by Calculated Risk on 9/08/2022 09:17:00 AM

Thursday, September 08, 2022

Homebuilder Comments in August: Increased Incentives Helping Sales, "Construction cycle time has improved"

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in August: Increased Incentives Helping Sales

A brief excerpt:

Here are some interesting homebuilder comments from around the country. In August, builders have cut prices and increased incentives. And cycle times are improving with less demand.There many more comments in the article. You can subscribe at https://calculatedrisk.substack.com/

Homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

#Austin builder: “A lot of spec inventory to work through. August was a very poor month for sales across the board. Cancellations spiked from July and buyers showed no sense of urgency.”

#Baltimore builder: “Jumbo loan rates below 5% are helping buyers move forward in that segment.”

#Boise builder: “Construction cycle time has improved over the last 30 days.”

#Charlotte builder: “Sales were fairly strong in August. Increased incentives to help with closing costs and a buy down rate appear to be helping.”

#Cleveland builder: “Build cycle times have been improving over the last 4 or 5 months. Appointments have completely dropped off and traffic is very sparse at the models.”

Weekly Initial Unemployment Claims decrease to 222,000

by Calculated Risk on 9/08/2022 08:33:00 AM

The DOL reported:

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 232,000 to 228,000. The 4-week moving average was 233,000, a decrease of 7,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 241,500 to 240,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 233,000.

The previous week was revised down.

Weekly claims were below the consensus forecast.

Wednesday, September 07, 2022

Thursday: Unemployment Claims, Fed Chair Powell

by Calculated Risk on 9/07/2022 08:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 240 thousand from 232 thousand last week.

• At 9:10 AM, Discussion, Fed Chair Powell, At the Cato Institute’s 40th Annual Monetary Conference

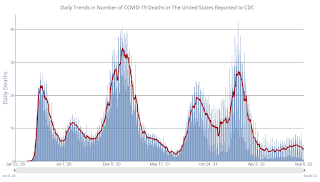

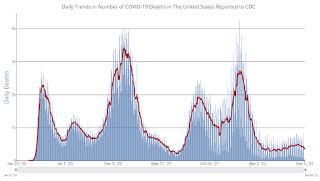

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 74,803 | 88,644 | ≤5,0001 | |

| Hospitalized2 | 29,491 | 31,842 | ≤3,0001 | |

| Deaths per Day2 | 336 | 414 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed's Beige Book: "Residential real estate conditions weakened noticeably as home sales fell in all twelve Districts"

by Calculated Risk on 9/07/2022 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of San Francisco based on information collected on or before August 29, 2022."

Economic activity was unchanged, on balance, since early July, with five Districts reporting slight to modest growth in activity and five others reporting slight to modest softening. Most Districts reported steady consumer spending as households continued to trade down and to shift spending away from discretionary goods and toward food and other essential items. Auto sales remained muted across most Districts, reflecting limited inventories and elevated prices. Hospitality and tourism contacts highlighted overall solid leisure travel activity with some reporting an uptick in business and group travel. Manufacturing activity grew in several Districts, although there were some reports of declining output as supply chain disruptions and labor shortages continued to hamper production. Despite some reports of strong leasing activity, residential real estate conditions weakened noticeably as home sales fell in all twelve Districts and residential construction remained constrained by input shortages. Commercial real estate activity softened, particularly demand for office space. Loan demand was mixed; while financial institutions reported generally strong demand for credit cards and commercial and industrial loans, residential loan demand was weak amid elevated mortgage interest rates. Nonfinancial services firms experienced stable to slightly higher demand. Demand for transportation services was mixed and reports on agriculture conditions across reporting Districts varied. While demand for energy products was robust, production remained constrained by supply chain bottlenecks for critical components. The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

emphasis added

Black Knight Mortgage Monitor: "Total market leverage was just 42% of mortgaged homes’ values, the lowest on record"

by Calculated Risk on 9/07/2022 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Total market leverage was just 42% of mortgaged homes’ values, the lowest on record"

A brief excerpt:

Most homeowners have a significant amount of equity and will not be “underwater” if house prices decline. This is an important difference compared to the housing bubble when many millions of borrowers had little or no equity even before house prices declined. As Black Knight notes in their monthly Mortgage Monitor report released this morning:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Overall, the market is on strong footing to weather a correction; total market leverage as of Q2 – including both first and second liens – was just 42% of mortgaged homes’ values, the lowest on recordThe first graph shows Black Knight’s estimate of tappable equity.

• Tappable equity – the amount a homeowner can borrow against while keeping a 20% equity stake – hit its 10th consecutive quarterly record high in Q2 2022 at $11.5T but appears to have peaked in May of this year

• Escalating declines in June and July have total tappable equity down 5% over the past two months, suggesting a sizeable reduction is likely in Q3, which would mark the first quarterly decline in three years

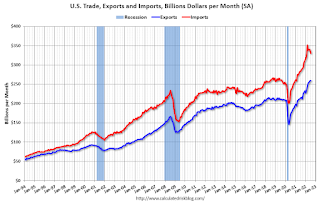

Trade Deficit decreased to $70.6 Billion in July

by Calculated Risk on 9/07/2022 08:39:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $70.6 billion in July, down $10.2 billion from $80.9 billion in June, revised.

July exports were $259.3 billion, $0.5 billion more than June exports. July imports were $329.9 billion, $9.7 billion less than June imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July.

Exports are up 21% year-over-year; imports are up 16% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and have now bounced back.

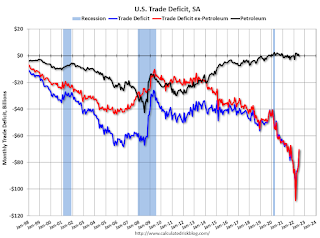

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $34.4 billion in July, from $28.6 billion a year ago.

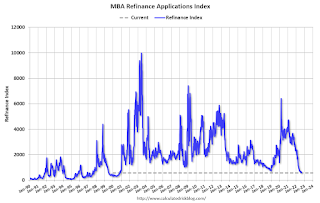

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/07/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 2, 2022.

... The Refinance Index decreased 1 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 23 percent lower than the same week one year ago.

“Mortgage rates moved higher over the course of last week as markets continued to re-assess the prospects for the economy and the path of monetary policy, with expectations for short-term rates to move and stay higher for longer,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “With the 30-year fixed rate rising to the highest level since mid-June, application volumes for both purchase and refinance loans dropped. Recent economic data will likely prevent any significant decline in mortgage rates in the near term, but the strong job market depicted in the August data should support housing demand. There is no sign of a rebound in purchase applications yet, but the robust job market and an increase in housing inventories should lead to an eventual increase in purchase activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.94 percent from 5.80 percent, with points increasing to 0.79 from 0.71 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 06, 2022

Wednesday: Trade Deficit, Beige Book

by Calculated Risk on 9/06/2022 09:14:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be $70.5 billion in July, from $79.6 billion in June.

• At At 12:35 PM, Speech, Fed Vice Chair Brainard, Economic Outlook and Monetary Policy, At The Clearing House and Bank Policy Institute Annual Conference, New York, N.Y.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 69,828 | 88,606 | ≤5,0001 | |

| Hospitalized2 | 26,072 | 32,120 | ≤3,0001 | |

| Deaths per Day2 | 342 | 423 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Are “National” Home Prices Already Falling?

by Calculated Risk on 9/06/2022 03:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Are “National” Home Prices Already Falling?

Excerpt:

A short but important note from housing economist Tom Lawler ...

However, some recent home price reports actually suggest that “national” home prices may already have started to decline, and they certainly show that home prices in some areas of the country have already begun to fall.

...

Given the lagged nature of some of these HPIs – and considering that closed transactions typically represent contract activity in the previous one or two months – it seems quite possible that home prices contemporaneously measured may in fact have already reached a peak for the year. Indeed, my own view is that a “base case” projection would be that all of these HPIs will show a December level that is below the June level.

The Sharp Slowdown in Year-over-year House Price Growth

by Calculated Risk on 9/06/2022 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Sharp Slowdown in Year-over-year House Price Growth

Excerpt:

And Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close. From Zillow Research: June 2022 Case-Shiller Results & Forecast: Moving Towards Rebalance ...

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be 15.9% in July. This would the lowest year-over-year increase since April 2021. This Case-Shiller National index was up 20.6% YoY in April, 19.9% in May, 18.0% in June, and Zillow is forecasting 15.9% in July. This is a sharp slowdown in YoY price increases.

For the most part, this deceleration was before the most recent rate increases (current 30-year mortgage rates are at 6.25%). Whether this means prices will stall on a national basis or decline something like 5% to 10% remains to be seen. It is clear there will be some double-digit regional declines, but I don’t expect cascading price declines this time since lending standards have been reasonably solid.