by Calculated Risk on 10/14/2022 08:56:00 PM

Friday, October 14, 2022

COVID Oct 14, 2022: Update on Cases, Hospitalizations and Deaths

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths):

Average daily deaths bottomed in July 2021 at 214 per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 37,808 | 42,593 | ≤5,0001 | |

| Hospitalized2 | 19,625 | 21,607 | ≤3,0001 | |

| Deaths per Day2 | 332 | 368 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

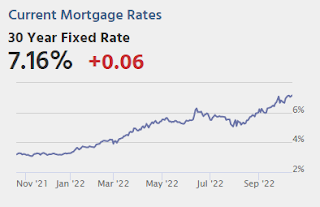

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q3 GDP Tracking: Moving on Up

by Calculated Risk on 10/14/2022 12:36:00 PM

From BofA:

On net, today's data on retail sales and import and export prices pushed up our 3Q US GDP tracking estimate by 0.2pp to 1.9% q/q saar, from 1.7% previously. [October 14th estimate]From Goldman:

emphasis added

Following today’s data, we boosted our Q3 GDP tracking estimate by 0.4pp to +2.3% (qoq ar). [October 14th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.8 percent on October 14, down from 2.9 percent on October 7. After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth decreased from 1.3 percent to 1.2 percent. [October 14th estimate]

Hotels: Occupancy Rate Down 3.5% Compared to Same Week in 2019

by Calculated Risk on 10/14/2022 10:35:00 AM

U.S. hotel performance increased from the previous week but produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 2-8, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 68.2% (-3.5%)

• Average daily rate (ADR): $153.79 (+16.9%)

• Revenue per available room (RevPAR): $104.83 (+12.8%)

While weekday performance showed an expected decline due to Yom Kippur, school breaks and the extended holiday weekend helped lift levels on Friday and Saturday. Performance levels in Florida were also lifted by post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Retail Sales Unchanged in September

by Calculated Risk on 10/14/2022 08:37:00 AM

On a monthly basis, retail sales were unchanged from August to September (seasonally adjusted), and sales were up 8.2 percent from September 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $684.0 billion, virtually unchanged from the previous month, but 8.2 percent above September 2021. ... The July 2022 to August 2022 percent change was revised from up 0.3% to up 0.4 percent (±0.2 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 7.2% on a YoY basis.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Thursday, October 13, 2022

Friday: Retail Sales

by Calculated Risk on 10/13/2022 08:37:00 PM

Realtor.com Reports Weekly Active Inventory Up 31% Year-over-year; New Listings Down 15%

by Calculated Risk on 10/13/2022 03:31:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending Oct 8, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 31% above one year ago.

Highlighting the roller coaster ride that the housing market and its participants have been on in the last few years, one’s take on the current number of homes for sale depends very much on the comparison point. After a period of unusually hot activity, financial conditions are cooling demand in the housing market and there are substantially more homes for-sale compared to one year ago. However, the market still falls short of pre-pandemic inventory levels by an even greater amount.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 15% from one year ago.

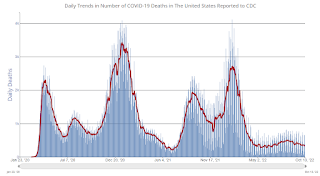

This week marks the fourteenth straight week of year over year declines in the number of new listings coming up for sale. As mortgage rates near 7 percent, which is a level not seen in more than two decades, sellers who are also trying to buy a home, nearly 3 of every 4 potential sellers, have had to alter their trade-up plans. It appears that many have put selling on hold despite record levels of home equity, as higher mortgage rates and home prices sap purchasing power.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

House Prices to National Average Wage Index

by Calculated Risk on 10/13/2022 01:07:00 PM

Today, in the Calculated Risk Real Estate Newsletter: House Prices to National Average Wage Index

A brief excerpt:

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately, most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).There is more in the article.

...

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020. This was the largest percentage increase in wages since 1981 - another reason to compare the current housing cycle to the 1978 to 1982 period (not the housing bubble and bust).

As of 2022, house prices were well above the median historical ratio - and at the level of the bubble peak - even though wages increased sharply in 2021. This suggests house prices are too high based on fundamentals, and I expect house prices to spend 7 years in purgatory.

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.6% in September

by Calculated Risk on 10/13/2022 11:17:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in September. The 16% trimmed-mean Consumer Price Index increased 0.6% in September. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" decreased at a 45% annualized rate in September.

Cost of Living Adjustment increases 8.7% in 2023, Contribution Base increased to $160,200

by Calculated Risk on 10/13/2022 08:55:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2023.

From Social Security: Social Security Announces 8.7 Percent Benefit Increase for 2023

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 8.7 percent in 2023, the Social Security Administration announced today. On average, Social Security benefits will increase by more than $140 per month starting in January.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (8.7% increase) and a list of previous Cost-of-Living Adjustments.

The 8.7 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Increased payments to more than 7 million SSI beneficiaries will begin on December 30, 2022. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

...

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $160,200 from $147,000.

The contribution and benefit base will be $160,200 in 2023.

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020 (used to calculate contribution base). This was the largest percentage increase in wages since the early '80s.

Weekly Initial Unemployment Claims increase to 228,000

by Calculated Risk on 10/13/2022 08:36:00 AM

The DOL reported:

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 228,000, an increase of 9,000 from the previous week's unrevised level of 219,000. The 4-week moving average was 211,500, an increase of 5,000 from the previous week's unrevised average of 206,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 211,500.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.