by Calculated Risk on 9/19/2022 10:11:00 AM

Monday, September 19, 2022

NAHB: Builder Confidence Declined in September

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 46, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Falls for Ninth Straight Month as Housing Slowdown Continues

In another sign that the slowdown in the housing market continues, builder sentiment fell for the ninth straight month in September as the combination of elevated interest rates, persistent building material supply chain disruptions and high home prices continue to take a toll on affordability.This was below the consensus forecast, and below 50.

Builder confidence in the market for newly built single-family homes fell three points in September to 46, the lowest level since May 2014 with the exception of the spring of 2020, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “In another indicator of a weakening market, 24% of builders reported reducing home prices, up from 19% last month.”

“Builder sentiment has declined every month in 2022, and the housing recession shows no signs of abating as builders continue to grapple with elevated construction costs and an aggressive monetary policy from the Federal Reserve that helped pushed mortgage rates above 6% last week, the highest level since 2008,” said NAHB Chief Economist Robert Dietz. “In this soft market, more than half of the builders in our survey reported using incentives to bolster sales, including mortgage rate buydowns, free amenities and price reductions.” …

All three HMI components posted declines in September. Current sales conditions dropped three points to 54, sales expectations in the next six months declined one point to 46 and traffic of prospective buyers fell one point to 31.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell five points to 51, the Midwest dropped five points to 44, the South fell seven points to 56 and the West posted a 10-point decline to 41.

emphasis added

Housing September 19th Update: Inventory Increased 0.9% Last Week

by Calculated Risk on 9/19/2022 07:30:00 AM

Note: this is a travel day, and posts will be brief.

As of September 16th, inventory was at 552 thousand (7-day average), compared to 547 thousand the prior week. Inventory was up 0.9% from the previous week. Inventory is down slightly from the 2022 peak of 555 thousand three weeks ago.

j 1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 3.7% according to Altos)

4. Inventory up compared to 2019 (currently down 42.7%).

Sunday, September 18, 2022

Sunday Night Futures

by Calculated Risk on 9/18/2022 08:34:00 PM

Weekend:

• Schedule for Week of September 18, 2022

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 47, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 63 (fair value).

Oil prices were down over the last week with WTI futures at $85.83 per barrel and Brent at $92.13 per barrel. A year ago, WTI was at $70, and Brent was at $73 - so WTI oil prices are up 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $3.17 per gallon, so gasoline prices are up $0.47 per gallon year-over-year.

FOMC Preview: 75bp Hike

by Calculated Risk on 9/18/2022 09:37:00 AM

Expectations are the FOMC will announce a 75bp rate increase in the federal funds rate at the meeting this week, although some analysts think a 100bp rate increase is possible.

"We think the Fed will read the incoming data as justifying another large 75bp rate hike, bringing the target range for the federal funds rate to 3.0-3.25%. We think the Fed will signal a terminal funds rate of 4.0-4.25% early next year, 37.5bp higher than in June. We expect the FOMC statement to say that monetary policy will be moving into restrictive territory and the committee expects it to remain there “for some time”, similar to the tone of Chair Powell’s remarks at Jackson Hole. In the press conference, Powell is likely to emphasize that the “overarching goal” of monetary policy is the restoration of price stability, even if doing so requires a hard landing. Updated projections are likely to send a similar message, with less growth, higher unemployment, and a more restrictive policy stance suggesting the window to a soft landing has narrowed further."From Goldman Sachs:

"We have raised our fed funds rate forecast by 75bp over the last two weeks, and now expect that the FOMC will hike by 75bp in September, 50bp in November, and 50bp in December to reach our terminal rate forecast of 4-4.25% by the end of 2022."

Wall Street forecasts have been revised down further since June due to the ongoing negative impacts from the pandemic. the war in Ukraine and financial tightening, and the FOMC will likely revise down their GDP projections. For example, from Goldman Sachs:

"We still forecast GDP growth of +1.1%/+1.0% in 2022Q3/Q4 and 0% GDP growth in 2022 on a Q4/Q4 basis, but now expect GDP growth of ... +1.1% in 2023 on a Q4/Q4 basis"

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

The unemployment rate was at 3.7% in August. So far, the economic slowdown has barely pushed up the unemployment rate.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

As of July 2022, PCE inflation was up 6.3% from July 2021. This was below the cycle high of 6.8% YoY in May. Analysts are expecting inflation to decline slowly, but the Q4 2022 year-over-year change will likely be revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

PCE core inflation was up 4.6% in July year-over-year. This was below the cycle high of 5.3% YoY in February.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

Saturday, September 17, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/17/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Current State of the Housing Market

• 2nd Look at Local Housing Markets in August

• Mortgage Equity Withdrawal Still Strong in Q2

• Q2 Update: Delinquencies, Foreclosures and REO

• California Home Sales off 24% YoY in August, Prices Up Only 1.4% YoY; August Existing Home Sales Forecast

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 18, 2022

by Calculated Risk on 9/17/2022 08:11:00 AM

The key reports this week are August Housing Starts and Existing Home sales.

The FOMC meets this week and is expected to raise rates 75 bp.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 47, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.445 million SAAR, down from 1.446 million SAAR.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.70 million SAAR, down from 4.81 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.70 million SAAR, down from 4.81 million in July.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 4.84 million SAAR.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 75bp at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 213 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for September.

No major economic releases scheduled.

Friday, September 16, 2022

COVID Sept 16, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/16/2022 09:34:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 60,831 | 68,949 | ≤5,0001 | |

| Hospitalized2 | 27,336 | 29,482 | ≤3,0001 | |

| Deaths per Day2🚩 | 391 | 342 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

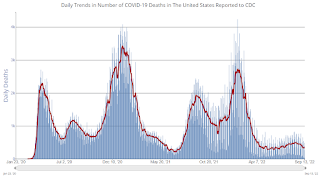

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

California Home Sales off 24% YoY in August, Prices Up Only 1.4% YoY; August Existing Home Sales Forecast

by Calculated Risk on 9/16/2022 03:24:00 PM

Today, in the Calucalated Risk Newsletter: California Home Sales off 24% YoY in August, Prices Up Only 1.4% YoY; August Existing Home Sales Forecast

On California:August’s sales pace was up 6.1 percent on a monthly basis from 295,460 in July and down 24.4 percent from a year ago, when 414,860 homes were sold on an annualized basis. ... The statewide median price edged up 0.7 percent in August to $839,460 from the $833,910 recorded in July and was up 1.4 percent from the $827,940 recorded last August. The year-over-year price gain was the smallest in more than two years.From housing economist Tom Lawler:I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.84 million in August, up 0.6% from July’s preliminary pace and down 19.2% from last August’s seasonally adjusted pace.

Q3 GDP Tracking: Close to 1%

by Calculated Risk on 9/16/2022 01:31:00 PM

From BofA:

On net, the data on retail trade and IP helped push our 3Q US GDP tracking estimate lower by 0.3pp to 0.8% qoq saar. Activity appears to be rebounding in the second half of the year off its first-half decline, but not by much. [September 16th estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +1.1% (qoq ar). [September 15th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 0.5 percent on September 15, down from 1.3 percent on September 9. After this week's releases from the US Department of the Treasury's Bureau of the Fiscal Service, the US Bureau of Labor Statistics, the US Census Bureau, and the Federal Reserve Board of Governors, decreases in the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth from 1.7 percent and -6.1 percent, respectively, to 0.4 percent and -6.4 percent, respectively, was slightly offset by an increase in the nowcast of third-quarter real government spending growth from 1.3 percent to 2.0 percent.[September 15th estimate]

Predicting the Next Recession

by Calculated Risk on 9/16/2022 09:29:00 AM

The recession callers were back in the first half of 2022, and some like ARK's Cathie Wood and Home Depot's Ken Langone claimed the US was already in a recession. I disagreed and noted I wasn't even on recession watch!

The Bureau of Economic Analysis (BEA) produces two measures of national output which, in theory, should be equivalent. In practice, however, there are often substantive differences.

In that 2013 post, I wrote:

The next recession will probably be caused by one of the following (from least likely to most likely):Unfortunately, in 2020, one of those low probability events happened (pandemic), and that led to a recession in 2020.

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

emphasis added

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession.We've seen several policy errors, mostly related to immigration and trade during the previous administration, but none that would lead the economy into a recession.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession.And this most common cause of a recession is the current concern. Since inflation picked up, mostly due to the pandemic (stimulus spending, supply constraints) and due to the invasion of Ukraine, the Fed has embarked on a tightening cycle to slow inflation.

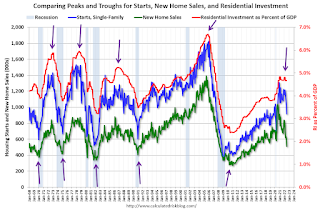

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single-family starts turned down last year, but that was partly due to the huge surge in sales during the pandemic - and then rebounded somewhat. Now both new home sales and single-family starts have turned down in response to higher mortgage rates. Residential investment has also peaked.

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 10% year-over-year.

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 10% year-over-year.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception was in late 2021 - we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. I ignored that pandemic distortion.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This is now happening, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.