by Calculated Risk on 9/26/2022 09:10:00 PM

Monday, September 26, 2022

Tuesday: Durable Goods, Case-Shiller and FHFA House Prices, New Home Sales, Richmond Fed Mfg

The most recent historical high water market for mortgage rates was "14 years." It was broken so many times in September that we officially declared it to be boring last Tuesday. Now, less than a week later, 14-year highs would be more exciting than boring. As of mid-day today, we're officially at 20 year highs. [30 year fixed 6.87%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.1% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for July. The consensus is for a 17.0% year-over-year increase in the Comp 20 index for July.

• Also at 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for 500 thousand SAAR, down from 511 thousand in July.

• Also at 10:00 AM, the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

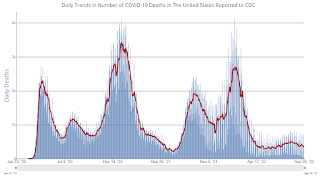

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 50,017 | 58,522 | ≤5,0001 | |

| Hospitalized2 | 22,280 | 26,467 | ≤3,0001 | |

| Deaths per Day2 | 348 | 391 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

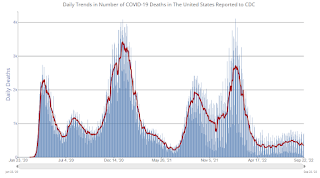

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

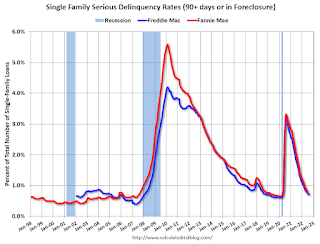

Freddie Mac: Mortgage Serious Delinquency Rate decreased in August

by Calculated Risk on 9/26/2022 05:05:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in August was 0.70%, down from 0.73% July. Freddie's rate is down year-over-year from 1.62% in August 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

New Home Sales and Cancellations: Net vs Gross Sales

by Calculated Risk on 9/26/2022 12:31:00 PM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales and Cancellations: Net vs Gross Sales

A brief excerpt:

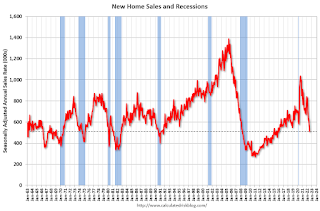

Tomorrow (Tuesday), the Census Bureau will report new home sales for August. The consensus is for 500 thousand on a Seasonally Adjusted Annual rates (SAAR) basis, down from 511 thousand in July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

When looking at new home sales, we are interested in net sales for each month, however the Census Bureau reports gross new sales. A simple equation would be:Sales (net) = Sales (gross) – Cancellations + Sales of earlier cancellations.In the long run, the cancellation terms balance out, and the Census Bureau numbers are what we want. In other words, Sales(net) = sales(gross). But in the short run, when cancellations increase, the Census Bureau overestimates sales; and when cancellations decrease, the Census Bureau underestimates sales.

...

The bottom line is - with rapidly rising cancellations - the Census Bureau will overestimate sales tomorrow (and underestimate new home inventory).

Housing September 26th Update: Inventory Increased 0.9% Last Week; Hits New Peak for 2022

by Calculated Risk on 9/26/2022 09:02:00 AM

Active inventory increased for the 2nd consecutive week, increasing 0.9% last week, and hitting a new peak for the year. Here are the same week inventory changes for the last four years:

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 1.9% according to Altos)

4. Inventory up compared to 2019 (currently down 42.2%).

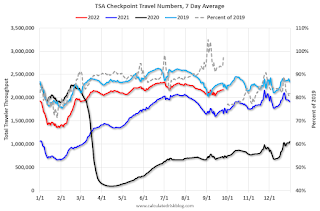

Four High Frequency Indicators for the Economy

by Calculated Risk on 9/26/2022 08:36:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 25th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 2.7% from the same day in 2019 (90.9% of 2019). (Dashed line)

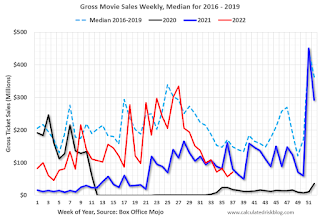

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $71 million last week, down about 52% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Sept 17th. The occupancy rate was down 2.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of September 16th, gasoline supplied was down 6.9% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, September 25, 2022

Sunday Night Futures

by Calculated Risk on 9/25/2022 06:32:00 PM

Weekend:

• Schedule for Week of September 25, 2022

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 6 and DOW futures are down 42 (fair value).

Oil prices were down over the last week with WTI futures at $78.74 per barrel and Brent at $86.15 per barrel. A year ago, WTI was at $75, and Brent was at $79 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.65 per gallon. A year ago, prices were at $3.17 per gallon, so gasoline prices are up $0.48 per gallon year-over-year.

Monthly Mortgage Payments Up Record Year-over-year

by Calculated Risk on 9/25/2022 11:58:00 AM

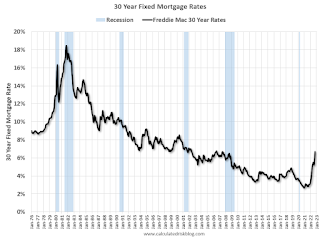

On Friday, the average 30-year mortgage rate hit 6.7% for zero points and top tier scenarios. This was the highest rate in 14 years and is close to the highest rate in over 20 years (above 6.76% will be the highest since early 2002).

Here is a graph showing the 30-year rate using Freddie Mac PMMS, and MND for last week.

This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) over the last 5 years.

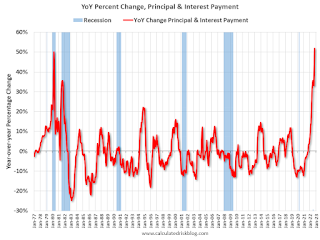

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 52% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up around 65% YoY for the same house.This is one of the reasons I've argued in my real estate newsletter Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

Saturday, September 24, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 9/24/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• August Housing Starts: Record Number of Housing Units Under Construction

• NAR: Existing-Home Sales Decreased Slightly to 4.80 million SAAR in August

• Why Measures of Existing Home Inventory appear Different

• Final Look at Local Housing Markets in August

• 3rd Look at Local Housing Markets in August

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 25, 2022

by Calculated Risk on 9/24/2022 08:11:00 AM

The key reports this week are August New Home sales, the third estimate of Q2 GDP, Personal Income and Outlays for August, and Case-Shiller house prices for July.

For manufacturing, the Richmond and Dallas Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.1% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for July.

9:00 AM: S&P/Case-Shiller House Price Index for July.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 17.0% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 500 thousand SAAR, down from 511 thousand in July.

10:00 AM: the Richmond Fed manufacturing survey for September. This is the last of the regional surveys for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for August. The consensus is 1.0% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 213 thousand last week.

8:30 AM: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), 2nd Quarter 2022 and Annual Update The consensus is that real GDP decreased 0.6% annualized in Q2, unchanged from the second estimate of -0.6%.

8:30 AM: Personal Income and Outlays, August 2022 and Annual Update The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.0% YoY, and core PCE prices up 4.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 52.0, down from 52.2 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 59.5.

Friday, September 23, 2022

COVID Sept 23, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 9/23/2022 08:42:00 PM

The positive close on a volatile Fed day offered false hope for rates--a fact that was laid bare with Thursday's massive sell-off. Now on Friday, more false hope as another massive overnight sell-off gave way to a full recovery by 9:20am. Since then, however, it's been all sellers.On COVID (focus on hospitalizations and deaths):

In other words, bond tanked again.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 53,376 | 62,577 | ≤5,0001 | |

| Hospitalized2 | 24,764 | 27,762 | ≤3,0001 | |

| Deaths per Day2 | 356 | 428 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.