by Calculated Risk on 11/08/2022 08:53:00 AM

Tuesday, November 08, 2022

1st Look at Local Housing Markets in October

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in October

A brief excerpt:

This is the first look at local markets in October. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in October were mostly for contracts signed in August and September. Mortgage rates moved higher in September, and that impacted closed sales in October.

The further sharp increase in mortgage rates in October - with the 30-year mortgage over 7% - will impact closed sales in November and December.

...

In October, sales were down 38.0%. In September, these same markets were down 28.5% YoY Not Seasonally Adjusted (NSA).

Note that in October 2022, there were the same number of selling days as in October 2021, so the SA decline will be similar to the NSA decline. And this suggests another significant step down in sales!

Many more local markets to come!

Monday, November 07, 2022

Tuesday: Small Business Survey

by Calculated Risk on 11/07/2022 09:00:00 PM

CPI-watching is all the more interesting these days due to the extreme prevalence of one particular month-over-month reading. Core monthly inflation came in at 0.6% no fewer than 8 times since the start of the pandemic, and 5 of those have been in 2022. No other level has been even half as prevalent. In annualized term, 0.6% represents a 7.2% core inflation rate--well over the current 6.6% level. The 2 most recent reports both came in at 0.6%, making it even more of a line in the sand--one that can help us identify a turning point. ... [30 year fixed 7.25%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

Fed Survey: Banks reported Tighter Standards, Weaker Demand for Most Loan Types; Stronger Demand for HELOCs

by Calculated Risk on 11/07/2022 05:06:00 PM

From the Federal Reserve: The October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2022.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, lending standards tightened or remained basically unchanged across all categories of residential real estate (RRE) loans and demand weakened for all such loans. In addition, banks reported tighter standards and stronger demand for home equity lines of credit (HELOCs). Standards tightened for credit card loans and other consumer loans while standards for auto loans remained unchanged. Meanwhile, demand strengthened for credit card loans, was unchanged for other consumer loans, and weakened for auto loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined sharply.

Housing November 7th Weekly Update: Inventory Decreased Slightly Week-over-week

by Calculated Risk on 11/07/2022 12:09:00 PM

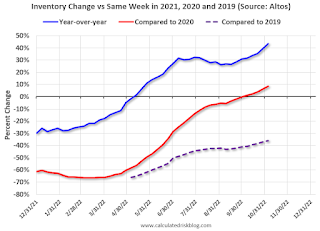

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 36.0%).

Black Knight Mortgage Monitor: Home Prices Declined in September; Down 2.6% since June

by Calculated Risk on 11/07/2022 10:33:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Declined in September; Down 2.6% since June

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 10.1% year-over-year but declined for the third straight month in September and is now 2.6% off the peak in June.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• Housing market watchers are split on whether we will see meaningful price declines in coming months – or even years – due to low affordability, or a more lateral correction moderated by historically low inventory

• September’s data brought fodder for both sides of the debate, with home prices slipping for a third consecutive month, but at 0.52%, less than half the monthly declines seen in July and August

• All in, prices have fallen 2.6% since June – the first 3-month decline since 30-year rates spiked to near 5% back in late 2018, and the worst 3-month stretch since early 2009.

Wholesale Used Car Prices Declined in October; Prices Down 10.6% Year-over-year

by Calculated Risk on 11/07/2022 09:12:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Smaller Decline in October

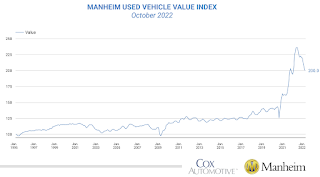

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.2% in October from September. The Manheim Used Vehicle Value Index declined to 200.0 and is now down 10.6% from a year ago. The non-adjusted price change in October was a decline of 2.1% compared to September, moving the unadjusted average price down 9.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Four High Frequency Indicators for the Economy

by Calculated Risk on 11/07/2022 08:32:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of November 6th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 7.7% below the same week in 2019 (92.2% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $91 million last week, down about 39% from the median for the week.

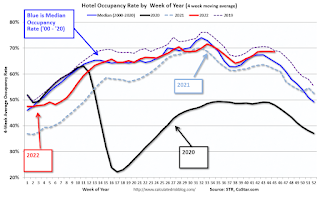

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Oct 29th. The occupancy rate was up 5.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of October 28th, gasoline supplied was down 11.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, November 06, 2022

Sunday Night Futures

by Calculated Risk on 11/06/2022 06:14:00 PM

Weekend:

• Schedule for Week of November 6, 2022

• Solid Holiday Retail Sales Forecasts

Monday:

• At 2:00 PM ET, Senior Loan Officer Opinion Survey on Bank Lending Practices for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 28 and DOW futures are down 208 (fair value).

Oil prices were up over the last week with WTI futures at $92.61 per barrel and Brent at $98.57 per barrel. A year ago, WTI was at $82, and Brent was at $83 - so WTI oil prices are up 12% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.78 per gallon. A year ago, prices were at $3.42 per gallon, so gasoline prices are up $0.36 per gallon year-over-year.

Solid Holiday Retail Sales Forecasts

by Calculated Risk on 11/06/2022 09:54:00 AM

Here are two holiday retail sales forecasts. One from the National Retail Federation (NRF), and another based on October seasonal retail hiring as described in Retail: October Seasonal Hiring vs. Holiday Retail Sales

First from the NRF: NRF Predicts Healthy Holiday Sales as Consumers Navigate Economic Headwinds

Holiday spending is expected to be healthy even with recent inflationary challenges, as the National Retail Federation today forecast that holiday retail sales during November and December will grow between 6% and 8% over 2021 to between $942.6 billion and $960.4 billion. Last year’s holiday sales grew 13.5% over 2020 and totaled $889.3 billion, shattering previous records. Holiday retail sales have averaged an increase of 4.9% over the past 10 years, with pandemic spending in recent years accounting for considerable gains.

emphasis added

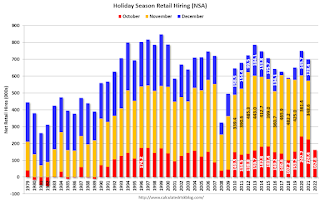

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the NRF showing the year-over-year change in retail sales in November and December (ex-automobile dealers, gasoline stations and restaurants). This is NOT seasonally adjusted, and just for November and December.

My approach below uses real retail sales for Q4 (October, November and December) adjusted with CPI.

This graph shows the historical net retail jobs added for October, November and December by year.

This graph shows the historical net retail jobs added for October, November and December by year.Retailers hired 163 thousand workers Not Seasonally Adjusted (NSA) net in October. This was down from the previous two years and suggests lower increase in real retail sales this holiday season than the previous two years -but still solid.

Note that in the early '90s, retailers started hiring seasonal workers earlier - and the trend towards hiring earlier has continued.

The following scatter graph is for the years 2005 through 2021 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.82 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants.

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.82 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants.NOTE: The dot in the upper right - with real Retail sales up almost 10% YoY is for 2020 - when retail sales soared due to the pandemic spending on goods (service spending was soft).

Saturday, November 05, 2022

Real Estate Newsletter Articles this Week: “Interest rates have put the brakes on the market.”

by Calculated Risk on 11/05/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• “Interest rates have put the brakes on the market.”

• First Look at 2023 Housing Forecasts

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2023?

• Year-over-year Pace of Rent Increases Continues to Slow

• Realtor.com Weekly Inventory Up 40% Year-over-year; Now Above Same Week in 2020

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/