by Calculated Risk on 9/20/2022 09:14:00 AM

Tuesday, September 20, 2022

August Housing Starts: Record Number of Housing Units Under Construction

Today, in the CalculatedRisk Real Estate Newsletter: August Housing Starts: Record Number of Housing Units Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 812 thousand single family units under construction (SA). This is below the previous four months, and 16 thousand below the peak in April and May. Single family units under construction have peaked since single family starts are now declining. The reason there are so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 890 thousand multi-family units under construction. This is the highest level since February 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.702 million units under construction. This is the all-time record number of units under construction.

Housing Starts Increased to 1.575 million Annual Rate in August

by Calculated Risk on 9/20/2022 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,575,000. This is 12.2 percent above the revised July estimate of 1,404,000, but is 0.1 percent below the August 2021 rate of 1,576,000. Single‐family housing starts in August were at a rate of 935,000; this is 3.4 percent above the revised July figure of 904,000. The August rate for units in buildings with five units or more was 621,000.

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,517,000. This is 10.0 percent below the revised July rate of 1,685,000 and is 14.4 percent below the August 2021 rate of 1,772,000. Single‐family authorizations in August were at a rate of 899,000; this is 3.5 percent below the revised July figure of 932,000. Authorizations of units in buildings with five units or more were at a rate of 571,000 in August.

emphasis added

Click on graph for larger image.

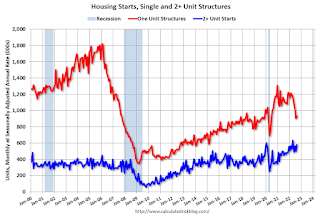

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in August compared to July. Multi-family starts were up 33.1% year-over-year in August.

Single-family starts (red) increased in August and were down 14.6% year-over-year.

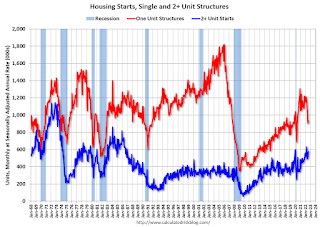

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery.

Total housing starts in August were above expectations, however, starts in June and July were revised down, combined.

I'll have more later …

Monday, September 19, 2022

Bloomberg: Home-Flipper Opendoor Hit With Losses in Echo of Zillow Collapse

by Calculated Risk on 9/19/2022 10:55:00 AM

From Bloomberg: Home-Flipper Opendoor Hit With Losses in Echo of Zillow Collapse excerpt:

The company, which sells thousands of homes in a typical month, lost money on 42% of its transactions in August, according to research from YipitData. Opendoor’s performance — as measured by the prices at which it bought and sold properties — was even worse in key markets such as Los Angeles, where the company lost money on 55% of sales, and Phoenix, where the share was 76%.

A representative for Opendoor declined to comment on the figures, which don’t include fees charged to customers or expenses incurred in renovating and marketing homes. Opendoor’s rocky summer is reminiscent of the pricing problems that doomed Zillow Group Inc.’s iBuying business last year, according to a research note from Mike DelPrete, a scholar-in-residence at the University of Colorado Boulder. That doesn’t mean Opendoor is going to shut down the business, but it demonstrates the depth of the losses — and September is likely to be even worse than August, DelPrete’s analysis shows. “Opendoor’s metrics are in the danger zone,” DelPrete said in an interview. “They are very close to where Zillow was in its worst moments.”

NAHB: Builder Confidence Declined in September

by Calculated Risk on 9/19/2022 10:11:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 46, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Falls for Ninth Straight Month as Housing Slowdown Continues

In another sign that the slowdown in the housing market continues, builder sentiment fell for the ninth straight month in September as the combination of elevated interest rates, persistent building material supply chain disruptions and high home prices continue to take a toll on affordability.This was below the consensus forecast, and below 50.

Builder confidence in the market for newly built single-family homes fell three points in September to 46, the lowest level since May 2014 with the exception of the spring of 2020, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “In another indicator of a weakening market, 24% of builders reported reducing home prices, up from 19% last month.”

“Builder sentiment has declined every month in 2022, and the housing recession shows no signs of abating as builders continue to grapple with elevated construction costs and an aggressive monetary policy from the Federal Reserve that helped pushed mortgage rates above 6% last week, the highest level since 2008,” said NAHB Chief Economist Robert Dietz. “In this soft market, more than half of the builders in our survey reported using incentives to bolster sales, including mortgage rate buydowns, free amenities and price reductions.” …

All three HMI components posted declines in September. Current sales conditions dropped three points to 54, sales expectations in the next six months declined one point to 46 and traffic of prospective buyers fell one point to 31.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell five points to 51, the Midwest dropped five points to 44, the South fell seven points to 56 and the West posted a 10-point decline to 41.

emphasis added

Housing September 19th Update: Inventory Increased 0.9% Last Week

by Calculated Risk on 9/19/2022 07:30:00 AM

Note: this is a travel day, and posts will be brief.

As of September 16th, inventory was at 552 thousand (7-day average), compared to 547 thousand the prior week. Inventory was up 0.9% from the previous week. Inventory is down slightly from the 2022 peak of 555 thousand three weeks ago.

j 1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 3.7% according to Altos)

4. Inventory up compared to 2019 (currently down 42.7%).

Sunday, September 18, 2022

Sunday Night Futures

by Calculated Risk on 9/18/2022 08:34:00 PM

Weekend:

• Schedule for Week of September 18, 2022

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 47, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 63 (fair value).

Oil prices were down over the last week with WTI futures at $85.83 per barrel and Brent at $92.13 per barrel. A year ago, WTI was at $70, and Brent was at $73 - so WTI oil prices are up 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $3.17 per gallon, so gasoline prices are up $0.47 per gallon year-over-year.

FOMC Preview: 75bp Hike

by Calculated Risk on 9/18/2022 09:37:00 AM

Expectations are the FOMC will announce a 75bp rate increase in the federal funds rate at the meeting this week, although some analysts think a 100bp rate increase is possible.

"We think the Fed will read the incoming data as justifying another large 75bp rate hike, bringing the target range for the federal funds rate to 3.0-3.25%. We think the Fed will signal a terminal funds rate of 4.0-4.25% early next year, 37.5bp higher than in June. We expect the FOMC statement to say that monetary policy will be moving into restrictive territory and the committee expects it to remain there “for some time”, similar to the tone of Chair Powell’s remarks at Jackson Hole. In the press conference, Powell is likely to emphasize that the “overarching goal” of monetary policy is the restoration of price stability, even if doing so requires a hard landing. Updated projections are likely to send a similar message, with less growth, higher unemployment, and a more restrictive policy stance suggesting the window to a soft landing has narrowed further."From Goldman Sachs:

"We have raised our fed funds rate forecast by 75bp over the last two weeks, and now expect that the FOMC will hike by 75bp in September, 50bp in November, and 50bp in December to reach our terminal rate forecast of 4-4.25% by the end of 2022."

Wall Street forecasts have been revised down further since June due to the ongoing negative impacts from the pandemic. the war in Ukraine and financial tightening, and the FOMC will likely revise down their GDP projections. For example, from Goldman Sachs:

"We still forecast GDP growth of +1.1%/+1.0% in 2022Q3/Q4 and 0% GDP growth in 2022 on a Q4/Q4 basis, but now expect GDP growth of ... +1.1% in 2023 on a Q4/Q4 basis"

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 1.5 to 1.9 | 1.3 to 2.0 | 1.5 to 2.0 | |

The unemployment rate was at 3.7% in August. So far, the economic slowdown has barely pushed up the unemployment rate.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 3.6 to 3.8 | 3.8 to 4.1 | 3.9 to 4.1 | |

As of July 2022, PCE inflation was up 6.3% from July 2021. This was below the cycle high of 6.8% YoY in May. Analysts are expecting inflation to decline slowly, but the Q4 2022 year-over-year change will likely be revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 5.0 to 5.3 | 2.4 to 3.0 | 2.0 to 2.5 | |

PCE core inflation was up 4.6% in July year-over-year. This was below the cycle high of 5.3% YoY in February.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| June 2022 | 4.2 to 4.5 | 2.5 to 3.2 | 2.1 to 2.5 | |

Saturday, September 17, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/17/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Current State of the Housing Market

• 2nd Look at Local Housing Markets in August

• Mortgage Equity Withdrawal Still Strong in Q2

• Q2 Update: Delinquencies, Foreclosures and REO

• California Home Sales off 24% YoY in August, Prices Up Only 1.4% YoY; August Existing Home Sales Forecast

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 18, 2022

by Calculated Risk on 9/17/2022 08:11:00 AM

The key reports this week are August Housing Starts and Existing Home sales.

The FOMC meets this week and is expected to raise rates 75 bp.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 47, down from 49 in August. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.445 million SAAR, down from 1.446 million SAAR.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.70 million SAAR, down from 4.81 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.70 million SAAR, down from 4.81 million in July.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 4.84 million SAAR.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 75bp at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 213 thousand last week.

11:00 AM: the Kansas City Fed manufacturing survey for September.

No major economic releases scheduled.

Friday, September 16, 2022

COVID Sept 16, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/16/2022 09:34:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 60,831 | 68,949 | ≤5,0001 | |

| Hospitalized2 | 27,336 | 29,482 | ≤3,0001 | |

| Deaths per Day2🚩 | 391 | 342 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

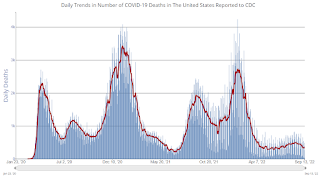

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.