by Calculated Risk on 10/03/2022 03:56:00 PM

Monday, October 03, 2022

Q3 2022 Update: Unofficial Problem Bank list Decreased to 51 Institutions; Search for "Whale" Continues

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through September 30, 2022. Since the last update at the end of June 2022, the list decreased by one to 51 institutions after an addition and two removals. Assets decreased by $2.9 billion to $51.5 billion, with the change primarily resulting from a $2.2 billion decrease from updated asset figures through June 30, 2021. A year ago, the list held 59 institutions with assets of $54.9 billion. Added during the third quarter was Unity National Bank of Houston, Houston, TX ($246 million). Removals during the quarter because of action termination included Southwestern National Bank, Houston, TX ($884 million) and Amory Federal Savings and Loan Association, Amory, MS ($74 million).

With the conclusion of the third quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,785 institutions have appeared on a weekly or monthly list since then. Only 2.9 percent of the banks that have appeared on a list remain today as 1,734 institutions have transitioned through the list. Departure methods include 1,024 action terminations, 411 failures, 280 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23 percent of the 1,785 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

On September 8, 2022, the FDIC released second quarter results and provided an update on the Official Problem Bank List. While FDIC did not make a comment within its press release on the Official Problem Bank List, they provided details in an attachment that listed 40 institutions with assets of $170 billion. In its 2022 first quarter release, the FDIC list had a material $119 billion increase in assets. Since that release, none of the prudential banking regulators – FDIC, Federal Reserve, and OCC – have publicly released an enforcement action detailing an enforcement action against a large institution. The Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) passed by Congress in 1989 requires publication of enforcement actions. See “Supervisory Enforcement Actions Since FIRREA and FDICIA,” published by the Federal reserve Bank of Minneapolis for further details. Prior to FIRREA, enforcement actions were not published by the prudential banking regulators. Section 913 of FIRREA requires public disclosures of enforcement actions. Section 913(2) does allow a delay in the enforcement action publication if “exceptional circumstances” exist. The prudential regulator must make a written determination that publication “would seriously threaten the safety & soundness of an insured depository institution.” The prudential regulator “may delay the publication of such order for a reasonable time.” The section does not define “a reasonable time.” It has been more than six months since that enforcement action was issued, so it seems the primary regulator considers this a “reasonable time” before it informs the public of a large, troubled institution.

Black Knight Mortgage Monitor: "Home Prices Down Again in August ... Now 2% Off June Peak"

by Calculated Risk on 10/03/2022 11:13:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Home Prices Down Again in August ... Now 2% Off June Peak"

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 12.1% year-over-year but was down almost 1% in August (after a similar decline in July).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• According to the Black Knight HPI, median home prices fell 0.98% in August, only marginally better than July's upwardly revised 1.05% monthly decline

• July and August 2022 mark the largest single-month price declines seen since January 2009 and rank among the eight largest on record

• The housing market has not seen such a significant two-month drop in prices since shortly after the collapse of Lehman Brothers in the winter of 2008

Construction Spending Decreased 0.7% in August

by Calculated Risk on 10/03/2022 10:19:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during August 2022 was estimated at a seasonally adjusted annual rate of $1,781.3 billion, 0.7 percent below the revised July estimate of $1,793.5 billion. The August figure is 8.5 percent above the August 2021 estimate of $1,641.6 billion.Both private spending and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,426.0 billion, 0.6 percent below the revised July estimate of $1,435.2 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $355.3 billion, 0.8 percent below the revised July estimate of $358.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 35% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 24% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 9% above the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 12.5%. Non-residential spending is up 5.5% year-over-year. Public spending is up 3.3% year-over-year.

ISM® Manufacturing index Declined to 50.9% in September

by Calculated Risk on 10/03/2022 10:05:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 50.9% in September, down from 52.8% in August. The employment index was at 48.7%, down from 54.2% last month, and the new orders index was at 47.1%, down from 51.3%.

From ISM: Manufacturing PMI® at 50.9% September 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in September, with the overall economy achieving a 28th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slower pace in September than in August. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The September Manufacturing PMI® registered 50.9 percent, 1.9 percentage points lower than the 52.8 percent recorded in August. This figure indicates expansion in the overall economy for the 28th month in a row after contraction in April and May 2020. The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index returned to contraction territory at 47.1 percent, 4.2 percentage points lower than the 51.3 percent recorded in August. The Production Index reading of 50.6 percent is a 0.2-percentage point increase compared to August’s figure of 50.4 percent. The Prices Index registered 51.7 percent, down 0.8 percentage point compared to the August figure of 52.5 percent. This is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 50.9 percent, 2.1 percentage points lower than the August reading of 53 percent. After a single month of expansion, the Employment Index contracted at 48.7 percent, 5.5 percentage points lower than the 54.2 percent recorded in August. The Supplier Deliveries Index reading of 52.4 percent is 2.7 percentage points lower than the August figure of 55.1 percent. This is the index’s lowest reading since before the coronavirus pandemic (52.2 percent in December 2019). The Inventories Index registered 55.5 percent, 2.4 percentage points higher than the August reading of 53.1 percent. The New Export Orders Index contracted at 47.8 percent, down 1.6 percentage points compared to August’s figure of 49.4 percent. This is the index’s lowest reading since June 2020, when it registered 47.6 percent. The Imports Index remained in expansion territory at 52.6 percent, 0.1 percentage point above the August reading of 52.5 percent.”

emphasis added

Housing October 3rd Update: Inventory Increased 0.8% Last Week; Hits New Peak for 2022

by Calculated Risk on 10/03/2022 08:49:00 AM

Active inventory increased for the 3rd consecutive week, increasing 0.8% last week, and hitting a new peak for the year. Here are the same week inventory changes for the last four years (usually inventory is declining at this time of year):

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 0.3% according to Altos)

4. Inventory up compared to 2019 (currently down 41.3%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 10/03/2022 08:33:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 2nd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 10.9% from the same day in 2019 (89.1% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $83 million last week, down about 41% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Sept 24th. The occupancy rate was down 1.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of September 23rd, gasoline supplied was down 5.6% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, October 02, 2022

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 10/02/2022 07:42:00 PM

Weekend:

• Schedule for Week of October 2, 2022

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for September. The consensus is for a reading of 52.2, down from 52.8 in August.

• Also, at 10:00 AM, Construction Spending for August. The consensus is for a 0.3% decrease.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 1 and DOW futures are up 42 (fair value).

Oil prices were up over the last week with WTI futures at $79.49 per barrel and Brent at $85.14 per barrel. A year ago, WTI was at $76, and Brent was at $79 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.76 per gallon. A year ago, prices were at $3.18 per gallon, so gasoline prices are up $0.58 per gallon year-over-year. NOTE: Gasoline prices in Los Angeles have spiked to near record $6.28 per gallon due to refinery issues.

Update: Framing Lumber Prices Close to Pre-Pandemic Levels

by Calculated Risk on 10/02/2022 12:04:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through September 30th.

Prices are close to the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a runup in prices as happened at the end of last year due to the housing slowdown.

Saturday, October 01, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 10/01/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Goldman Sees US House Prices Falling 5% to 10%

• Case-Shiller: National House Price Index "Continued its Deceleration" to 15.8% year-over-year increase in July

• Inflation Adjusted House Prices Declined Further in July

• New Home Sales Increased in August; Completed Inventory Increased

• Pace of Rent Increases Continues to Slow

• New Home Sales and Cancellations: Net vs Gross Sales

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 2, 2022

by Calculated Risk on 10/01/2022 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM Manufacturing and Services indices, September auto sales and the August trade deficit.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 52.2, down from 52.8 in August.

10:00 AM: Construction Spending for August. The consensus is for a 0.3% decrease.

8:00 AM ET: Corelogic House Price index for August.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 11.239 million from 11.040 million in June.

The number of job openings (yellow) were up 4% year-over-year. Quits were up 2% year-over-year.

All day: Light vehicle sales for September.

All day: Light vehicle sales for September.The consensus is for sales of 13.5 million SAAR, up from 13.2 million SAAR in August (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 205,000 jobs added, up from 132,000 in August.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $68.0 billion in August, from $70.7 billion in July.

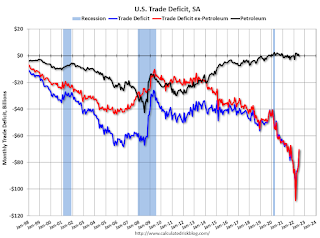

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $68.0 billion in August, from $70.7 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 203 thousand from 193 thousand last week.

8:30 AM: Employment Report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 315,000 jobs added in August, and the unemployment rate was at 3.7%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, 30 months after the onset of the current employment recession, all of the jobs have returned.