by Calculated Risk on 10/29/2022 02:11:00 PM

Saturday, October 29, 2022

Real Estate Newsletter Articles this Week: National House Price Index "Continued to Decelerate"

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Continued to Decelerate" to 13.0% year-over-year increase in August

• New Home Sales Decreased in September; Completed Inventory Increased

• Lawler: Update on the Household “Conundrum”

• Inflation Adjusted House Prices 2.3% Below Peak

• Final Look at Local Housing Markets in September

• Lawler: Selected Operating Results, Large Home Builders

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 30, 2022

by Calculated Risk on 10/29/2022 08:11:00 AM

Boo!

The key report this week is the October employment report on Friday.

Other key indicators include the October ISM manufacturing and services indexes, October vehicle sales, and the September trade deficit.

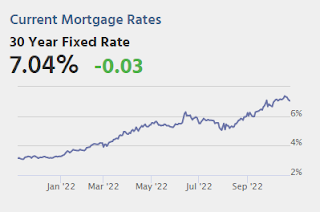

The FOMC meets this week and is expected to raise rates 75 bp.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 47.2, up from 45.7 in September.

10:00 AM: The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

8:00 AM ET: Corelogic House Price index for September.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.9, down from 50.9.

10:00 AM: Construction Spending for September. The consensus is for 0.5% decrease in spending.

All day: Light vehicle sales for October.

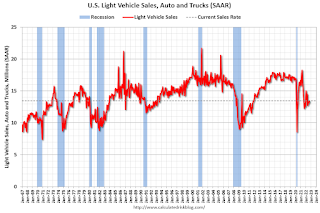

All day: Light vehicle sales for October.The consensus is for sales of 14.3 million SAAR, up from 13.5 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 200,000 jobs added, down from 208,000 in September.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise rates 75bp at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 222 thousand from 217 thousand last week.

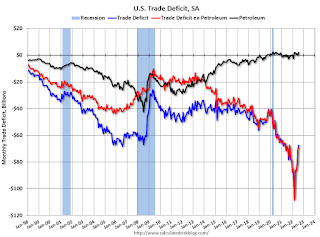

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $72.1 billion in September, from $67.4 billion in August.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $72.1 billion in September, from $67.4 billion in August.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for October. The consensus is for a decrease to 55.5 from 56.7.

8:30 AM: Employment Report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.There were 263,000 jobs added in September, and the unemployment rate was at 3.5%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, all of the jobs have returned.

Friday, October 28, 2022

COVID Oct 28, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 10/28/2022 09:12:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

Weekly deaths bottomed in July 2021 at 1,666.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 265,893 | 261,315 | ≤35,0001 | |

| Hospitalized2 | 20,938 | 21,078 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,649 | 2,591 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Down 0.5% Compared to Same Week in 2019

by Calculated Risk on 10/28/2022 05:28:00 PM

U.S. hotel performance decreased slightly from the previous week but showed improved comparisons with 2019, according to STR‘s latest data through Oct. 22.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 16-22, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 69.9% (-0.5%)

• Average daily rate (ADR): $157.43 (+16.7%)

• Revenue per available room (RevPAR): $110.11 (+16.1%)

Among the Top 25 Markets, Tampa reported the largest increases over 2019 in occupancy (+7.4% to 75.9%) and RevPAR (+39.2% to $117.28). Tampa has been one of the markets in Florida that have seen a performance lift associated with post-Hurricane Ian demand. ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Lawler: Selected Operating Results, Large Home Builders; Cancellation Rates Increasing Sharply

by Calculated Risk on 10/28/2022 01:42:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Selected Operating Results, Large Home Builders

Excerpt:

Below are some selected operating results from some large home builders for last quarter. Note that the sales cancellations number are derived from reported sales cancellations rates and may be off by a bit due to rounding.

Deliveries and Average Sales Price

...

One of the more striking statistics on orders and cancellations was from MDC Holdings, where gross orders totaled 1,569 while sales cancellations totaled 1,270!!!! And in its “Mountain” division (Colorado, Idaho, and Utah), net orders were NEGATIVE 3 homes!

NMHC: Survey shows "Apartment Market Softens" in October

by Calculated Risk on 10/28/2022 11:42:00 AM

From the National Multifamily Housing Council (NMHC): Apartment Market Softens, Sales Put on Hold Amidst Rising Rates and Economic Uncertainty

Rising interest rates caused by the Federal Reserve’s ongoing efforts to combat inflation continue to impact the multifamily business. However, it is worth noting that the overall apartment market has begun to revert to pre-pandemic trends as rent growth is decreasing.

Apartment market conditions weakened in the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions for October 2022, as the Market Tightness (20), Sales Volume (6), Equity Financing (13), and Debt Financing (5) indices all came in well below the breakeven level (50).

“The Fed’s continued interest rate hikes have resulted in higher costs of both debt and equity and a higher degree of economic uncertainty," noted NMHC’s Chief Economist Mark Obrinsky. “This has caused the market for apartment transactions to come to a virtual standstill, as buyers seek a higher rate of return that sellers are unwilling to accommodate via lower prices.”

“The physical apartment market is also starting to normalize after six consecutive quarters of tightening conditions, with a majority of survey respondents reporting higher vacancy and lower rent growth compared to the three months prior.”

...

• Market Tightness Index came in at 20 this quarter — well below the breakeven level (50) — indicating looser market conditions for the first time in six quarters. The majority of respondents (66%) reported markets to be looser than three months ago, while only 5% thought markets have become tighter. The remaining 29% of respondents thought that market conditions were unchanged over the past three months, a considerable decline from the 56% of respondents who said the same in July.

...

It is important to remember that the index does not measure the magnitude of change but, rather, the degree to which respondents agree on the direction of change. For instance, an index value of 0 in market tightness would indicate that all respondents believe market conditions have become looser, but this does not tell us how much looser markets have become.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter.

NAR: Pending Home Sales Decreased 10.2% in September, Year-over-year Down 31%

by Calculated Risk on 10/28/2022 10:03:00 AM

From the NAR: Pending Home Sales Waned 10.2% in September

Pending home sales trailed off for the fourth consecutive month in September, according to the National Association of REALTORS®. All four major regions recorded month-over-month and year-over-year declines in transactions.This was a much larger decline than expected for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slumped 10.2% to 79.5 in September. Year-over-year, pending transactions slid by 31.0%. An index of 100 is equal to the level of contract activity in 2001.

"Persistent inflation has proven quite harmful to the housing market," said NAR Chief Economist Lawrence Yun. "The Federal Reserve has had to drastically raise interest rates to quell inflation, which has resulted in far fewer buyers and even fewer sellers."

...

The Northeast PHSI descended 16.2% from last month to 64.2, a decline of 30.1% from September 2021. The Midwest index retracted 8.8% to 80.7 in September, down 26.7% from one year ago.

The South PHSI faded 8.1% to 97.0 in September, a drop of 30.0% from the prior year. The West index slipped by 11.7% in September to 62.7, down 38.7% from September 2021.

emphasis added

Personal Income increased 0.4% in September; Spending increased 0.6%

by Calculated Risk on 10/28/2022 08:38:00 AM

The BEA released the Personal Income and Outlays report for June:

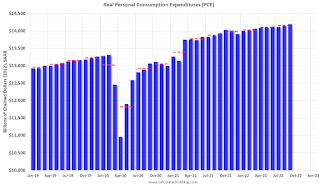

Personal income increased $78.9 billion (0.4 percent) in September, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $71.3 billion (0.4 percent) and personal consumption expenditures (PCE) increased $113.0 billion (0.6 percent).The September PCE price index increased 6.2 percent year-over-year (YoY), unchanged 6.2 percent YoY in August, and down from 7.0 percent in June.

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.5 percent. Real DPI increased less than 0.1 percent in September and Real PCE increased 0.3 percent; goods increased 0.4 percent and services increased 0.3 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through September 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and the increase in PCE were both above expectations.

Thursday, October 27, 2022

Friday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 10/27/2022 08:59:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 5.2% YoY.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 5.0% decrease in the index.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 59.8.

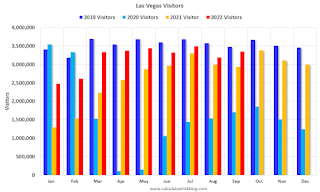

Las Vegas September 2022: Visitor Traffic Down Just 3.5% Compared to 2019

by Calculated Risk on 10/27/2022 02:25:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: August 2022 Las Vegas Visitor Statistics

September saw strong visitation of 3.35M visitors, just ‐3.5% behind September 2019, with notable weekend holidays and events from Labor Day to the Life Is Beautiful festival, the Canelo/GGG fight, Mexican Independence Day, the Raiders/Cardinals home game, Bad Bunny World's Hottest Tour and the iHeartRadio Music festival.

Overall hotel occupancy reached 83.1%, +10.1 pts ahead of last September but down ‐5.2 pts vs. September 2019. Weekend occupancy reached 92.1% (up +3.0 pts YoY but down ‐3.5 pts vs. September 2019), while Midweek occupancy reached 78.6% (up +12.5 pts YoY but down ‐6.5 pts vs. September 2019).

Strong weekend demand supported by major events translated to record monthly ADR levels as September ADR approached $187, +20.1% YoY and +36.5% ahead of September 2019 while RevPAR neared $156 for the month, +36.8% YoY and +28.5% over September 2019

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 3.5% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.