by Calculated Risk on 9/13/2022 08:48:00 AM

Tuesday, September 13, 2022

Early Look at 2023 Cost-Of-Living Adjustments and Maximum Contribution Base

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 8.7 percent over the last 12 months to an index level of 291.629 (1982-84=100). For the month, the index declined 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2021, the Q3 average of CPI-W was 268.421.

The 2021 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 8.7% year-over-year in August, and although this is early - we need the data for September - my guess is COLA will probably be around 8.6% to 8.8% this year, the largest increase since 11.2% in 1981 (and larger than the 7.4% increase in 1982).

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2021 yet, but wages probably increased again in 2021. If wages increased 4% in 2021, then the contribution base next year will increase to around $153,000 in 2023, from the current $147,000.

Remember - this is an early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: CPI increased 0.1% in August; Core CPI increased 0.6%

by Calculated Risk on 9/13/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in August on a seasonally adjusted basis after being unchanged in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.3 percent before seasonal adjustment.Both CPI and core CPI were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the broad-based monthly all items increase. These increases were mostly offset by a 10.6-percent decline in the gasoline index. The food index continued to rise, increasing 0.8 percent over the month as the food at home index rose 0.7 percent. The energy index fell 5.0 percent over the month as the gasoline index declined, but the electricity and natural gas indexes increased.

The index for all items less food and energy rose 0.6 percent in August, a larger increase than in July. The indexes for shelter, medical care, household furnishings and operations, new vehicles, motor vehicle insurance, and education were among those that increased over the month. There were some indexes that declined in August, including those for airline fares, communication, and used cars and trucks.

The all items index increased 8.3 percent for the 12 months ending August, a smaller figure than the 8.5-percent increase for the period ending July. The all items less food and energy index rose 6.3 percent over the last 12 months. The energy index increased 23.8 percent for the 12 months ending August, a smaller increase than the 32.9-percent increase for the period ending July. The food index increased 11.4 percent over the last year, the largest 12-month increase since the period ending May 1979.

emphasis added

Monday, September 12, 2022

Tuesday: CPI

by Calculated Risk on 9/12/2022 08:44:00 PM

Mortgage rates moved slightly higher today, but only after moving slightly lower earlier this morning. [30 year fixed 5.98%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.1% decrease in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 8.1% year-over-year and core CPI to be up 6.1% YoY.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 60,185 | 83,434 | ≤5,0001 | |

| Hospitalized2 | 26,145 | 30,503 | ≤3,0001 | |

| Deaths per Day2 | 328 | 394 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Second Home Market: South Lake Tahoe in August

by Calculated Risk on 9/12/2022 02:52:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through August 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but up 5-fold from the record low set in February 2022, and up 44% year-over-year. Prices are up 3.8% YoY (and the YoY change has been trending down).

Mortgage Equity Withdrawal Still Strong in Q2; Homeowners now relying on Home Equity lines to extract equity

by Calculated Risk on 9/12/2022 12:26:00 PM

Today, in the Real Estate Newsletter: Mortgage Equity Withdrawal Still Strong in Q2

Excerpt:

Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released on Friday. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (All ad free, most content free).

In Q2 2022, mortgage debt increased $263 billion, the most since 2006. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).

Housing September 12th Update: Inventory Decreased 1.0% Last Week

by Calculated Risk on 9/12/2022 10:20:00 AM

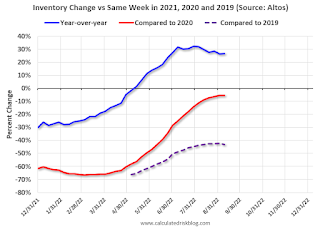

Active inventory decreased 1.0% last week. Here are the same week inventory changes for the last four years (the increase in 2019 was a one-week surge):

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 5.5% according to Altos)

4. Inventory up compared to 2019 (currently down 43.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 9/12/2022 08:30:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 11th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 4.9% from the same day in 2019 (90.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $82 million last week, down about 44% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Sept 3rd. The occupancy rate was up 3.1% compared to the same week in 2019. This was the first week, since the onset of the pandemic, with the occupancy higher than the comparable week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of September 2nd, gasoline supplied was down 7.9% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, September 11, 2022

Sunday Night Futures

by Calculated Risk on 9/11/2022 07:27:00 PM

Weekend:

• Schedule for Week of September 11, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 12 and DOW futures are up 79 (fair value).

Oil prices were down over the last week with WTI futures at $86.45 per barrel and Brent at $92.61 per barrel. A year ago, WTI was at $70, and Brent was at $73 - so WTI oil prices are up 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.67 per gallon. A year ago, prices were at $3.15 per gallon, so gasoline prices are up $0.52 per gallon year-over-year.

Hotels: Occupancy Rate UP 3.1% Compared to Same Week in 2019

by Calculated Risk on 9/11/2022 08:11:00 AM

U.S. hotel performance dipped from the previous week but continued to improve in comparison with 2019, according to STR‘s latest data through Sept. 3.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Aug. 28 through Sept. 3, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 62.8% (+3.1%)

• Average daily rate (ADR): $147.14 (+20.9%)

• Revenue per available room (RevPAR): $92.45 (+24.6%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, September 10, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/10/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 1st Look at Local Housing Markets in August

• Homebuilder Comments in August: Increased Incentives Helping Sales

• Black Knight Mortgage Monitor: "Total market leverage was just 42% of mortgaged homes’ values, the lowest on record"

• Lawler: Are “National” Home Prices Already Falling?

• The Sharp Slowdown in Year-over-year House Price Growth

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/