by Calculated Risk on 10/16/2022 10:59:00 AM

Sunday, October 16, 2022

Monthly Mortgage Payments Up Record Year-over-year

Today, in the Calculated Risk Real Estate Newsletter: Monthly Mortgage Payments Up Record Year-over-year

Excerpt:

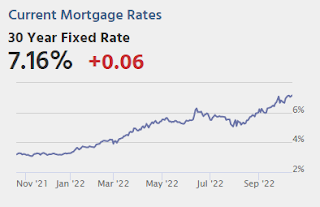

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 59% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

This is above the previous record increase of 50% in 1980. This assumed a fixed loan amount - if we add in the year-over-year increase in house prices, payments would be up over 70% YoY for the same house.

This is one of the reasons I've argued Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

...

In the 1980 period, new home sales fell about 40% YoY and about 60% from the peak in the 1970s to the trough in 1980. A similar decline might push new home sales down to around 400 thousand SAAR in coming months. ... Even though we can expect significant further declines in new home sales and single-family housing starts, the good news for the homebuilders is activity usually picks up quickly following an interest rate induced slowdown (as opposed to following the housing bust when the recovery took many years).

Saturday, October 15, 2022

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 10/15/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Current State of the Housing Market

• House Prices to National Average Wage Index

• 2nd Look at Local Housing Markets in September

• MBA: Mortgage Credit Availability was Never Excessive During the Recent Housing Boom

• Housing Discussion with Fortune's Lance Lambert

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 16, 2022

by Calculated Risk on 10/15/2022 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home sales.

For manufacturing, September Industrial Production, and the October New York and Philly Fed surveys will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of -4.0, down from -1.5.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 80.0%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 44, down from 46 in September. Any number below 50 indicates that more builders view sales conditions as poor than good.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

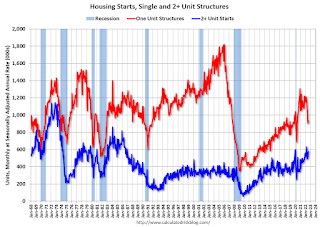

8:30 AM: Housing Starts for September. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.478 million SAAR, down from 1.575 million SAAR.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 232 thousand from 228 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of -4.5, up from -9.9.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for September 2022

Friday, October 14, 2022

COVID Oct 14, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 10/14/2022 08:56:00 PM

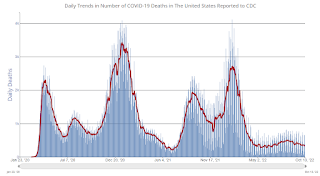

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths):

Average daily deaths bottomed in July 2021 at 214 per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 37,808 | 42,593 | ≤5,0001 | |

| Hospitalized2 | 19,625 | 21,607 | ≤3,0001 | |

| Deaths per Day2 | 332 | 368 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q3 GDP Tracking: Moving on Up

by Calculated Risk on 10/14/2022 12:36:00 PM

From BofA:

On net, today's data on retail sales and import and export prices pushed up our 3Q US GDP tracking estimate by 0.2pp to 1.9% q/q saar, from 1.7% previously. [October 14th estimate]From Goldman:

emphasis added

Following today’s data, we boosted our Q3 GDP tracking estimate by 0.4pp to +2.3% (qoq ar). [October 14th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.8 percent on October 14, down from 2.9 percent on October 7. After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth decreased from 1.3 percent to 1.2 percent. [October 14th estimate]

Hotels: Occupancy Rate Down 3.5% Compared to Same Week in 2019

by Calculated Risk on 10/14/2022 10:35:00 AM

U.S. hotel performance increased from the previous week but produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 2-8, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 68.2% (-3.5%)

• Average daily rate (ADR): $153.79 (+16.9%)

• Revenue per available room (RevPAR): $104.83 (+12.8%)

While weekday performance showed an expected decline due to Yom Kippur, school breaks and the extended holiday weekend helped lift levels on Friday and Saturday. Performance levels in Florida were also lifted by post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Retail Sales Unchanged in September

by Calculated Risk on 10/14/2022 08:37:00 AM

On a monthly basis, retail sales were unchanged from August to September (seasonally adjusted), and sales were up 8.2 percent from September 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $684.0 billion, virtually unchanged from the previous month, but 8.2 percent above September 2021. ... The July 2022 to August 2022 percent change was revised from up 0.3% to up 0.4 percent (±0.2 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 7.2% on a YoY basis.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Sales in September were below expectations, however sales in July and August were revised up, combined.

Thursday, October 13, 2022

Friday: Retail Sales

by Calculated Risk on 10/13/2022 08:37:00 PM

Realtor.com Reports Weekly Active Inventory Up 31% Year-over-year; New Listings Down 15%

by Calculated Risk on 10/13/2022 03:31:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending Oct 8, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 31% above one year ago.

Highlighting the roller coaster ride that the housing market and its participants have been on in the last few years, one’s take on the current number of homes for sale depends very much on the comparison point. After a period of unusually hot activity, financial conditions are cooling demand in the housing market and there are substantially more homes for-sale compared to one year ago. However, the market still falls short of pre-pandemic inventory levels by an even greater amount.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 15% from one year ago.

This week marks the fourteenth straight week of year over year declines in the number of new listings coming up for sale. As mortgage rates near 7 percent, which is a level not seen in more than two decades, sellers who are also trying to buy a home, nearly 3 of every 4 potential sellers, have had to alter their trade-up plans. It appears that many have put selling on hold despite record levels of home equity, as higher mortgage rates and home prices sap purchasing power.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

House Prices to National Average Wage Index

by Calculated Risk on 10/13/2022 01:07:00 PM

Today, in the Calculated Risk Real Estate Newsletter: House Prices to National Average Wage Index

A brief excerpt:

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately, most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).There is more in the article.

...

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020. This was the largest percentage increase in wages since 1981 - another reason to compare the current housing cycle to the 1978 to 1982 period (not the housing bubble and bust).

As of 2022, house prices were well above the median historical ratio - and at the level of the bubble peak - even though wages increased sharply in 2021. This suggests house prices are too high based on fundamentals, and I expect house prices to spend 7 years in purgatory.