by Calculated Risk on 10/07/2022 08:44:00 AM

Friday, October 07, 2022

September Employment Report: 263 thousand Jobs, 3.5% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 263,000 in September, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality and in health care.

...

The change in total nonfarm payroll employment for July was revised up by 11,000, from +526,000 to +537,000, and the change for August remained at +315,000. After revision, employment gains in July and August combined were 11,000 higher than previously reported

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

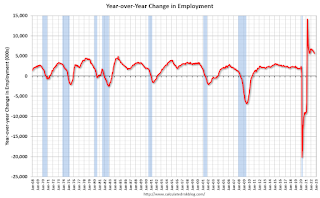

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 5.69 million jobs. Employment was up significantly year-over-year.

Total payrolls increased by 263 thousand in September. Private payrolls increased by 288 thousand, and public payrolls decreased 25 thousand.

Payrolls for July and August were revised up 11 thousand, combined.

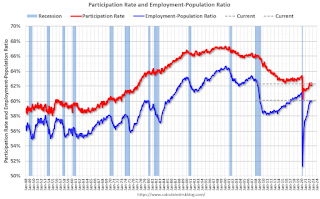

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.3% in September, from 62.4% in August. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.3% in September, from 62.4% in August. This is the percentage of the working age population in the labor force. The Employment-Population ratio was unchanged at 60.1% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

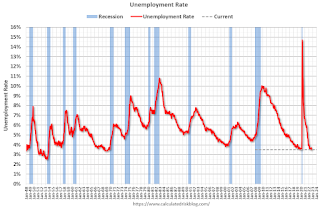

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was decreased in September to 3.5% from 3.7% in August.

This was slightly above consensus expectations; and July and August payrolls were revised up by 11,000 combined.

Thursday, October 06, 2022

Friday: Employment Report

by Calculated Risk on 10/06/2022 08:29:00 PM

Goldman September Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

Goldman September Payrolls Preview

by Calculated Risk on 10/06/2022 04:25:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 200k in September (mom sa), 50k below consensus and a slowdown from the +315k pace in August. ... We estimate the unemployment rate was unchanged at 3.7% in September ...CR Note: The consensus is for 250 thousand jobs added, and for the unemployment rate to be unchanged at 3.7%.

emphasis added

September Employment Preview

by Calculated Risk on 10/06/2022 02:16:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

Click on graph for larger image.

Click on graph for larger image.• First, as of August there are 240 thousand more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of August 2022, all of the jobs have returned.

This doesn't include the preliminary benchmark revision that showed there were 462 thousand more jobs than originally reported in March 2022.

• ADP Report: The ADP employment report showed 208,000 private sector jobs were added in September. This is the second release of ADP's new methodology, and this suggests job gains inline with consensus expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in September to 48.7%, down from 54.2% last month. This would suggest 25,000 jobs lost in manufacturing.

The ISM® services employment index increased in September to 53.0%, down from 50.2% last month. This would suggest service employment increased 155,000 in September.

Combined, the ISM surveys suggest 130,000 jobs added in September (below the consensus forecast).

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 245,000 in August to 209,000 in September. This would usually suggest fewer layoffs in September than in August. In general, weekly claims were lower than expectations in September.

Hotels: Occupancy Rate Down 2.4% Compared to Same Week in 2019

by Calculated Risk on 10/06/2022 01:50:00 PM

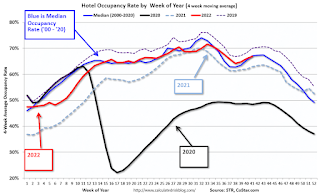

As expected with the Rosh Hashanah holiday, U.S. hotel performance dropped from the previous week and showed mixed comparisons with 2019, according to STR‘s latest data through Oct. 1.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Sept. 25 through Oct. 1, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.4% (-2.4%)

• Average daily rate (ADR): $149.71 (+15.7%)

• Revenue per available room (RevPAR): $99.36 (+12.9%)

In addition to the Rosh Hashanah impact on business travel and groups in the major markets, there were demand shifts in the southeast region due to Hurricane Ian. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

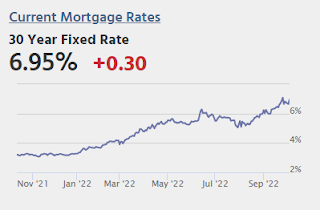

"For many [home] sellers, it likely feels like the rug has been pulled out from underneath them"

by Calculated Risk on 10/06/2022 10:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: "For many [home] sellers, it likely feels like the rug has been pulled out from underneath them"

A brief excerpt:

A few early reporting markets …There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the first look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

...

From Denver Metro Association of Realtors® (DMAR): DMAR Real Estate Market Trends ReportUsing months of inventory as a metric indicates that Denver Metro is moving toward a balanced market. … However, for many sellers, it likely feels like the rug has been pulled out from underneath them.In September, sales were down 33.1%. In August, these same markets were down 32.4% YoY Not Seasonally Adjusted (NSA).

Note that in September 2022, there were the same number of selling days as in September 2021, so the SA decline will be similar to the NSA decline. Last month, in August 2022, there was one more selling day than in August 2021 - so seasonally adjusted, the decline in sales in August was larger than in September for these markets.

Many more local markets to come!

Weekly Initial Unemployment Claims increase to 219,000

by Calculated Risk on 10/06/2022 08:33:00 AM

The DOL reported:

In the week ending October 1, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 29,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 193,000 to 190,000. The 4-week moving average was 206,500, an increase of 250 from the previous week's revised average. The previous week's average was revised down by 750 from 207,000 to 206,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 206,500.

The previous week was revised down.

Weekly claims were higher than the consensus forecast.

Wednesday, October 05, 2022

Thursday: Unemployment Claims

by Calculated Risk on 10/05/2022 09:01:00 PM

Reis: Office Vacancy Rate Unchanged in Q3, Mall Vacancy Rate Unchanged

by Calculated Risk on 10/05/2022 03:44:00 PM

From Moody’s Analytics Senior Economist Lu Chen: Office continues its bumpy ride, and Retail remains flat

Office vacancy has been persistently stuck at over 18% since early 2021, a consequence of excess inventories and strains on companies’ expansion plans. Net absorption rose in June and July, in line with the return to office sentiment, but that trend was short-lived as economic uncertainties pressured the sector’s fundamentals. The 3rd quarter ended with an increase in office demand, but the 1.75 million square feet (sqft) total net absorption was less than a third of the total construction delivery of around 6 million sqft. Office vacancy moved slightly upwards last quarter, but due to rounding remained at an elevated 18.4%, near its pandemic peak. Asking rent exceeded $35/sqft ($35.04), which is equivalent of 0.4% growth compared to last quarter. Effective rent kept pace, but that’s only half its rate in Q2.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

And from Reis on Retail:

Our data shows the national vacancy for neighborhood and community shopping center has stayed flat at 10.3% since a year ago, while asking/effective rent kept virtually unchanged in the 3rd quarter. Trend data on regional and super regional malls tells a similar story. Vacancy ticked up 10 basis-point to 11.1% and effective rent was up 0.1% this quarter. Despite some signs of stabilization, regional mall properties continue to be the most at-risk retail subtype according to our commercial mortgage delinquency data, and they are driving overall delinquency behavior among retail assets.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q3, unchanged from 10.3% in Q2, and down from 10.4% in Q3 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Apartments: Net Absorption Very Low in Q3, New Construction Deliveries Even Lower

by Calculated Risk on 10/05/2022 11:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Apartments: Net Absorption Very Low in Q3, New Construction Deliveries Even Lower

A brief excerpt:

Moody’s Analytics also reported the effective rents were up 1.7% in Q3 from Q2, and up 10.2% year-over-year (YoY). This is a sharp slowdown from Q2 when rents were up 16.9% YoY.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

Click on graph for larger image.

Last week, I posted a graph of the year-over-year change for various measures of rent. The Zillow measure is up 12.3% YoY in August, down from 13.8% YoY in July. This is down from a peak of 17.2% YoY in February. The ApartmentList measure is up 7.5% YoY as of September, down from 9.8% in August. This is down from the peak of 18.0% YoY last November.

Reis’ survey (dashed red) is quarterly and shows a similar slowdown in effective rents.

...

The bottom line is apartment demand was soft in Q3, household formation has slowed sharply, and there are a large number of apartments in the pipeline. We should see completions above net absorption soon, and the completion of all these units under construction should help with rent pressure.