by Calculated Risk on 9/06/2022 03:37:00 PM

Tuesday, September 06, 2022

Lawler: Are “National” Home Prices Already Falling?

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Are “National” Home Prices Already Falling?

Excerpt:

A short but important note from housing economist Tom Lawler ...

However, some recent home price reports actually suggest that “national” home prices may already have started to decline, and they certainly show that home prices in some areas of the country have already begun to fall.

...

Given the lagged nature of some of these HPIs – and considering that closed transactions typically represent contract activity in the previous one or two months – it seems quite possible that home prices contemporaneously measured may in fact have already reached a peak for the year. Indeed, my own view is that a “base case” projection would be that all of these HPIs will show a December level that is below the June level.

The Sharp Slowdown in Year-over-year House Price Growth

by Calculated Risk on 9/06/2022 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Sharp Slowdown in Year-over-year House Price Growth

Excerpt:

And Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close. From Zillow Research: June 2022 Case-Shiller Results & Forecast: Moving Towards Rebalance ...

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be 15.9% in July. This would the lowest year-over-year increase since April 2021. This Case-Shiller National index was up 20.6% YoY in April, 19.9% in May, 18.0% in June, and Zillow is forecasting 15.9% in July. This is a sharp slowdown in YoY price increases.

For the most part, this deceleration was before the most recent rate increases (current 30-year mortgage rates are at 6.25%). Whether this means prices will stall on a national basis or decline something like 5% to 10% remains to be seen. It is clear there will be some double-digit regional declines, but I don’t expect cascading price declines this time since lending standards have been reasonably solid.

ISM® Services Index Increased to 56.9% in August

by Calculated Risk on 9/06/2022 10:03:00 AM

(Posted with permission). The ISM® Services index was at 56.9%, up from 56.7% last month. The employment index increased to 50.2%, from 49.1%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.9% August 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in August for the 27th month in a row — with the Services PMI® registering 56.9 percent — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.This was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In August, the Services PMI® registered 56.9 percent, 0.2 percentage point higher than July’s reading of 56.7 percent. The Business Activity Index registered 60.9 percent, an increase of 1 percentage point compared to the reading of 59.9 percent in July. The New Orders Index figure of 61.8 percent is 1.9 percentage points higher than the July reading of 59.9 percent.

emphasis added

CoreLogic: House Prices up 15.8% YoY in July

by Calculated Risk on 9/06/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Year-Over-Year Home Price Growth Dips Again in July as Higher Mortgage Rates Cool Demand

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for July 2022.

Annual home price growth slowed for the third consecutive month in July but remained elevated at 15.8%. As 30-year, fixed-rate mortgages neared 6% this summer, some prospective homebuyers pulled back, helping ease overheated and unsustainable price growth. Notably, home prices declined by 0.3% from June to July, a trend not seen between 2010 and 2019, when price increases averaged 0.5% between those two months, according to CoreLogic’s historic data. Looking ahead, CoreLogic expects to see a more balanced housing market, with year-over-year appreciation slowing to 3.8% by July 2023.

“Following June’s surge in mortgage rates and the resulting dampening effect on housing demand, price growth is taking a decisive turn,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “And even though annual price growth remains in double digits, the month-over-month decline suggests further deceleration on the horizon. The higher cost of homeownership has clearly eroded affordability, as inflation-adjusted monthly mortgage expenses are now even higher than they were at their former peak in 2006.”

emphasis added

Monday, September 05, 2022

Tuesday: CoreLogic House Prices, ISM Services

by Calculated Risk on 9/05/2022 07:03:00 PM

Weekend:

• Schedule for Week of September 4, 2022

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for July

• At 10:00 AM, the ISM Services Index for August. The consensus is for a reading of 55.5, down from 56.7.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 19 and DOW futures are up 162 (fair value).

Oil prices were down over the last week with WTI futures at $88.93 per barrel and Brent at $95.74 per barrel. A year ago, WTI was at $69, and Brent was at $73 - so WTI oil prices are up 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.75 per gallon. A year ago, prices were at $3.17 per gallon, so gasoline prices are up $0.58 per gallon year-over-year.

Summer Teen Employment

by Calculated Risk on 9/05/2022 01:40:00 PM

Here is a look at the change in teen employment over time.

The graph below shows the employment-population ratio for teens (6 to 19 years old) since 1948.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment had been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) Teen employment was significantly impacted in 2020 by the pandemic.

3) A smaller percentage of teenagers are obtaining summer employment. The seasonal spikes are smaller than in previous decades.

3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years).

Housing September 5th Update: Inventory Dips Slightly

by Calculated Risk on 9/05/2022 10:42:00 AM

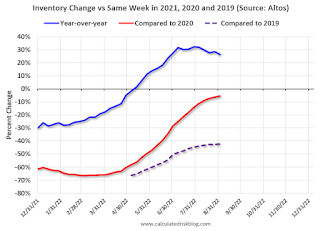

Inventory decreased slightly last week. Still, inventory decreased less than in 2019 at this time of year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 5.4% according to Altos)

4. Inventory up compared to 2019 (currently down 42.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 9/05/2022 08:21:00 AM

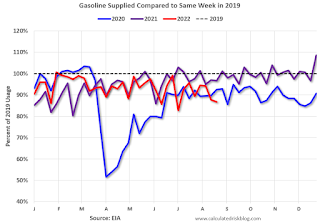

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 4th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 3.4% from the same day in 2019 (90.9% of 2019). (Dashed line)

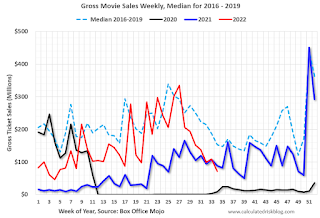

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $78 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 27th. The occupancy rate was down 2.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 26th, gasoline supplied was down 13.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, September 04, 2022

Hotels: Occupancy Rate Down 2.5% Compared to Same Week in 2019

by Calculated Risk on 9/04/2022 09:01:00 AM

U.S. hotel performance came in lower than the previous week and showed mixed comparisons with 2019, according to STR‘s latest data through Aug. 27.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Aug. 21-27, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.0% (-2.5%)

• Average daily rate (ADR): $147.16 (+15.0%)

• Revenue per available room (RevPAR): $95.62 (+12.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, September 03, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/03/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller National House Price Index "Decelerated" to 18.0% year-over-year increase in June

• Inflation Adjusted House Prices Declined in June

• Pace of Rent Increases Continues to Slow

• Will House Prices Decline Nationally?

• Active vs Total Existing Home Inventory

• 30-Year Mortgage Rates Pushing 6% Again

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/