by Calculated Risk on 10/06/2022 10:34:00 AM

Thursday, October 06, 2022

"For many [home] sellers, it likely feels like the rug has been pulled out from underneath them"

Today, in the Calculated Risk Real Estate Newsletter: "For many [home] sellers, it likely feels like the rug has been pulled out from underneath them"

A brief excerpt:

A few early reporting markets …There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the first look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

...

From Denver Metro Association of Realtors® (DMAR): DMAR Real Estate Market Trends ReportUsing months of inventory as a metric indicates that Denver Metro is moving toward a balanced market. … However, for many sellers, it likely feels like the rug has been pulled out from underneath them.In September, sales were down 33.1%. In August, these same markets were down 32.4% YoY Not Seasonally Adjusted (NSA).

Note that in September 2022, there were the same number of selling days as in September 2021, so the SA decline will be similar to the NSA decline. Last month, in August 2022, there was one more selling day than in August 2021 - so seasonally adjusted, the decline in sales in August was larger than in September for these markets.

Many more local markets to come!

Weekly Initial Unemployment Claims increase to 219,000

by Calculated Risk on 10/06/2022 08:33:00 AM

The DOL reported:

In the week ending October 1, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 29,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 193,000 to 190,000. The 4-week moving average was 206,500, an increase of 250 from the previous week's revised average. The previous week's average was revised down by 750 from 207,000 to 206,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 206,500.

The previous week was revised down.

Weekly claims were higher than the consensus forecast.

Wednesday, October 05, 2022

Thursday: Unemployment Claims

by Calculated Risk on 10/05/2022 09:01:00 PM

Reis: Office Vacancy Rate Unchanged in Q3, Mall Vacancy Rate Unchanged

by Calculated Risk on 10/05/2022 03:44:00 PM

From Moody’s Analytics Senior Economist Lu Chen: Office continues its bumpy ride, and Retail remains flat

Office vacancy has been persistently stuck at over 18% since early 2021, a consequence of excess inventories and strains on companies’ expansion plans. Net absorption rose in June and July, in line with the return to office sentiment, but that trend was short-lived as economic uncertainties pressured the sector’s fundamentals. The 3rd quarter ended with an increase in office demand, but the 1.75 million square feet (sqft) total net absorption was less than a third of the total construction delivery of around 6 million sqft. Office vacancy moved slightly upwards last quarter, but due to rounding remained at an elevated 18.4%, near its pandemic peak. Asking rent exceeded $35/sqft ($35.04), which is equivalent of 0.4% growth compared to last quarter. Effective rent kept pace, but that’s only half its rate in Q2.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

And from Reis on Retail:

Our data shows the national vacancy for neighborhood and community shopping center has stayed flat at 10.3% since a year ago, while asking/effective rent kept virtually unchanged in the 3rd quarter. Trend data on regional and super regional malls tells a similar story. Vacancy ticked up 10 basis-point to 11.1% and effective rent was up 0.1% this quarter. Despite some signs of stabilization, regional mall properties continue to be the most at-risk retail subtype according to our commercial mortgage delinquency data, and they are driving overall delinquency behavior among retail assets.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q3, unchanged from 10.3% in Q2, and down from 10.4% in Q3 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Apartments: Net Absorption Very Low in Q3, New Construction Deliveries Even Lower

by Calculated Risk on 10/05/2022 11:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Apartments: Net Absorption Very Low in Q3, New Construction Deliveries Even Lower

A brief excerpt:

Moody’s Analytics also reported the effective rents were up 1.7% in Q3 from Q2, and up 10.2% year-over-year (YoY). This is a sharp slowdown from Q2 when rents were up 16.9% YoY.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

Click on graph for larger image.

Last week, I posted a graph of the year-over-year change for various measures of rent. The Zillow measure is up 12.3% YoY in August, down from 13.8% YoY in July. This is down from a peak of 17.2% YoY in February. The ApartmentList measure is up 7.5% YoY as of September, down from 9.8% in August. This is down from the peak of 18.0% YoY last November.

Reis’ survey (dashed red) is quarterly and shows a similar slowdown in effective rents.

...

The bottom line is apartment demand was soft in Q3, household formation has slowed sharply, and there are a large number of apartments in the pipeline. We should see completions above net absorption soon, and the completion of all these units under construction should help with rent pressure.

ISM® Services Index Decreased to 56.7% in September

by Calculated Risk on 10/05/2022 10:04:00 AM

(Posted with permission). The ISM® Services index was at 56.7%, down from 56.9% last month. The employment index increased to 53.0%, from 50.2%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.7% September 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in September for the 28th month in a row — with the Services PMI® registering 56.7 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In September, the Services PMI® registered 56.7 percent, 0.2 percentage point lower than August’s reading of 56.9 percent. The Business Activity Index registered 59.1 percent, a decrease of 1.8 percentage points compared to the reading of 60.9 percent in August. The New Orders Index figure of 60.6 percent is 1.2 percentage points lower than the August reading of 61.8 percent.

emphasis added

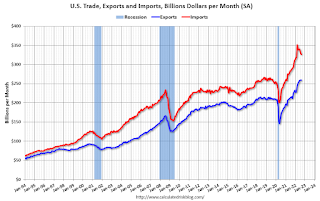

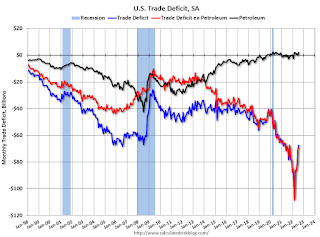

Trade Deficit decreased to $67.4 Billion in August

by Calculated Risk on 10/05/2022 08:38:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.4 billion in August, down $3.1 billion from $70.5 billion in July, revised.

August exports were $258.9 billion, $0.7 billion less than July exports. August imports were $326.3 billion, $3.7 billion less than July imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in August.

Exports are up 20% year-over-year; imports are up 14% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and have now bounced back.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $37.4 billion in August, from $21.7 billion a year ago.

ADP: Private Employment Increased 208,000 in September

by Calculated Risk on 10/05/2022 08:20:00 AM

Note: This is the second release of a new methodology. Historical data based on the new methodology is available.

From ADP: ADP National Employment Report: Private Sector Employment Increased by

208,000 Jobs in September; Annual Pay was Up 7.8%

Private sector employment increased by 208,000 jobs in September and annual pay was up 7.8% year-over-year, according to the September ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was close to the consensus forecast of 205,000. The BLS report will be released Friday, and the consensus is for 250 thousand non-farm payroll jobs added in September.

The jobs report and pay insights use ADP’s fine-grained anonymized and aggregated payroll data of over 25 million U.S. employees to provide a representative picture of the labor market. The report details the current month’s total private employment change, and weekly job data from the previous month. ADP’s pay measure uniquely captures the earnings of a cohort of almost 10 million employees over a 12-month period.

“We are continuing to see steady job gains,” said Nela Richardson, chief economist, ADP. “While job stayers saw a pay increase, annual pay growth for job changers in September is down from August.”

emphasis added

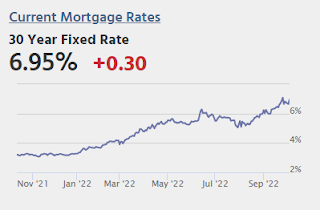

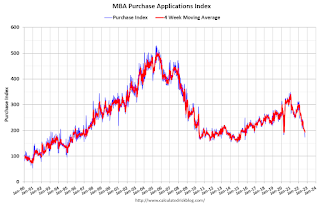

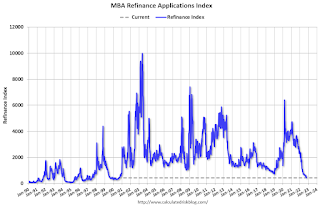

MBA: Mortgage Applications Decrease in Latest Weekly Survey; Purchase Activity Below Pandemic Low

by Calculated Risk on 10/05/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 14.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 30, 2022.

... The Refinance Index decreased 18 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 13 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 37 percent lower than the same week one year ago.

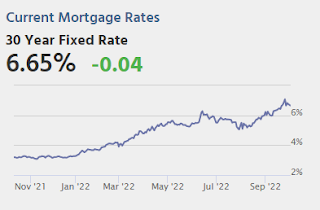

“Mortgage rates continued to climb last week, causing another pullback in overall application activity, which dropped to its slowest pace since 1997. The 30-year fixed rate hit 6.75 percent last week – the highest rate since 2006,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The current rate has more than doubled over the past year and has increased 130 basis points in the past seven weeks alone. The steep increase in rates continued to halt refinance activity and is also impacting purchase applications, which have fallen 37 percent behind last year’s pace. Additionally, the spreads between the conforming rate compared to jumbo loans widened again, and we saw the ARM share rise further to almost 12 percent of applications.”

Added Kan, “There was also an impact from Hurricane Ian’s arrival in Florida last week, which prompted widespread closings and evacuations. Applications in Florida fell 31 percent, compared to 14 percent overall, on a non-seasonally adjusted basis.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.75 percent from 6.52 percent, with points decreasing to 0.95 from 1.15 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 04, 2022

Wednesday: ADP Employment, Trade Deficit, ISM Services

by Calculated Risk on 10/04/2022 08:59:00 PM

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 205,000 jobs added, up from 132,000 in August.

• At 8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $68.0 billion in August, from $70.7 billion in July.

• At 10:00 AM: the ISM Services Index for September.