by Calculated Risk on 10/13/2022 11:17:00 AM

Thursday, October 13, 2022

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.6% in September

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in September. The 16% trimmed-mean Consumer Price Index increased 0.6% in September. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" decreased at a 45% annualized rate in September.

Cost of Living Adjustment increases 8.7% in 2023, Contribution Base increased to $160,200

by Calculated Risk on 10/13/2022 08:55:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2023.

From Social Security: Social Security Announces 8.7 Percent Benefit Increase for 2023

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 8.7 percent in 2023, the Social Security Administration announced today. On average, Social Security benefits will increase by more than $140 per month starting in January.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (8.7% increase) and a list of previous Cost-of-Living Adjustments.

The 8.7 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Increased payments to more than 7 million SSI beneficiaries will begin on December 30, 2022. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

...

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $160,200 from $147,000.

The contribution and benefit base will be $160,200 in 2023.

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020 (used to calculate contribution base). This was the largest percentage increase in wages since the early '80s.

Weekly Initial Unemployment Claims increase to 228,000

by Calculated Risk on 10/13/2022 08:36:00 AM

The DOL reported:

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 228,000, an increase of 9,000 from the previous week's unrevised level of 219,000. The 4-week moving average was 211,500, an increase of 5,000 from the previous week's unrevised average of 206,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 211,500.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.

BLS: CPI increased 0.4% in September; Core CPI increased 0.6%

by Calculated Risk on 10/13/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis after rising 0.1 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.2 percent before seasonal adjustment.Both CPI and core CPI were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the monthly seasonally adjusted all items increase. These increases were partly offset by a 4.9-percent decline in the gasoline index. The food index continued to rise, increasing 0.8 percent over the month as the food at home index rose 0.7 percent. The energy index fell 2.1 percent over the month as the gasoline index declined, but the natural gas and electricity indexes increased.

The index for all items less food and energy rose 0.6 percent in September, as it did in August. The indexes for shelter, medical care, motor vehicle insurance, new vehicles, household furnishings and operations, and education were among those that increased over the month. There were some indexes that declined in September, including those for used cars and trucks, apparel, and communication.

The all items index increased 8.2 percent for the 12 months ending September, a slightly smaller figure than the 8.3-percent increase for the period ending August. The all items less food and energy index rose 6.6 percent over the last 12 months. The energy index increased 19.8 percent for the 12 months ending September, a smaller increase than the 23.8-percent increase for the period ending August. The food index increased 11.2 percent over the last year.

emphasis added

Wednesday, October 12, 2022

Thursday: CPI, Unemployment Claims

by Calculated Risk on 10/12/2022 08:29:00 PM

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 219 thousand last week (likely impact from Hurricane Ian).

• Also at 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.1% year-over-year and core CPI to be up 6.5% YoY.

FOMC Minutes "Purposefully moving to a restrictive policy stance in the near term"

by Calculated Risk on 10/12/2022 02:06:00 PM

In their assessment of the effects of policy actions and communications to date, participants concurred that the Committee's actions to raise expeditiously the target range for the federal funds rate demonstrated its resolve to lower inflation to 2 percent and to keep inflation expectations anchored at levels consistent with that longer-run goal. Participants noted that the Committee's commitment to restoring price stability, together with its purposeful policy actions and communications, had contributed to a notable tightening of financial conditions over the past year that would likely help reduce inflation pressures by restraining aggregate demand. Participants observed that this tightening had led to substantial increases in real interest rates across the maturity spectrum. Most participants remarked that, although some interest-sensitive categories of spending—such as housing and business fixed investment—had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response. They noted also that inflation had not yet responded appreciably to policy tightening and that a significant reduction in inflation would likely lag that of aggregate demand. Participants observed that a period of real GDP growth below its trend rate, very likely accompanied by some softening in labor market conditions, was required. They agreed that, by moving its policy purposefully toward an appropriately restrictive stance, the Committee would help ensure that elevated inflation did not become entrenched and that inflation expectations did not become unanchored. These policy moves would therefore prevent the far greater economic pain associated with entrenched high inflation, including the even tighter policy and more severe restraint on economic activity that would then be needed to restore price stability.

In light of the broad-based and unacceptably high level of inflation, the intermeeting news of higher-than-expected inflation, and upside risks to the inflation outlook, participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations. Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation. Several participants observed that as policy moved into restrictive territory, risks would become more two-sided, reflecting the emergence of the downside risk that the cumulative restraint in aggregate demand would exceed what was required to bring inflation back to 2 percent. A few of these participants noted that this possibility was heightened by factors beyond the Committee's actions, including the tightening of monetary policy stances abroad and the weakening global economic outlook, that were also likely to restrain domestic economic activity in the period ahead.

emphasis added

2nd Look at Local Housing Markets in September

by Calculated Risk on 10/12/2022 11:07:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in September

A brief excerpt:

This is the second look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are seeing a sharp decline in closed sales, and inventory is up significantly year-over-year. Also, new listings are down as the sellers’ strike continues. The increase in inventory so far has been due to softer demand because of higher mortgage rates.

In September, sales were down 22.5%. In August, sales in these same markets were down 20.2% YoY Not Seasonally Adjusted (NSA).

Note that in September 2022, there were the same number of selling days as in September 2021, so the SA decline will be similar to the NSA decline. Last month, in August 2022, there was one more selling day than in August 2021 - so seasonally adjusted, the decline in sales in September will be about the same as in August for these markets.

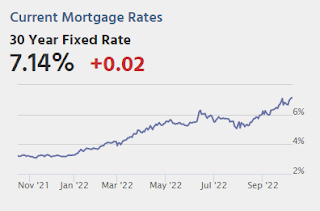

Closed sales in September were mostly for contracts signed in July and August when 30-year mortgage rates averaged about 5.3%. Rates increased to around 6% in September and that will impact closed sales in October and November. In early October 30-year rates have jumped to over 7%.

Many more local markets to come!

MBA: Mortgage Applications Decrease in Latest Weekly Survey; Purchase Activity 7% Below Pandemic Low

by Calculated Risk on 10/12/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 7, 2022.

... The Refinance Index decreased 2 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 39 percent lower than the same week one year ago.

“Mortgage rates moved higher once again during the first week of the fourth quarter of 2022, with the 30- year conforming rate reaching 6.81 percent, the highest level since 2006. Mortgage rates increased across all product types in MBA’s survey, with the largest, a 20-basis-point increase, for 5-year ARM loans. The ARM share of applications remained quite high at 11.7 percent – just below last week’s level,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Application volumes for both refinancing and home purchases declined and continue to fall further behind last year’s record levels. The news that job growth and wage growth continued in September is positive for the housing market, as higher incomes support housing demand. However, it also pushed off the possibility of any near-term pivot from the Federal Reserve on its plans for additional rate hikes.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.81 percent from 6.75 percent, with points increasing to 0.97 from 0.95 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 11, 2022

Wednesday: PPI, FOMC Minutes

by Calculated Risk on 10/11/2022 08:10:00 PM

Treasury futures took a beating on Monday as the UK bond market once again traded in panic mode. The high rate implications were still in place as of Tuesday's overnight trading. 10yr Treasury yields broke above 4.0% yet again and continued struggling to move much lower until later in the trading day. ... The weaker opening levels resulted in mortgage rates remaining at long term highs, but they would have been higher highs had it not been for an admirable show of support in the bond market. In fact, by the afternoon hours, Treasuries and MBS were both very close to the same territory seen on Friday afternoon ... [30 year fixed 7.14%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

• At 2:00 PM, FOMC Minutes, Meeting of September 20-21, 2022

MBA: Mortgage Credit Availability was Never Excessive During the Recent Housing Boom

by Calculated Risk on 10/11/2022 10:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Credit Availability was Never Excessive During the Recent Housing Boom

A brief excerpt:

Although mortgage credit availability decreased in September (the MBA headline below), the most important point is mortgage credit availability was never excessive during the boom. Here is the expanded series from the MBA of mortgage credit availability that includes the bubble years (2004 - 2006).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Look at that huge increase in mortgage credit availability back in the 2004 - 2006 period (remember “fog a mirror, get a loan”, NINJA loans: No Income, No Job or Assets?). In the recent boom, lending was reasonably solid, and most homeowners have substantial equity in their homes. Although I expect an increase in foreclosures from record low levels, there will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

Here is the article from the MBA: Mortgage Credit Availability Decreased in September