by Calculated Risk on 10/24/2022 08:15:00 AM

Monday, October 24, 2022

Housing October 24th Weekly Update: Inventory Increased, New High for 2022

Click on graph for larger image.

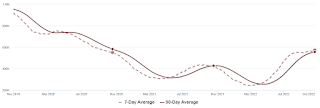

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 38.4%).

Sunday, October 23, 2022

Sunday Night Futures

by Calculated Risk on 10/23/2022 06:40:00 PM

Weekend:

• Schedule for Week of October 23, 2022

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 38 and DOW futures are up 244 (fair value).

Oil prices were down over the last week with WTI futures at $85.05 per barrel and Brent at $93.50 per barrel. A year ago, WTI was at $85, and Brent was at $85 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.76 per gallon. A year ago, prices were at $3.35 per gallon, so gasoline prices are up $0.41 per gallon year-over-year.

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 10/23/2022 10:38:00 AM

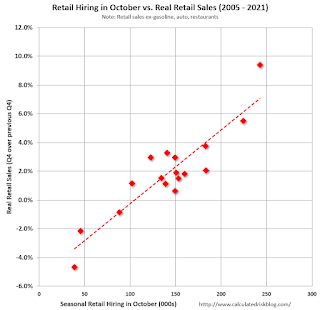

Every year I track seasonal retail hiring for hints about holiday retail sales. At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

Here is a graph of retail hiring for previous years based on the BLS employment report:

This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired about 700 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 224 thousand seasonal workers last October.

Note that in the early '90s, retailers started hiring seasonal workers earlier - and the trend towards hiring earlier has continued.

The following scatter graph is for the years 2005 through 2021 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

NOTE: The dot in the upper right - with real Retail sales up almost 10% YoY is for 2020 - when retail sales soared due to the pandemic spending on goods (service spending was soft).

Saturday, October 22, 2022

Real Estate Newsletter Articles this Week: Record Number of Housing Units Under Construction

by Calculated Risk on 10/22/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.71 million SAAR in September

• September Housing Starts: Record Number of Housing Units Under Construction

• Monthly Mortgage Payments Up Record Year-over-year

• 3rd Look at Local Housing Markets in September, California Sales off 30% YoY

• Lawler: Early Read on Existing Home Sales in September; CAR Predicts Home Prices to Decline 8.8% in 2023!

• Some "Good News" for Homebuilders

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 23, 2022

by Calculated Risk on 10/22/2022 08:11:00 AM

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Other key indicators include Personal Income and Outlays for September and Case-Shiller house prices for August.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

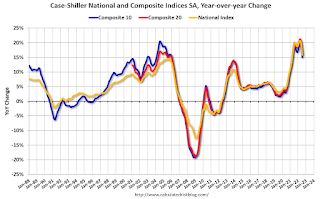

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 16.1% year-over-year.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 16.1% year-over-year.This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 590 thousand SAAR, down from 685 thousand in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 214 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2022 (advance estimate). The consensus is that real GDP increased 2.4% annualized in Q3, up from -0.6% in Q2.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 5.2% YoY.

10:00 AM: Pending Home Sales Index for September. The consensus is 5.0% decrease in the index.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 59.8.

Friday, October 21, 2022

COVID Oct 21, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 10/21/2022 09:11:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

Weekly deaths bottomed in July 2021 at 1,666.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 260,808 | 265,175 | ≤35,0001 | |

| Hospitalized2🚩 | 21,062 | 19,625 | ≤3,0001 | |

| Deaths per Week2 | 2,566 | 2,582 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Total Housing Completions Will Increase About 6% in 2022

by Calculated Risk on 10/21/2022 02:56:00 PM

Even as housing starts slow, completions will increase in 2022 compared to 2021.

This graph shows total housing completions and placements since 1968 with an estimate for 2022. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

Click on graph for larger image.

Click on graph for larger image.My current estimate is total completions (single family, multi-family, manufactured homes) will increase about 6% in 2022 to over 1.5 million. This will be close to the same level of completions as in 2007.

This is an update to an August article in the Calculated Risk Real Estate Newsletter: Update: Housing Completions will Increase Sharply in Late 2022 and Early 2023

Q3 GDP Tracking: In 2% Range

by Calculated Risk on 10/21/2022 10:06:00 AM

The advance estimate for Q3 GDP will be released next Thursday and the consensus is that real GDP increased 2.4%, on a seasonally adjusted annual rate basis.

From BofA:

The smaller-than-expected decline in existing home sales lifted our 3Q US GDP tracker from 2.0% q/q saar to 2.1%. [October 20th estimate]From Goldman:

emphasis added

Following this morning’s data, we left our Q3 GDP tracking estimate unchanged at +2.4% (qoq ar). [October 20th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.9 percent on October 19, up from 2.8 percent on October 14. After recent releases from the Federal Reserve Board of Governors and the US Census Bureau, the nowcast of third-quarter real gross private domestic investment growth increased from -3.6 percent to -3.3 percent. [October 19th estimate]

Black Knight: Mortgage Delinquency Rate decreased in September

by Calculated Risk on 10/21/2022 08:11:00 AM

From Black Knight: Black Knight: September Prepayments at More Than 20-Year Low on Spiking Interest Rates; Foreclosure Starts Fall 9% from August, Remain 53% Below Pre-Pandemic Levels

• Prepayment activity dropped -14.9% to a single-month mortality (SMM) rate of 0.57% in September – below the recent record of 0.59% set in January 2019 – to the lowest level since November 2000According to Black Knight's First Look report, the percent of loans delinquent decreased 0.2% in September compared to August and decreased 29% year-over-year.

• The national delinquency rate inched down -0.2% from August to 2.78%, just 3 basis points above the record low set in May 2022, with the number of past-due mortgages holding relatively steady across the board

• The number of borrowers a single payment past due rose by 1%, while 90-day delinquencies fell -1.5 % in September and are now only 24% above the pre-pandemic serious delinquency rate

• Foreclosure starts fell 9% from August to 18,400 – 53% below pre-pandemic levels – with starts initiated on 3% of serious delinquencies, still less than half the rate of the years leading up to the pandemic

• Active foreclosure inventory held steady in the month at volumes that have remained subdued in early 2022 after the record lows of 2021 due to widespread moratoriums and forbearance protections

• Prepays (SMM) edged up 1.5% for the month, due to calendar-related effects, but are still down by 69% year-over-year as rising rates continue to put downward pressure on both purchase and refinance lending

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.78% in September, down from 2.79% in August.

The percent of loans in the foreclosure process was unchanged in September at 0.35%, from 0.35% in August.

The number of delinquent properties, but not in foreclosure, is down 577,000 properties year-over-year, and the number of properties in the foreclosure process is up 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2022 | Aug 2022 | Sept 2021 | Sept 2020 | |

| Delinquent | 2.78% | 2.79% | 3.91% | 6.66% |

| In Foreclosure | 0.35% | 0.35% | 0.26% | 0.34% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,491,000 | 1,489,000 | 2,068,000 | 3,542,000 |

| Number of properties in foreclosure pre-sale inventory: | 185,000 | 185,000 | 135,000 | 181,000 |

| Total Properties | 1,677,000 | 1,674,000 | 2,203,000 | 3,722,000 |

Thursday, October 20, 2022

Hotels: Occupancy Rate Down 2.7% Compared to Same Week in 2019

by Calculated Risk on 10/20/2022 04:24:00 PM

U.S. hotel performance increased from the previous week and produced mixed comparisons with 2019, according to STR‘s latest data through Oct. 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 9-15, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 70.3% (-2.7%)

• Average daily rate (ADR): $157.52 (+15.8%)

• Revenue per available room (RevPAR): $110.78 (+12.8%)

Among the Top 25 Markets, Tampa reported the largest increases over 2019 in each of the key performance metrics: occupancy (+17.1% to 80.6%), ADR (+34.6% to $159.80) and RevPAR (+57.7% to $128.85). Tampa has been one of the markets in Florida that have seen a performance lifted associated with post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).