is 0.1 percentage point lower than the July figure of 55.2 percent. The Inventories Index registered 53.1 percent, 4.2 percentage points lower than the July reading of 57.3 percent. The New Export Orders Index contracted at 49.4 percent, down 3.2 percentage points compared to July’s figure of 52.6 percent. The Imports Index remained in expansion territory at 52.5 percent, but 1.9 percentage points below the July reading of 54.4 percent.”

emphasis added

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 9/01/2022 08:38:00 AM

The DOL reported:

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 6,000 from 243,000 to 237,000. The 4-week moving average was 241,500, a decrease of 4,000 from the previous week's revised average. The previous week's average was revised down by 1,500 from 247,000 to 245,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,500.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, August 31, 2022

Thursday: Unemployment Claims, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 8/31/2022 09:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 250 thousand from 243 thousand last week.

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 52,1, down from 52.8 in July.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 0.1% decrease in construction spending.

• Late, Light vehicle sales for August. The consensus is for light vehicle sales to be 13.6 million SAAR in August, up from 13.34 million in July (Seasonally Adjusted Annual Rate).

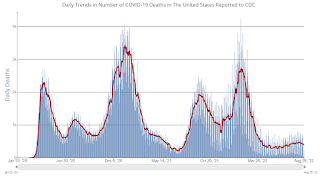

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 88,286 | 90,064 | ≤5,0001 | |

| Hospitalized2 | 31,517 | 33,640 | ≤3,0001 | |

| Deaths per Day2 | 383 | 423 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in July

by Calculated Risk on 8/31/2022 04:10:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.76% in July from 0.81% in June. The serious delinquency rate is down from 1.94% in July 2021. This is almost back to pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.60% are seriously delinquent (down from 2.75% in June).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Inflation Adjusted House Prices Declined in June

by Calculated Risk on 8/31/2022 11:13:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices Declined in June

Excerpt:

It has been over 16 years since the bubble peak. In the Case-Shiller release yesterday, the seasonally adjusted National Index (SA), was reported as being 66% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 16% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 7% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). As an example, if a house price was $200,000 in January 2000, the price would be almost $339,000 today adjusted for inflation (69.5% increase). That is why the second graph below is important - this shows "real" prices (adjusted for inflation). ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices. In real terms, the National index is 14.6% above the bubble peak, and the Composite 20 index is 6.1% above the bubble peak in early 2006.

Note that real prices declined in June, with nominal prices increasing less than inflation.

ADP: Private Employment Increased 132,000 in August

by Calculated Risk on 8/31/2022 08:27:00 AM

Note: This is the first release of a new methodology. Historical data based on the new methodology is available.

From ADP: ADP National Employment Report: Private Sector Employment Increased by

132,000 Jobs in August; Annual Pay was Up 7.6%

Private sector employment increased by 132,000 jobs in August and annual pay was up 7.6% according to the August ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).The BLS report will be released Friday, and the consensus is for 280 thousand non-farm payroll jobs added in August.

The jobs report and pay insights use ADP’s fine-grained anonymized and aggregated payroll data of over 25 million U.S. employees to provide a representative picture of the labor market. The report details the current month’s total private employment change, and weekly job data from the previous month. ADP’s pay measure uniquely captures the earnings of a cohort of almost 10 million employees over a 12-month period.

“Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy's conflicting signals,” said Nela Richardson, chief economist, ADP. “We could be at an inflection point, from super-charged job gains to something more normal.”

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/31/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

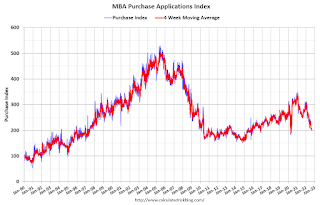

Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 26, 2022.

... The Refinance Index decreased 8 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 23 percent lower than the same week one year ago.

“The 30-year fixed mortgage rate increased for the second week in a row to 5.80 percent, reaching its highest level since mid-July. Mortgage rates and Treasury yields rose last week as Federal Reserve officials indicated that short-term rates would stay higher for longer. Mortgage rates have been volatile over the past month, bouncing between 5.4 percent and 5.8 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “In another sign that market volatility has picked up, the average rate on a jumbo loan was 5.32 percent, 48 basis points lower than for a conforming loan. This spread reached a high of over 50 basis points in July – and had narrowed – before now widening again.”

Added Kan, “Application volume dropped and remained at a multi-decade low last week, led by an 8 percent decline in refinance applications, which now make up only 30 percent of all applications. Purchase applications have declined in eight of the last nine weeks, as demand continues to shrink due to higher rates and a weaker economic outlook. However, rising inventories and slower home-price growth could potentially bring some buyers back into the market later this year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.80 percent from 5.65 percent, with points increasing to 0.71 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 30, 2022

Wednesday: ADP Employment, Chicago PMI

by Calculated Risk on 8/30/2022 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for August. This report is for private payrolls only (no government). This is the first release of a new methodology.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 82,475 | 91,792 | ≤5,0001 | |

| Hospitalized2 | 31,601 | 33,900 | ≤3,0001 | |

| Deaths per Day2 | 387 | 433 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Las Vegas July 2022: Visitor Traffic Down 5.3% Compared to 2019

by Calculated Risk on 8/30/2022 02:08:00 PM

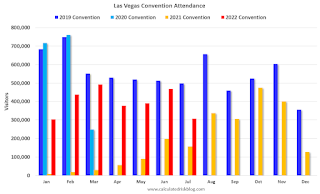

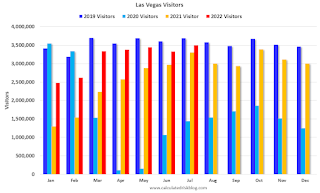

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: July 2022 Las Vegas Visitor Statistics

July saw the highest monthly visitation since the start of the pandemic, reaching nearly 3.5M visitors for the month, up 5.7% YoY and just 5.3% below the July 2019 tally.

Overall hotel occupancy reached 83.4%, 4.0 pts ahead of last July but down 7.7 pts vs. July 2019. Weekend occupancy exceeded 91% (up 3.0 pts YoY but down 6.1 pts vs. July 2019), while Midweek occupancy reached 79.1% (up 4.5 pts YoY but down 9.6 pts vs. July 2019).

ADR exceeded $160, 5.5% ahead of last July and over 26% above July 2019 while RevPAR approached $134 for the month, +10.8% YoY and +15.7% over July 2019

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 5.3% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.