by Calculated Risk on 10/21/2022 09:11:00 PM

Friday, October 21, 2022

COVID Oct 21, 2022: Update on Cases, Hospitalizations and Deaths

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

Weekly deaths bottomed in July 2021 at 1,666.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 260,808 | 265,175 | ≤35,0001 | |

| Hospitalized2🚩 | 21,062 | 19,625 | ≤3,0001 | |

| Deaths per Week2 | 2,566 | 2,582 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Total Housing Completions Will Increase About 6% in 2022

by Calculated Risk on 10/21/2022 02:56:00 PM

Even as housing starts slow, completions will increase in 2022 compared to 2021.

This graph shows total housing completions and placements since 1968 with an estimate for 2022. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

Click on graph for larger image.

Click on graph for larger image.My current estimate is total completions (single family, multi-family, manufactured homes) will increase about 6% in 2022 to over 1.5 million. This will be close to the same level of completions as in 2007.

This is an update to an August article in the Calculated Risk Real Estate Newsletter: Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

Q3 GDP Tracking: In 2% Range

by Calculated Risk on 10/21/2022 10:06:00 AM

The advance estimate for Q3 GDP will be released next Thursday and the consensus is that real GDP increased 2.4%, on a seasonally adjusted annual rate basis.

From BofA:

The smaller-than-expected decline in existing home sales lifted our 3Q US GDP tracker from 2.0% q/q saar to 2.1%. [October 20th estimate]From Goldman:

emphasis added

Following this morning’s data, we left our Q3 GDP tracking estimate unchanged at +2.4% (qoq ar). [October 20th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.9 percent on October 19, up from 2.8 percent on October 14. After recent releases from the Federal Reserve Board of Governors and the US Census Bureau, the nowcast of third-quarter real gross private domestic investment growth increased from -3.6 percent to -3.3 percent. [October 19th estimate]

Black Knight: Mortgage Delinquency Rate decreased in September

by Calculated Risk on 10/21/2022 08:11:00 AM

From Black Knight: Black Knight: September Prepayments at More Than 20-Year Low on Spiking Interest Rates; Foreclosure Starts Fall 9% from August, Remain 53% Below Pre-Pandemic Levels

• Prepayment activity dropped -14.9% to a single-month mortality (SMM) rate of 0.57% in September – below the recent record of 0.59% set in January 2019 – to the lowest level since November 2000According to Black Knight's First Look report, the percent of loans delinquent decreased 0.2% in September compared to August and decreased 29% year-over-year.

• The national delinquency rate inched down -0.2% from August to 2.78%, just 3 basis points above the record low set in May 2022, with the number of past-due mortgages holding relatively steady across the board

• The number of borrowers a single payment past due rose by 1%, while 90-day delinquencies fell -1.5 % in September and are now only 24% above the pre-pandemic serious delinquency rate

• Foreclosure starts fell 9% from August to 18,400 – 53% below pre-pandemic levels – with starts initiated on 3% of serious delinquencies, still less than half the rate of the years leading up to the pandemic

• Active foreclosure inventory held steady in the month at volumes that have remained subdued in early 2022 after the record lows of 2021 due to widespread moratoriums and forbearance protections

• Prepays (SMM) edged up 1.5% for the month, due to calendar-related effects, but are still down by 69% year-over-year as rising rates continue to put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.78% in September, down from 2.79% in August.

The percent of loans in the foreclosure process was unchanged in September at 0.35%, from 0.35% in August.

The number of delinquent properties, but not in foreclosure, is down 577,000 properties year-over-year, and the number of properties in the foreclosure process is up 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2022 | Aug 2022 | Sept 2021 | Sept 2020 | |

| Delinquent | 2.78% | 2.79% | 3.91% | 6.66% |

| In Foreclosure | 0.35% | 0.35% | 0.26% | 0.34% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,491,000 | 1,489,000 | 2,068,000 | 3,542,000 |

| Number of properties in foreclosure pre-sale inventory: | 185,000 | 185,000 | 135,000 | 181,000 |

| Total Properties | 1,677,000 | 1,674,000 | 2,203,000 | 3,722,000 |

Thursday, October 20, 2022

Hotels: Occupancy Rate Down 2.7% Compared to Same Week in 2019

by Calculated Risk on 10/20/2022 04:24:00 PM

U.S. hotel performance increased from the previous week and produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 9-15, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 70.3% (-2.7%)

• Average daily rate (ADR): $157.52 (+15.8%)

• Revenue per available room (RevPAR): $110.78 (+12.8%)

Among the Top 25 Markets, Tampa reported the largest increases over 2019 in each of the key performance metrics: occupancy (+17.1% to 80.6%), ADR (+34.6% to $159.80) and RevPAR (+57.7% to $128.85). Tampa has been one of the markets in Florida that have seen a performance lifted associated with post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Realtor.com Reports Weekly Active Inventory Up 34% Year-over-year; New Listings Down 15%

by Calculated Risk on 10/20/2022 01:35:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 15, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 34% above one year ago. ... This week’s big jump in the active inventory trend (from 31% last week to 34% this week), even as new listings remain low, suggests that buyers are likely being squeezed by the renewed advance of mortgage rates which were very near 7% last week and are likely to top that mark this week.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 15% from one year ago. This week marks the fifteenth straight week of year over year declines in the number of new listings coming up for sale. Seasonally, fewer homeowners contemplate a home sale as the temperature cools and the holidays approach. Still, the consistent declines relative to one year ago signal dwindling enthusiasm on the part of potential sellers.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

More Analysis on September Existing Home Sales

by Calculated Risk on 10/20/2022 10:39:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.71 million SAAR in September

Excerpt:

The second graph shows existing home sales by month for 2021 and 2022.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Sales declined 23.8% year-over-year compared to September 2021. This was the thirteen consecutive month with sales down year-over-year.

...

Existing home sales are being impacted by higher mortgage rates. Rates have increased sharply in October, and that will impact closed sales in November and December - so I expect further declines in sales later this year.

NAR: Existing-Home Sales Decreased to 4.71 million SAAR in September

by Calculated Risk on 10/20/2022 10:10:00 AM

From the NAR: Existing-Home Sales Decreased 1.5% in September

Existing-home sales descended in September, the eighth month in a row of declines, according to the National Association of REALTORS®. Three out of the four major U.S. regions notched month-over-month sales contractions, while the West held steady. On a year-over-year basis, sales dropped in all regions.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, retracted 1.5% from August to a seasonally adjusted annual rate of 4.71 million in September. Year-over-year, sales waned by 23.8% (down from 6.18 million in September 2021).

...

Total housing inventory registered at the end of September was 1.25 million units, which was down 2.3% from August and 0.8% from the previous year. Unsold inventory sits at a 3.2-month supply at the current sales pace – unchanged from August and up from 2.4 months in September 2021.

emphasis added

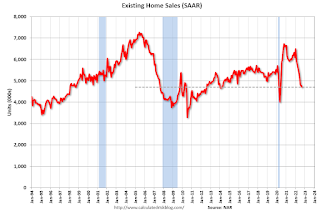

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (4.71 million SAAR) were down 1.5% from the previous month and were 23.8% below the September 2021 sales rate.

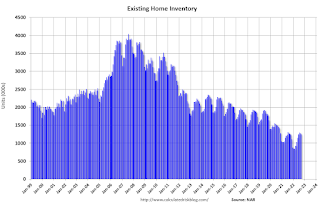

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.25 million in September from 1.28 million in August.

According to the NAR, inventory decreased to 1.25 million in September from 1.28 million in August.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was essentially unchanged year-over-year (blue) in September compared to September 2021.

Inventory was essentially unchanged year-over-year (blue) in September compared to September 2021. Months of supply (red) was unchanged at 3.2 months in September from 3.2 months in August.

This was close to the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims decrease to 214,000

by Calculated Risk on 10/20/2022 08:33:00 AM

The DOL reported:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 228,000 to 226,000. The 4-week moving average was 212,250, an increase of 1,250 from the previous week's revised average. The previous week's average was revised down by 500 from 211,500 to 211,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,250.

The previous week was revised down.

Weekly claims were lower than the consensus forecast.

Wednesday, October 19, 2022

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 10/19/2022 08:40:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 232 thousand from 228 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of -4.5, up from -9.9.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 4.69 million SAAR, down from 4.80 million in August. Housing economist Tom Lawler expects the NAR to report sales of 4.82 million SAAR.