by Calculated Risk on 10/19/2022 04:17:00 PM

Wednesday, October 19, 2022

LA Port Traffic Declined in September

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 1.5% in September compared to the rolling 12 months ending in August. Outbound traffic increased 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Fed's Beige Book: "Rising mortgage rates and elevated house prices further weakened single-family starts and sales"

by Calculated Risk on 10/19/2022 02:09:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Dallas based on information collected on or before October 7, 2022."

National economic activity expanded modestly on net since the previous report; however, conditions varied across industries and Districts. Four Districts noted flat activity and two cited declines, with slowing or weak demand attributed to higher interest rates, inflation, and supply disruptions. Retail spending was relatively flat, reflecting lower discretionary spending, and auto dealers noted sustained sluggishness in sales stemming from limited inventories, high vehicle prices, and rising interest rates. Travel and tourist activity rose strongly, boosted by continued strength in leisure activity and a pickup in business travel. Manufacturing activity held steady or expanded in most Districts in part due to easing in supply chain disruptions, though there were a few reports of output declines. Demand for nonfinancial services rose. Activity in transportation services was mixed, as port activity increased strongly whereas reports of trucking and freight demand were mixed. Rising mortgage rates and elevated house prices further weakened single-family starts and sales, but helped buoy apartment leasing and rents, which generally remained high. Commercial real estate slowed in both construction and sales amid supply shortages and elevated construction and borrowing costs, and there were scattered reports of declining property prices. Industrial leasing remained robust, while office demand was tepid. Bankers in most reporting Districts cited declines in loan volumes, partly a result of shrinking residential real estate lending. Energy activity expanded moderately, whereas agriculture reports were mixed, as drought conditions and high input costs remained a challenge. Outlooks grew more pessimistic amidst growing concerns about weakening demand.

Employment continued to rise at a modest to moderate pace in most Districts. Several Districts reported a cooling in labor demand, with some noting that businesses were hesitant to add to payrolls amid increased concerns of an economic downturn. There were also scattered mentions of hiring freezes. Overall labor market conditions remained tight, though half of Districts noted some easing of hiring and/or retention difficulties.

emphasis added

AIA: Architecture Billings Index "Moderates but remains healthy" in September

by Calculated Risk on 10/19/2022 12:09:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

The AIA Architecture Billings Index (ABI) score for September was 51.7 down from a score of 53.3 in August, indicating essentially stable business conditions for architecture firms (any score above 50 indicates an increase in billings from the prior month). Also in September, both the new project inquiries and design contracts indexes moderated from August but remained positive with scores of 53.6 and 50.7, respectively.

“While billings in the Northeast region and the Institutional sector reached their highest pace of growth in several years, there appears to be emerging weakness in the previously healthy multifamily residential and commercial/industrial sectors, both of which saw a decline in billings for the first time since the post-pandemic recovery began,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Across the broader architecture sector, backlogs at firms remained at a robust 7.0 months as of the end of September, still near record-high levels since we began collecting this data regularly more than a decade ago.”

...

• Regional averages: Northeast (54.6); Midwest (52.1); South (51.7); West (51.6)

• Sector index breakdown: institutional (58.9); mixed practice (50.3); commercial/industrial (49.6); multi-family residential (47.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.7 in September, down from 53.3 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for 20 consecutive months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment into 2023.

September Housing Starts: Record Number of Housing Units Under Construction

by Calculated Risk on 10/19/2022 09:02:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: September Housing Starts: Record Number of Housing Units Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 800 thousand single family units (red) under construction (SA). This is below the previous six months, and 28 thousand below the peak in April and May. Single family units under construction have peaked since single family starts are now declining. The reason there are so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 910 thousand multi-family units under construction. This is the highest level since February 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.710 million units under construction. This is the all-time record number of units under construction.

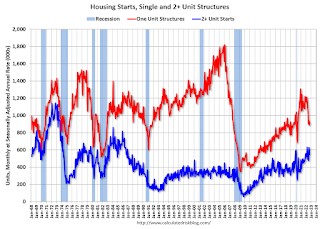

Housing Starts Decreased to 1.439 million Annual Rate in September

by Calculated Risk on 10/19/2022 08:36:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in September were at a seasonally adjusted annual rate of 1,439,000. This is 8.1 percent below the revised August estimate of 1,566,000 and is 7.7 percent below the September 2021 rate of 1,559,000. Single‐family housing starts in September were at a rate of 892,000; this is 4.7 percent below the revised August figure of 936,000. The September rate for units in buildings with five units or more was 530,000

Building Permits:

Privately‐owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,564,000. This is 1.4 percent above the revised August rate of 1,542,000, but is 3.2 percent below the September 2021 rate of 1,615,000. Single‐family authorizations in September were at a rate of 872,000; this is 3.1 percent below the revised August figure of 900,000. Authorizations of units in buildings with five units or more were at a rate of 644,000 in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in September compared to August. Multi-family starts were up 18.5% year-over-year in September.

Single-family starts (red) decreased in September and were down 14.6% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery.

Total housing starts in September were below expectations, and starts in July and August were revised down, combined.

I'll have more later …

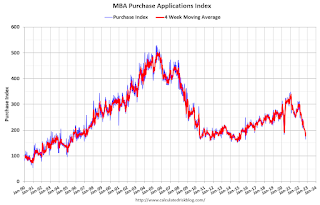

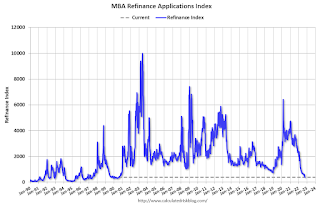

MBA: Mortgage Applications Decrease in Latest Weekly Survey; Lowest Level Since 1997

by Calculated Risk on 10/19/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 14, 2022.

... The Refinance Index decreased 7 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 38 percent lower than the same week one year ago.

“Mortgage applications are now into their fourth month of declines, dropping to the lowest level since 1997, as the 30-year fixed mortgage rate hit 6.94 percent – the highest level since 2002,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The speed and level to which rates have climbed this year have greatly reduced refinance activity and exacerbated existing affordability challenges in the purchase market. Residential housing activity ranging from new housing starts to home sales have been on downward trends coinciding with the rise in rates. The current 30-year fixed rate is now well over three percentage points higher than a year ago, and both purchase and refinance applications were down 38 percent and 86 percent over the year, respectively.”

Added Kan: “With rates at these high levels, the ARM share rose to 12.8 percent of all applications, which was the highest share since March 2008. ARM loans continue to remain a viable option for borrowers who are still trying to find ways to reduce their monthly payments.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.94 percent from 6.81 percent, with points decreasing to 0.95 from 0.97 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 18, 2022

Wednesday: Housing Starts, Beige Book

by Calculated Risk on 10/18/2022 08:51:00 PM

For traders who believe the Fed's restrictive policies will eventually drive growth and inflation lower, it's hard to make a case for longer-term yields going much above 4%, even with core inflation over 6%. If you ask traders, the actual outlook for inflation over the next 10 years is close to the Fed's target range. ... [30 year fixed 7.15%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September. The consensus is for 1.478 million SAAR, down from 1.575 million SAAR.

• During the day, The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

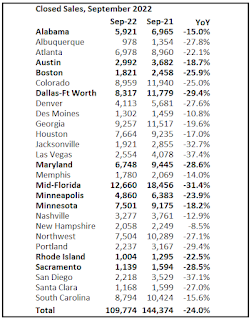

3rd Look at Local Housing Markets in September, California Sales off 30% YoY

by Calculated Risk on 10/18/2022 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in September, California Sales off 30% YoY

A brief excerpt:

California doesn’t report monthly inventory numbers, but they do report the change in months of inventory. Here is the press release from the California Association of Realtors® (C.A.R.): Rising interest rates depress September home sales and prices, C.A.R. reportsThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/September’s sales pace was down 2.5 percent on a monthly basis from 313,540 in August and down 30.2 percent from a year ago ...

The statewide median home price continued to increase on a year-over-year basis in September, but the growth rate remained very mild compared to those observed earlier this year. At an increase of 1.6 percent year-over-year, September marked the fourth consecutive month with a single-digit annual increase. … With closed sales dropping more than 25 percent and pending sales falling over 40 percent, active listings have been staying on the market significantly longer, which contributed to a surge in for-sale properties by 51.5 percent in September.In September, sales were down 24.0% YoY Not Seasonally Adjusted (NSA) for these markets.

NOTE: Housing economist Tom Lawler expects the NAR to report sales of 4.82 million SAAR for September (the NAR reports this coming Thursday).!

NAHB: Builder Confidence Decreased Sharply in October

by Calculated Risk on 10/18/2022 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 38, down from 46 in September. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Down 10 Straight Months as Housing Market Continues to Weaken

In a further signal that rising interest rates, building material bottlenecks and elevated home prices continue to weaken the housing market, builder sentiment fell for the 10th straight month in October and traffic of prospective buyers fell to its lowest level since 2012 (excluding the two-month period in the spring of 2020 at the beginning of the pandemic).

Builder confidence in the market for newly built single-family homes dropped eight points in October to 38—half the level it was just six months ago—according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest confidence reading since August 2012, with the exception of the onset of the pandemic in the spring of 2020.

“High mortgage rates approaching 7% have significantly weakened demand, particularly for first-time and first-generation prospective home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “This situation is unhealthy and unsustainable. Policymakers must address this worsening housing affordability crisis.”

“This will be the first year since 2011 to see a decline for single-family starts,” said NAHB Chief Economist Robert Dietz. “And given expectations for ongoing elevated interest rates due to actions by the Federal Reserve, 2023 is forecasted to see additional single-family building declines as the housing contraction continues. While some analysts have suggested that the housing market is now more ‘balanced,’ the truth is that the homeownership rate will decline in the quarters ahead as higher interest rates and ongoing elevated construction costs continue to price out a large number of prospective buyers.”

...

All three HMI components posted declines in October. Current sales conditions fell nine points to 45, sales expectations in the next six months declined 11 points to 35 and traffic of prospective buyers fell six points to 25.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell three points to 48, the Midwest dropped three points to 41, the South fell seven points to 49 and the West posted a seven-point decline to 34.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast, and the lowest level since 2012 (excluding the two-month drop at the beginning of the pandemic).

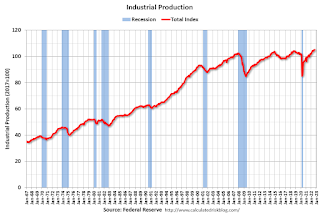

Industrial Production Increased 0.4 Percent in September

by Calculated Risk on 10/18/2022 09:20:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.4 percent in September and 2.9 percent at an annual rate in the third quarter. In September, manufacturing output rose 0.4 percent after advancing a similar amount in the previous month. The index for mining moved up 0.6 percent, and the index for utilities fell 0.3 percent. At 105.2 percent of its 2017 average, total industrial production in September was 5.3 percent above its year-earlier level. Capacity utilization moved up 0.2 percentage point in September to 80.3 percent, a rate that is 0.7 percentage point above its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 80.3% is 0.7% above the average from 1972 to 2021. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in September to 105.2. This is above the pre-pandemic level.

The change in industrial production was above consensus expectations.