by Calculated Risk on 11/03/2022 09:09:00 PM

Thursday, November 03, 2022

Friday: Employment Report

Goldman October Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.

Goldman October Payrolls Preview

by Calculated Risk on 11/03/2022 05:01:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 225k in October (mom sa) ... Labor demand remains elevated despite declining this year, and Big Data indicators generally point to above-consensus payroll gains. ... We estimate the unemployment rate was unchanged at 3.5% in Octobe ... We estimate average hourly earnings rose 0.35% month-over-month and 4.7% year-on-year.

emphasis added

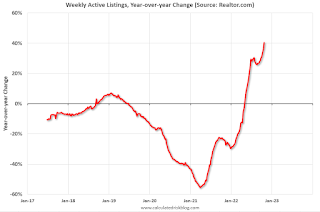

Realtor.com Reports Weekly Active Inventory Up 40% Year-over-year; New Listings Down 13%

by Calculated Risk on 11/03/2022 03:35:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 29, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 40% above one year ago. This is the third week of a more notable step up in inventory gains after rough stability since July.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 13% from one year ago. This marks the seventeenth week of year over year declines in the number of new listings coming up for sale.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

October Employment Preview

by Calculated Risk on 11/03/2022 12:07:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for 200,000 jobs added, and for the unemployment rate to increase to 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, as of September there are 514 thousand more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of August 2022, all of the jobs have returned.

This doesn't include the preliminary benchmark revision that showed there were 462 thousand more jobs than originally reported in March 2022.

• ADP Report: The ADP employment report showed 239,000 private sector jobs were added in October. This is the third release of ADP's new methodology, and this suggests job gains somewhat above consensus expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in October to 50.0%, down from 48.7% last month. This would suggest 20,000 jobs lost in manufacturing.

The ISM® services employment index decreased in October to 49.1%, down from 53.0% last month. This would suggest service employment increased 40,000 in October.

Combined, the ISM surveys suggest 20,000 jobs added in October (way below the consensus forecast).

• Unemployment Claims: The weekly claims report showed a slight increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 209,000 in September to 214,000 in October. This would usually suggest above the same number of layoffs in October as in September. In general, weekly claims were lower than expectations in October.

ISM® Services Index Decreased to 54.4% in October

by Calculated Risk on 11/03/2022 10:14:00 AM

(Posted with permission). The ISM® Services index was at 54.4%, down from 56.7% last month. The employment index decreased to 49.1%, from 53.0%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 54.4% October 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in October for the 29th month in a row — with the Services PMI® registering 54.4 percent — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.This was lower than expected and the employment index was below 50.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In October, the Services PMI® registered 54.4 percent, 2.3 percentage points lower than September’s reading of 56.7 percent. This is the lowest reading since May 2020, when the index registered 45.2 percent. The Business Activity Index registered 55.7 percent, a decrease of 3.4 percentage points compared to the reading of 59.1 percent in September. The New Orders Index figure of 56.5 percent is 4.1 percentage points lower than the September reading of 60.6 percent.

emphasis added

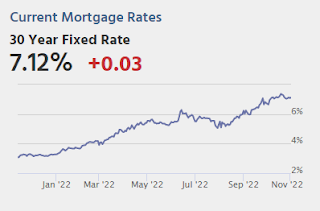

“Interest rates have put the brakes on the market.”

by Calculated Risk on 11/03/2022 09:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: “Interest rates have put the brakes on the market.”

A brief excerpt:

Here are some interesting real estate agent comments from around the country courtesy of Eric Finnigan, VP at John Burns Real Estate Consulting:There many more comments in the article. You can subscribe at https://calculatedrisk.substack.com/

#Sarasota, FL: “I've had numerous buyers looking but the prices are much higher than they want to spend. Many pulled back waiting for the market to go down.” ...

#NewYork: “Open house attendance is weaker than usual, and sales take longer.”

#OrangeCounty, CA: “Interest rates have put the brakes on the market.”

And here is some info on bidding wars from the survey:

If you are an agent, you can participate in this monthly survey … Burns Real Estate Agent Survey

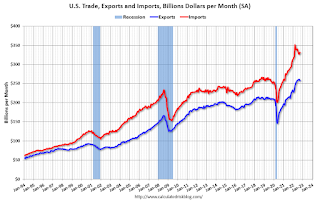

Trade Deficit increased to $73.3 Billion in September

by Calculated Risk on 11/03/2022 08:46:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $73.3 billion in September, up $7.6 billion from $65.7 billion in August, revised.

September exports were $258.0 billion, $2.8 billion less than August exports. September imports were $331.3 billion, $4.8 billion more than August imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in September.

Exports are up 22% year-over-year; imports are up 14% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and have now bounced back.

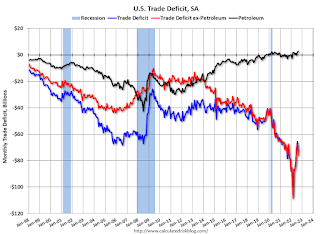

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are slightly positive.

The trade deficit with China increased to $37.3 billion in September, from $36.4 billion a year ago.

Weekly Initial Unemployment Claims at 217,000

by Calculated Risk on 11/03/2022 08:33:00 AM

The DOL reported:

In the week ending October 29, the advance figure for seasonally adjusted initial claims was 217,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 217,000 to 218,000. The 4-week moving average was 218,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 219,000 to 219,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, November 02, 2022

Thursday: Unemployment Claims, Trade Deficit, ISM Services

by Calculated Risk on 11/02/2022 08:29:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 222 thousand from 217 thousand last week.

• Also at 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $72.1 billion in September, from $67.4 billion in August.

• At 10:00 AM, the ISM Services Index for October. The consensus is for a decrease to 55.5 from 56.7.

Fed's Powell: "Ultimate level of interest rates will be higher than previously expected"

by Calculated Risk on 11/02/2022 04:28:00 PM

A quick note ... this was the key sentence from Fed Chair Powell's press conference: "the ultimate level of interest rates will be higher than previously expected".

Powell also said that "At some point it will be appropriate to slow the rate of increases", but he said that might be in December or in 2023.

Overall his comments were hawkish.