by Calculated Risk on 9/02/2022 09:09:00 PM

Friday, September 02, 2022

COVID Sept 2, 2022, Update on Cases, Hospitalizations and Deaths

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 83,939 | 91,017 | ≤5,0001 | |

| Hospitalized2 | 31,020 | 33,091 | ≤3,0001 | |

| Deaths per Day2 | 407 | 422 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

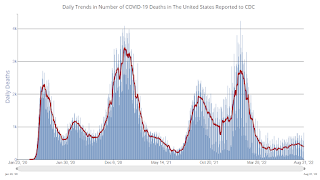

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Will House Prices Decline Nationally?

by Calculated Risk on 9/02/2022 02:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Will House Prices Decline Nationally?

Excerpt:

And yesterday, in an interview with Bilal Hafeez, Ivy Zelman, CEO of Zelman & Associates forecast national house price declines of 4% in 2023, and 5% in 2024: Ivy Zelman on the Coming US Housing Crisis (price discussion starts at around 20:00)There are some mortgage guard rails that could mitigate nationally a severe downturn, and yet the magnitude of the decline for us - the 4% that we are expecting in 2023, and 5% in 2024 -I feel like it is a starting point … the speed of the declines makes us feel like that maybe that could be conservative. But we could see double digit price corrections [in the] hot markets.There are some factors arguing against national price declines. ...

But there are also factors arguing for national price declines.

Q3 GDP Forecasts: Just Over 1%

by Calculated Risk on 9/02/2022 01:14:00 PM

From BofA:

Our 3Q US GDP tracking estimate rose to 1.3% q/q seasonally adjusted annualized rate (SAAR), up from from 0.5% q/q saar last wee [September 2nd estimate]From Goldman:

emphasis added

[D]ata on employment, auto sales, and factory orders caused our US 3Q GDP tracking estimate to fall by two-tenths, to 1.1% q/q saar, from 1.3% previously. [September 2nd estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.6 percent on September 1, up from 1.6 percent on August 26. [September 1st estimate]

Heavy Truck Sales Decline Slightly in August; Still Solid

by Calculated Risk on 9/02/2022 11:23:00 AM

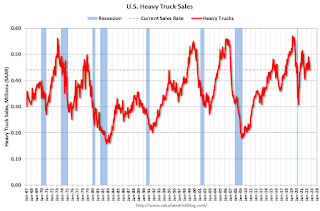

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the August 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Comments on August Employment Report

by Calculated Risk on 9/02/2022 09:16:00 AM

The headline jobs number in the August employment report was above expectations, however employment for the previous two months was revised down by 107,000, combined. The participation rate increased, pushing up the unemployment rate to 3.7%. And the employment-population ratio increased slightly.

In August, the year-over-year employment change was 5.84 million jobs.

Prime (25 to 54 Years Old) Participation

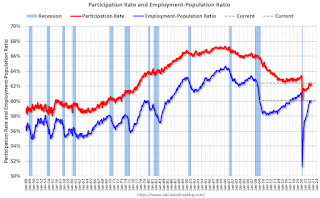

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in August to 82.8% from 82.4% in July, and the 25 to 54 employment population ratio increased to 80.3% from 80.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons was little changed at 4.1 million in August. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full- time jobs."The number of persons working part time for economic reasons increased in August to 4.149 million from 3.924 million in July. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% from 6.7% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is at the same level as in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.137 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.067 million the previous month.

This is back to pre-pandemic levels.

Summary:

The headline monthly jobs number was above expectations; however, employment for the previous two months was revised down by 107,000, combined.

August Employment Report: 315 thousand Jobs, 3.7% Unemployment Rate

by Calculated Risk on 9/02/2022 08:43:00 AM

From the BLS:

Total nonfarm payroll employment increased by 315,000 in August, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, health care, and retail trade.

...

The change in total nonfarm payroll employment for June was revised down by 105,000, from +398,000 to +293,000, and the change for July was revised down by 2,000, from +528,000 to +526,000. With these revisions, employment in June and July combined is 107,000 lower than previously reported.

emphasis added

Click on graph for larger image.

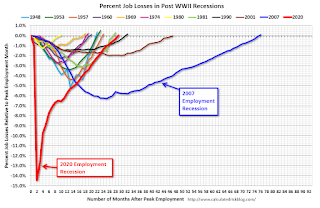

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

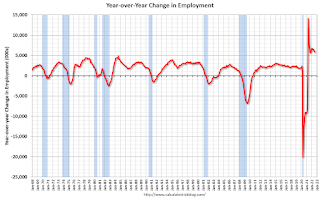

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was 5.84 million jobs. Employment was up significantly year-over-year.

Total payrolls increased by 315 thousand in August. Private payrolls increased by 308 thousand, and public payrolls increased 7 thousand.

Payrolls for June and July were revised down 107 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.4% in August, from 62.1% in July. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.4% in August, from 62.1% in July. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.1% from 60.0% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was increased in August to 3.7% from 3.5% in July.

This was above consensus expectations; however, June and July payrolls were revised down by 107,000 combined.

Thursday, September 01, 2022

Friday: Employment Report

by Calculated Risk on 9/01/2022 09:00:00 PM

Friday:

• At 8:30 AM ET, Employment Report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 85,761 | 91,773 | ≤5,0001 | |

| Hospitalized2 | 31,114 | 33,384 | ≤3,0001 | |

| Deaths per Day2 | 403 | 426 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Vehicles Sales Decreased to 13.18 million SAAR in August

by Calculated Risk on 9/01/2022 07:37:00 PM

Wards Auto released their estimate of light vehicle sales for August. Wards Auto estimates sales of 13.18 million SAAR in August 2022 (Seasonally Adjusted Annual Rate), down 1.1% from the July sales rate, and up 0.7% from August 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for August (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Goldman August Payrolls Preview

by Calculated Risk on 9/01/2022 04:07:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 350k in August (mom sa) ... We estimate the unemployment rate edged down to 3.4% in August ...CR Note: The consensus is for 280 thousand jobs added, and for the unemployment rate to be unchanged at 3.5%.

emphasis added

August Employment Preview

by Calculated Risk on 9/01/2022 02:52:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for 280,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

Click on graph for larger image.

Click on graph for larger image.• First, as of July there 32 thousand more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of July 2022, all of the jobs have returned.

This doesn't include the preliminary benchmark revision that showed there were 462 thousand more jobs than originally reported in March 2022.

• ADP Report: The ADP employment report showed 132,000 private sector jobs were added in September. This is the first release of ADP's new methodology, and this suggests a weaker than expected employment report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in August to 54.2%, up from 49.9% last month. This would suggest about 5,000 jobs added in manufacturing.

The ISM® services employment index has not yet been released.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 261,000 in July to 245,000 in August. This would usually suggest fewer layoffs in August than in July. In general, weekly claims were lower than expectations in August.