by Calculated Risk on 10/25/2022 04:42:00 PM

Tuesday, October 25, 2022

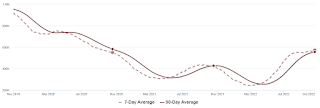

Freddie Mac: Mortgage Serious Delinquency Rate decreased in September

Freddie Mac reported that the Single-Family serious delinquency rate in September was 0.67%, down from 0.70% August. Freddie's rate is down year-over-year from 1.46% in September 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

Lawler: Update on the Household “Conundrum”

by Calculated Risk on 10/25/2022 02:25:00 PM

Today, in the Real Estate Newsletter: Lawler: Update on the Household “Conundrum”

Excerpt:

This is from housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The pandemic wreaked havoc on some of the government surveys designed to measure the number of and characteristics of US households (though there were measurement issues before the pandemic), making it difficult for analysts how much of the extraordinary strength in the housing market during 2021 and early 2022 was related to “demographics” as opposed to behavioral and preference changes. (Here is the November 2021 piece on this issue). Nevertheless, it may still be useful to see what these reports are showing.

...

What is striking about the estimated household gain is that it is significantly above – in fact, about double -- what one would have projected if one had assumed that so-called “headship rates” in each age group (the number of householders in an age group divided by the total population of that age group) had remained the same over this period. Moreover, headship rate increases were concentrated in the 15–34-year-old categories.

If in fact over the 12-month period ending March of this year the number of households increased by almost two million, then household growth significantly outpaced housing production, as total housing completions plus manufactured housing shipments totaled only about 1.44 million.

In terms of household growth, there are several reasons to expect that household growth has slowed sharply since the beginning of this year ...

...

If in fact this dynamic shift between household growth and housing production is taking place, then it, combined with (1) the unprecedented increase in housing prices over a 2-year period from mid-2020 to mid-2022, and (2) the unprecedented surge in mortgage rates this year, would suggest that a non-trivial decline in home prices from the middle of this year to at least the middle of next year would be a logical “base case.” This shift, combined with (1) the unprecedented increase in rents from late 2020 to the middle of this year and (2) the significant increase in rental units coming to market over the next year, suggest not only that rent growth should soon decelerate sharply (in fact, some indicators suggest that it already has), but that an actual decline in rents next year would be a reasonable base case.

Comments on August Case-Shiller and FHFA House Prices

by Calculated Risk on 10/25/2022 10:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Continued to Decelerate" to 13.0% year-over-year increase in August

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for August were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for “August” is a 3-month average of June, July and August closing prices. June closing prices include some contracts signed in April, so there is a significant lag to this data.

The MoM decrease in Case-Shiller was at -0.86% seasonally adjusted. This was the second consecutive MoM decrease, and the largest MoM since February 2010. Since this includes closings in June and July, this suggests prices fell sharply for August closings.

On a seasonally adjusted basis, prices declined in all of the Case-Shiller cities on a month-to-month basis. The largest monthly declines seasonally adjusted were in San Francisco (-3.7%), Seattle (-2.9%), and San Diego (-2.5%). San Francisco has fallen 8.2% from the peak in May 2022.

...

The August Case-Shiller report is mostly for contracts signed in the April through July period when 30-year mortgage rates were in the low-to-mid 5% range. The September report will mostly be for contracts signed in the May through August period - when rates were also in the low-to-mid 5% range.

The impact from higher rates in September and October will not show up for several more months.

Case-Shiller: National House Price Index "Continued to Decelerate" to 13.0% year-over-year increase in August

by Calculated Risk on 10/25/2022 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Continued to Decelerate in August

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 13.0% annual gain in August, down from 15.6% in the previous month. The 10- City Composite annual increase came in at 12.1%, down from 14.9% in the previous month. The 20- City Composite posted a 13.1% year-over-year gain, down from 16.0% in the previous month.

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in August. Miami led the way with a 28.6% year-over-year price increase, followed by Tampa in second with a 28.0% increase, and Charlotte in third with a 21.3% increase. All 20 cities reported lower price increases in the year ending August 2022 versus the year ending July 2022.

...

Before seasonal adjustment, the U.S. National Index posted a -1.1% month-over-month decrease in August, while the 10-City and 20-City Composites both posted decreases of -1.6%.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.9%, and the 10-City and 20-City Composites both posted decreases of -1.3%.

In August, all 20 cities reported declines before and after seasonal adjustments.

“The forceful deceleration in U.S. housing prices that we noted a month ago continued in our report for August 2022,” says Craig J. Lazzara, Managing Director at S&P DJI. “For example, the National Composite Index rose by 13.0% for the 12 months ended in August, down from its 15.6% year-over-year growth in July. The -2.6% difference between those two monthly rates of change is the largest deceleration in the history of the index (with July’s deceleration now ranking as the second largest). We see similar patterns in our 10-City Composite (up 12.1% in August vs. 14.9% in July) and our 20-City Composite (up 13.1% in August vs. 16.0% in July). Further, price gains decelerated in every one of our 20 cities. These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.

“Month-over-month comparisons are consistent with these observations. All three composites declined in July, as did prices in every one of our 20 cities. On a month-over-month basis, the biggest declines occurred on the west coast, with San Francisco (-4.3%), Seattle (-3.9%), and San Diego (-2.8%) falling the most.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is down 1.3% in August (SA).

The Composite 20 index is down 1.3% (SA) in August.

The National index is 64% above the bubble peak (SA), and down 0.9% (SA) in August. The National index is up 121% from the post-bubble low set in February 2012 (SA).

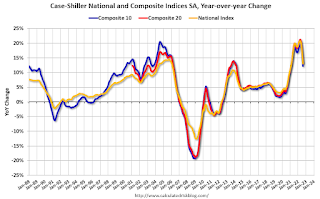

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 12.1% year-over-year. The Composite 20 SA is up 13.1% year-over-year.

The National index SA is up 13.0% year-over-year.

Price increases were lower than expectations. I'll have more later.

Monday, October 24, 2022

Tuesday: Case-Shiller and FHFA House Prices, Richmond Fed Mfg

by Calculated Risk on 10/24/2022 08:54:00 PM

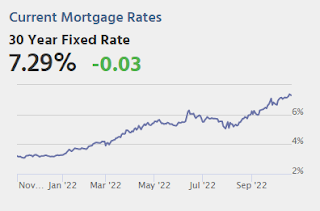

Now here's a rare thing! Mortgage rates managed to move lower, on average, for the 2nd consecutive business day on Monday. That hasn't happened for roughly 3 weeks, and you'd need to go back another 3 weeks to see the previous example. ... [30 year fixed 7.29%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 16.1% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for October.

October Vehicle Sales Forecast: "Signs of Life"

by Calculated Risk on 10/24/2022 01:54:00 PM

From WardsAuto: October U.S. Light-Vehicle Sales Show Signs of Life (pay content). Brief excerpt:

"The fourth-quarter SAAR is pegged at 14.2 million units, an improvement on Q2’s 13.3 million and Q3’s 13.4 million, but also meaning November-December results will weaken from October, with the primary reason being stiffer economic headwinds expected. Still, inventory will continue rising through the end of November, creating upside to the outlook"

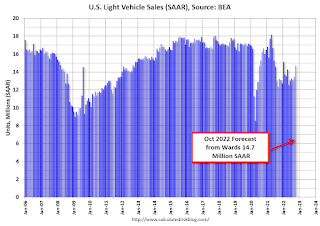

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

The Wards forecast of 14.7 million SAAR, would be up 9% from last month, and up 11% from a year ago (sales weakened in the second half of 2021, due to supply chain issues).

Final Look at Local Housing Markets in September

by Calculated Risk on 10/24/2022 11:36:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in September

A brief excerpt:

The big story for September existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down YoY in September as many potential sellers are locked into their current home (low mortgage rate).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in September. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I update these tables throughout the month as additional data is released.

Important: Closed sales in September were mostly for contracts signed in July and August when 30-year mortgage rates averaged about 5.3%. Rates increased to around 6% in September and that will impact closed sales in October and November. In October 30-year mortgage rates have jumped to over 7%, negatively impacting closed sales in November and December.

...

And a table of September sales. In September, sales were down 22.1% YoY Not Seasonally Adjusted (NSA) for these markets. The NAR reported sales were down 21.6% NSA YoY.

Sales in some of the hottest markets are down around 30% YoY (all of California was down 30%), whereas in other markets, sales are only down in the teens YoY.

More local data coming in November for activity in October! We should expect even larger YoY declines in the next few months due to the recent increase in mortgage rates.

Four High Frequency Indicators for the Economy

by Calculated Risk on 10/24/2022 09:23:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

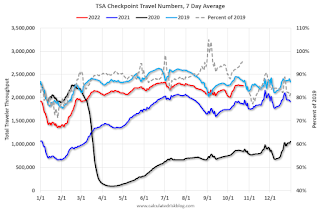

The TSA is providing daily travel numbers.

This data is as of October 23rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 3.9% from the same day in 2019 (96.1% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $96 million last week, down about 42% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Oct 15th. The occupancy rate was down 2.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of October 14th, gasoline supplied was down 7.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Housing October 24th Weekly Update: Inventory Increased, New High for 2022

by Calculated Risk on 10/24/2022 08:15:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 38.4%).

Sunday, October 23, 2022

Sunday Night Futures

by Calculated Risk on 10/23/2022 06:40:00 PM

Weekend:

• Schedule for Week of October 23, 2022

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 38 and DOW futures are up 244 (fair value).

Oil prices were down over the last week with WTI futures at $85.05 per barrel and Brent at $93.50 per barrel. A year ago, WTI was at $85, and Brent was at $85 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.76 per gallon. A year ago, prices were at $3.35 per gallon, so gasoline prices are up $0.41 per gallon year-over-year.