by Calculated Risk on 9/05/2022 01:40:00 PM

Monday, September 05, 2022

Summer Teen Employment

Here is a look at the change in teen employment over time.

The graph below shows the employment-population ratio for teens (6 to 19 years old) since 1948.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment had been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) Teen employment was significantly impacted in 2020 by the pandemic.

3) A smaller percentage of teenagers are obtaining summer employment. The seasonal spikes are smaller than in previous decades.

3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years).

Housing September 5th Update: Inventory Dips Slightly

by Calculated Risk on 9/05/2022 10:42:00 AM

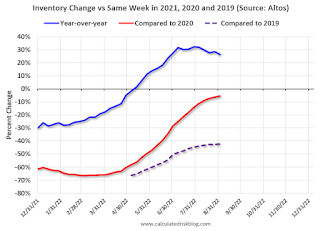

Inventory decreased slightly last week. Still, inventory decreased less than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 5.4% according to Altos)

4. Inventory up compared to 2019 (currently down 42.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 9/05/2022 08:21:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 4th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 3.4% from the same day in 2019 (90.9% of 2019). (Dashed line)

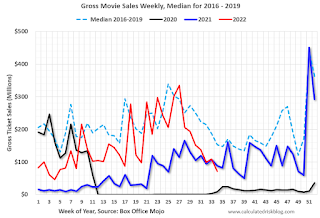

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $78 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 27th. The occupancy rate was down 2.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

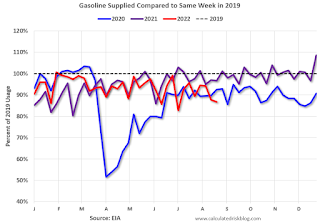

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 26th, gasoline supplied was down 13.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, September 04, 2022

Hotels: Occupancy Rate Down 2.5% Compared to Same Week in 2019

by Calculated Risk on 9/04/2022 09:01:00 AM

U.S. hotel performance came in lower than the previous week and showed mixed comparisons with 2019, according to STR‘s latest data through Aug. 27.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Aug. 21-27, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-2.5%)

• Average daily rate (ADR): $147.16 (+15.0%)

• Revenue per available room (RevPAR): $95.62 (+12.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, September 03, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/03/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller National House Price Index "Decelerated" to 18.0% year-over-year increase in June

• Inflation Adjusted House Prices Declined in June

• Pace of Rent Increases Continues to Slow

• Will House Prices Decline Nationally?

• Active vs Total Existing Home Inventory

• 30-Year Mortgage Rates Pushing 6% Again

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 4, 2022

by Calculated Risk on 9/03/2022 08:11:00 AM

This will be a light week for economic data.

All US markets will be closed in observance of the Labor Day holiday.

8:00 AM ET: Corelogic House Price index for July

10:00 AM: the ISM Services Index for August. The consensus is for a reading of 55.5, down from 56.7.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be $70.5 billion in July, from $79.6 billion in June.

At 12:35 PM: Speech, Fed Vice Chair Brainard, Economic Outlook and Monetary Policy, At The Clearing House and Bank Policy Institute Annual Conference, New York, N.Y.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 240 thousand from 232 thousand last week.

9:10AM: Discussion, Fed Chair Powell, At the Cato Institute’s 40th Annual Monetary Conference

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, September 02, 2022

COVID Sept 2, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/02/2022 09:09:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 83,939 | 91,017 | ≤5,0001 | |

| Hospitalized2 | 31,020 | 33,091 | ≤3,0001 | |

| Deaths per Day2 | 407 | 422 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Will House Prices Decline Nationally?

by Calculated Risk on 9/02/2022 02:35:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Will House Prices Decline Nationally?

Excerpt:

And yesterday, in an interview with Bilal Hafeez, Ivy Zelman, CEO of Zelman & Associates forecast national house price declines of 4% in 2023, and 5% in 2024: Ivy Zelman on the Coming US Housing Crisis (price discussion starts at around 20:00)There are some mortgage guard rails that could mitigate nationally a severe downturn, and yet the magnitude of the decline for us - the 4% that we are expecting in 2023, and 5% in 2024 -I feel like it is a starting point … the speed of the declines makes us feel like that maybe that could be conservative. But we could see double digit price corrections [in the] hot markets.There are some factors arguing against national price declines. ...

But there are also factors arguing for national price declines.

Q3 GDP Forecasts: Just Over 1%

by Calculated Risk on 9/02/2022 01:14:00 PM

From BofA:

Our 3Q US GDP tracking estimate rose to 1.3% q/q seasonally adjusted annualized rate (SAAR), up from from 0.5% q/q saar last wee [September 2nd estimate]From Goldman:

emphasis added

[D]ata on employment, auto sales, and factory orders caused our US 3Q GDP tracking estimate to fall by two-tenths, to 1.1% q/q saar, from 1.3% previously. [September 2nd estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.6 percent on September 1, up from 1.6 percent on August 26. [September 1st estimate]

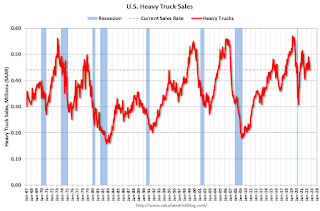

Heavy Truck Sales Decline Slightly in August; Still Solid

by Calculated Risk on 9/02/2022 11:23:00 AM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the August 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.