by Calculated Risk on 10/21/2022 08:11:00 AM

Friday, October 21, 2022

Black Knight: Mortgage Delinquency Rate decreased in September

From Black Knight: Black Knight: September Prepayments at More Than 20-Year Low on Spiking Interest Rates; Foreclosure Starts Fall 9% from August, Remain 53% Below Pre-Pandemic Levels

• Prepayment activity dropped -14.9% to a single-month mortality (SMM) rate of 0.57% in September – below the recent record of 0.59% set in January 2019 – to the lowest level since November 2000According to Black Knight's First Look report, the percent of loans delinquent decreased 0.2% in September compared to August and decreased 29% year-over-year.

• The national delinquency rate inched down -0.2% from August to 2.78%, just 3 basis points above the record low set in May 2022, with the number of past-due mortgages holding relatively steady across the board

• The number of borrowers a single payment past due rose by 1%, while 90-day delinquencies fell -1.5 % in September and are now only 24% above the pre-pandemic serious delinquency rate

• Foreclosure starts fell 9% from August to 18,400 – 53% below pre-pandemic levels – with starts initiated on 3% of serious delinquencies, still less than half the rate of the years leading up to the pandemic

• Active foreclosure inventory held steady in the month at volumes that have remained subdued in early 2022 after the record lows of 2021 due to widespread moratoriums and forbearance protections

• Prepays (SMM) edged up 1.5% for the month, due to calendar-related effects, but are still down by 69% year-over-year as rising rates continue to put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.78% in September, down from 2.79% in August.

The percent of loans in the foreclosure process was unchanged in September at 0.35%, from 0.35% in August.

The number of delinquent properties, but not in foreclosure, is down 577,000 properties year-over-year, and the number of properties in the foreclosure process is up 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2022 | Aug 2022 | Sept 2021 | Sept 2020 | |

| Delinquent | 2.78% | 2.79% | 3.91% | 6.66% |

| In Foreclosure | 0.35% | 0.35% | 0.26% | 0.34% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,491,000 | 1,489,000 | 2,068,000 | 3,542,000 |

| Number of properties in foreclosure pre-sale inventory: | 185,000 | 185,000 | 135,000 | 181,000 |

| Total Properties | 1,677,000 | 1,674,000 | 2,203,000 | 3,722,000 |

Thursday, October 20, 2022

Hotels: Occupancy Rate Down 2.7% Compared to Same Week in 2019

by Calculated Risk on 10/20/2022 04:24:00 PM

U.S. hotel performance increased from the previous week and produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 9-15, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 70.3% (-2.7%)

• Average daily rate (ADR): $157.52 (+15.8%)

• Revenue per available room (RevPAR): $110.78 (+12.8%)

Among the Top 25 Markets, Tampa reported the largest increases over 2019 in each of the key performance metrics: occupancy (+17.1% to 80.6%), ADR (+34.6% to $159.80) and RevPAR (+57.7% to $128.85). Tampa has been one of the markets in Florida that have seen a performance lifted associated with post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Realtor.com Reports Weekly Active Inventory Up 34% Year-over-year; New Listings Down 15%

by Calculated Risk on 10/20/2022 01:35:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 15, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 34% above one year ago. ... This week’s big jump in the active inventory trend (from 31% last week to 34% this week), even as new listings remain low, suggests that buyers are likely being squeezed by the renewed advance of mortgage rates which were very near 7% last week and are likely to top that mark this week.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 15% from one year ago. This week marks the fifteenth straight week of year over year declines in the number of new listings coming up for sale. Seasonally, fewer homeowners contemplate a home sale as the temperature cools and the holidays approach. Still, the consistent declines relative to one year ago signal dwindling enthusiasm on the part of potential sellers.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

More Analysis on September Existing Home Sales

by Calculated Risk on 10/20/2022 10:39:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.71 million SAAR in September

Excerpt:

The second graph shows existing home sales by month for 2021 and 2022.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Sales declined 23.8% year-over-year compared to September 2021. This was the thirteen consecutive month with sales down year-over-year.

...

Existing home sales are being impacted by higher mortgage rates. Rates have increased sharply in October, and that will impact closed sales in November and December - so I expect further declines in sales later this year.

NAR: Existing-Home Sales Decreased to 4.71 million SAAR in September

by Calculated Risk on 10/20/2022 10:10:00 AM

From the NAR: Existing-Home Sales Decreased 1.5% in September

Existing-home sales descended in September, the eighth month in a row of declines, according to the National Association of REALTORS®. Three out of the four major U.S. regions notched month-over-month sales contractions, while the West held steady. On a year-over-year basis, sales dropped in all regions.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, retracted 1.5% from August to a seasonally adjusted annual rate of 4.71 million in September. Year-over-year, sales waned by 23.8% (down from 6.18 million in September 2021).

...

Total housing inventory registered at the end of September was 1.25 million units, which was down 2.3% from August and 0.8% from the previous year. Unsold inventory sits at a 3.2-month supply at the current sales pace – unchanged from August and up from 2.4 months in September 2021.

emphasis added

Click on graph for larger image.

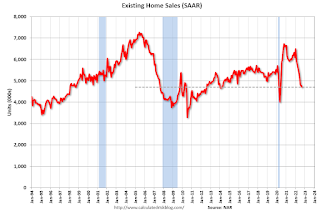

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (4.71 million SAAR) were down 1.5% from the previous month and were 23.8% below the September 2021 sales rate.

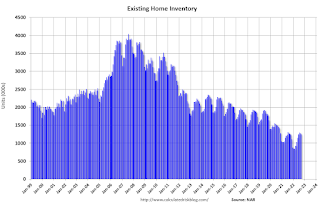

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.25 million in September from 1.28 million in August.

According to the NAR, inventory decreased to 1.25 million in September from 1.28 million in August.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was essentially unchanged year-over-year (blue) in September compared to September 2021.

Inventory was essentially unchanged year-over-year (blue) in September compared to September 2021. Months of supply (red) was unchanged at 3.2 months in September from 3.2 months in August.

This was close to the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims decrease to 214,000

by Calculated Risk on 10/20/2022 08:33:00 AM

The DOL reported:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 228,000 to 226,000. The 4-week moving average was 212,250, an increase of 1,250 from the previous week's revised average. The previous week's average was revised down by 500 from 211,500 to 211,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,250.

The previous week was revised down.

Weekly claims were lower than the consensus forecast.

Wednesday, October 19, 2022

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 10/19/2022 08:40:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 232 thousand from 228 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of -4.5, up from -9.9.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August. Housing economist Tom Lawler expects the NAR to report sales of 4.82 million SAAR.

LA Port Traffic Declined in September

by Calculated Risk on 10/19/2022 04:17:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 1.5% in September compared to the rolling 12 months ending in August. Outbound traffic increased 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Fed's Beige Book: "Rising mortgage rates and elevated house prices further weakened single-family starts and sales"

by Calculated Risk on 10/19/2022 02:09:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Dallas based on information collected on or before October 7, 2022."

National economic activity expanded modestly on net since the previous report; however, conditions varied across industries and Districts. Four Districts noted flat activity and two cited declines, with slowing or weak demand attributed to higher interest rates, inflation, and supply disruptions. Retail spending was relatively flat, reflecting lower discretionary spending, and auto dealers noted sustained sluggishness in sales stemming from limited inventories, high vehicle prices, and rising interest rates. Travel and tourist activity rose strongly, boosted by continued strength in leisure activity and a pickup in business travel. Manufacturing activity held steady or expanded in most Districts in part due to easing in supply chain disruptions, though there were a few reports of output declines. Demand for nonfinancial services rose. Activity in transportation services was mixed, as port activity increased strongly whereas reports of trucking and freight demand were mixed. Rising mortgage rates and elevated house prices further weakened single-family starts and sales, but helped buoy apartment leasing and rents, which generally remained high. Commercial real estate slowed in both construction and sales amid supply shortages and elevated construction and borrowing costs, and there were scattered reports of declining property prices. Industrial leasing remained robust, while office demand was tepid. Bankers in most reporting Districts cited declines in loan volumes, partly a result of shrinking residential real estate lending. Energy activity expanded moderately, whereas agriculture reports were mixed, as drought conditions and high input costs remained a challenge. Outlooks grew more pessimistic amidst growing concerns about weakening demand.

Employment continued to rise at a modest to moderate pace in most Districts. Several Districts reported a cooling in labor demand, with some noting that businesses were hesitant to add to payrolls amid increased concerns of an economic downturn. There were also scattered mentions of hiring freezes. Overall labor market conditions remained tight, though half of Districts noted some easing of hiring and/or retention difficulties.

emphasis added

AIA: Architecture Billings Index "Moderates but remains healthy" in September

by Calculated Risk on 10/19/2022 12:09:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

The AIA Architecture Billings Index (ABI) score for September was 51.7 down from a score of 53.3 in August, indicating essentially stable business conditions for architecture firms (any score above 50 indicates an increase in billings from the prior month). Also in September, both the new project inquiries and design contracts indexes moderated from August but remained positive with scores of 53.6 and 50.7, respectively.

“While billings in the Northeast region and the Institutional sector reached their highest pace of growth in several years, there appears to be emerging weakness in the previously healthy multifamily residential and commercial/industrial sectors, both of which saw a decline in billings for the first time since the post-pandemic recovery began,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Across the broader architecture sector, backlogs at firms remained at a robust 7.0 months as of the end of September, still near record-high levels since we began collecting this data regularly more than a decade ago.”

...

• Regional averages: Northeast (54.6); Midwest (52.1); South (51.7); West (51.6)

• Sector index breakdown: institutional (58.9); mixed practice (50.3); commercial/industrial (49.6); multi-family residential (47.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.7 in September, down from 53.3 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for 20 consecutive months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment into 2023.