by Calculated Risk on 9/24/2022 08:11:00 AM

Saturday, September 24, 2022

Schedule for Week of September 25, 2022

The key reports this week are August New Home sales, the third estimate of Q2 GDP, Personal Income and Outlays for August, and Case-Shiller house prices for July.

For manufacturing, the Richmond and Dallas Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.1% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for July.

9:00 AM: S&P/Case-Shiller House Price Index for July.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 17.0% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for August from the Census Bureau.

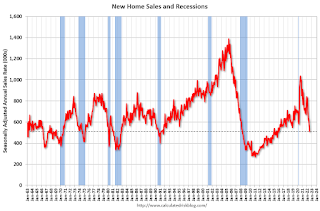

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 500 thousand SAAR, down from 511 thousand in July.

10:00 AM: the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for August. The consensus is 1.0% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 213 thousand last week.

8:30 AM: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), 2nd Quarter 2022 and Annual Update The consensus is that real GDP decreased 0.6% annualized in Q2, unchanged from the second estimate of -0.6%.

8:30 AM: Personal Income and Outlays, August 2022 and Annual Update The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.0% YoY, and core PCE prices up 4.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 52.0, down from 52.2 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 59.5.

Friday, September 23, 2022

COVID Sept 23, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/23/2022 08:42:00 PM

The positive close on a volatile Fed day offered false hope for rates--a fact that was laid bare with Thursday's massive sell-off. Now on Friday, more false hope as another massive overnight sell-off gave way to a full recovery by 9:20am. Since then, however, it's been all sellers.On COVID (focus on hospitalizations and deaths):

In other words, bond tanked again.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

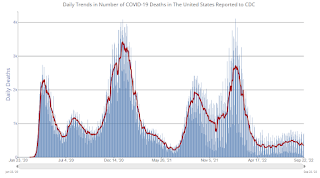

| New Cases per Day2 | 53,376 | 62,577 | ≤5,0001 | |

| Hospitalized2 | 24,764 | 27,762 | ≤3,0001 | |

| Deaths per Day2 | 356 | 428 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

September Vehicle Sales Forecast: Increase to 13.7 million SAAR

by Calculated Risk on 9/23/2022 04:09:00 PM

From WardsAuto: September U.S. Light-Vehicle Sales Tracking to 5-Month High (pay content). Brief excerpt:

"Despite the amount of pent-up demand waiting to be tapped, without an increase in incentives combined with dealers selling fewer vehicles above sticker price, waning availability of affordable offerings on dealer lots will cause sales gains to lag the expected growth in inventory."

Click on graph for larger image.

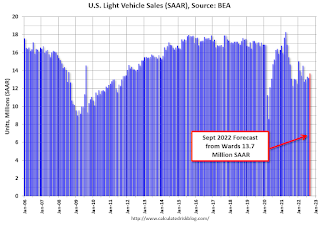

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for September (Red).

The Wards forecast of 13.7 million SAAR, would be mostly up 4% from last month, and up 11% from a year ago (sales started to weaken in mid-2021, due to supply chain issues).

Why Measures of Existing Home Inventory appear Different

by Calculated Risk on 9/23/2022 01:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Why Measures of Existing Home Inventory appear Different

A brief excerpt:

There is a significant difference between measures of inventory, and this is leading to some confusion.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph comparing the year-over-year change in Realtor.com’s active inventory, the NAR’s inventory, and Realtor.com inventory including pending sales. Note that the blue line (NAR) and dashed black line (Realtor including pending sales) track.

As Lawler noted, including pending sales understated the decline in active inventory in 2020 and 2021, and is now understating the increase in active inventory.

But what about Redfin? Redfin takes a very different approach. Their active inventory number for any month includes homes that came on the market and sold quickly during the month, whereas the other measures are a snapshot at the end of the month (or week).

Q3 GDP Tracking: Close to 1%

by Calculated Risk on 9/23/2022 09:54:00 AM

From BofA:

On net, August data on housing starts and existing home sales boosted our tracking estimate for residential investment modestly. After rounding, however, our 3Q US GDP tracking remained unchanged at 0.8% qoq saar. [September 23rd estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +1.2% (qoq ar). [September 21st estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 0.3 percent on September 20, down from 0.5 percent on September 15. After this morning's housing starts report from the US Census Bureau, the nowcast of third-quarter residential investment growth decreased from -20.8 percent to -24.5 percent. [September 20th estimate]

Black Knight: Mortgage Delinquency Rate decreased in August

by Calculated Risk on 9/23/2022 08:11:00 AM

From Black Knight: Black Knight: Mortgage Delinquencies Near Record Low in August; Foreclosure Starts Up 15% from July, Still More Than 40% Below Pre-Pandemic Levels

• The national delinquency rate fell 3.6% in August to 2.79%, just 4 basis points above May 2022’s record lowAccording to Black Knight's First Look report, the percent of loans delinquent decreased 3.6% in August compared to July and decreased 30% year-over-year.

• Improvement was broad-based, with the number of borrowers a single payment past due falling by 4% and those 90 or more days delinquent down 4.5%

• After dropping steadily over recent months, cure activity also improved in August, with 62K seriously delinquent loans curing to current status, up from 58K in July

• The month’s 20.3K foreclosure starts represent a 15% jump in activity from July, but remain 44% below August 2019 levels

• Likewise, starts were initiated on 3.4% of serious delinquencies; up slightly from July but still less than half the rate seen in the years leading up to the pandemic

• Prepays (SMM) edged up 1.5% for the month, due to calendar-related effects, but are still down by 69% year-over-year as rising rates continue to put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.79% in August, down from 2.89% in July.

The percent of loans in the foreclosure process increased in August to 0.35%, from 0.35% in July.

The number of delinquent properties, but not in foreclosure, is down 633,000 properties year-over-year, and the number of properties in the foreclosure process is up 43,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| August 2022 | July 2022 | August 2021 | August 2020 | |

| Delinquent | 2.79% | 2.89% | 4.00% | 6.88% |

| In Foreclosure | 0.35% | 0.35% | 0.27% | 0.35% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,489,000 | 1,543,000 | 2,122,000 | 3,679,000 |

| Number of properties in foreclosure pre-sale inventory: | 185,000 | 184,000 | 142,000 | 187,000 |

| Total Properties | 1,674,000 | 1,728,000 | 2,264,000 | 3,867,000 |

Thursday, September 22, 2022

LA Port Traffic: Inbound Declined in August

by Calculated Risk on 9/22/2022 06:33:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 1.0% in August compared to the rolling 12 months ending in July. Outbound traffic increased 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Realtor.com Reports Weekly Active Inventory Up 28% Year-over-year; New Listings Down 10%

by Calculated Risk on 9/22/2022 02:17:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale and Jiayi Xu: Weekly Housing Trends View — Data Week Ending Sep 17, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, and improved 28% above one year ago. . The number of homes for sale has grown as buyers and sellers navigate a rebalancing housing market with shifting advantages and challenges.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 10% from one year ago.. This week marks the eleventh straight week of year over year declines in the number of new listings coming up for sale, and this week the data continues to maintain at double-digit territory.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Hotels: Occupancy Rate Down 2.4% Compared to Same Week in 2019

by Calculated Risk on 9/22/2022 12:32:00 PM

U.S. hotel performance increased from the previous week and showed improved comparisons with 2019, according to STR‘s latest data through Sept. 17.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Sept. 11-17, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 69.6% (-2.4%)

• Average daily rate (ADR): $155.58 (+15.6%)

• Revenue per available room (RevPAR): $108.25 (+12.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Final Look at Local Housing Markets in August

by Calculated Risk on 9/22/2022 09:32:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in August

A brief excerpt:

The big story for August existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down YoY in August as the sellers’ strike continued. And active listings were up. Also, median prices are falling nationally (more than normal seasonally).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in August. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I update these tables throughout the month as additional data is released.

...

And a table of August sales. In August, sales in these markets were down 18.7% YoY. The NAR reported sales were down 17.4% NSA YoY. Contracts for sales in August were mostly signed in June and July, and we are seeing the impact of higher mortgage rates on August closings.

...

Looking ahead: In September 2022, there were the same number of working days as in September 2021, so the SA and NSA declines in sales will be similar.