by Calculated Risk on 11/10/2022 04:27:00 PM

Thursday, November 10, 2022

Realtor.com Reports Weekly Active Inventory Up 42% Year-over-year; New Listings Down 20%

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Nov 5, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 42% above one year ago. Inventory accelerated by a more modest amount this week, but it was still the fourth consecutive week of roughly 2+% inventory gains after a fair amount of stability since July. Inventory growth even in the face of fewer newly listed homes indicates how many buyers have retreated from the housing market rather than navigate higher costs stemming from higher purchase prices and higher mortgage rates.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 20% from one year ago. This marks the eighteenth week of year over year declines in homeowners listing their home for sale, a sign that homeowners are well aware of the market’s reset. This data suggests that many potential sellers may be joining buyers in “wait-and-see” mode.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Housing and Inflation

by Calculated Risk on 11/10/2022 02:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing and Inflation

A brief excerpt:

A few key points:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• The Fed has been raising rates to slow inflation. Since housing is a key transmission mechanism for Fed policy, the housing market has slowed dramatically as the Fed raised rates (and mortgage rates increased).

• The CPI report this morning contained some good news on inflation.

• The BLS reported “The index for shelter contributed over half of the monthly all items increase”.

• The BLS measure for shelter is seriously lagged and is likely behind the curve on the sharp slowdown in rents.

...

Both CPI and core CPI were below expectations, and the year-over-year change is declining. Bond yields fell sharply this morning, and the 30-year mortgage rate dropped significantly to 6.67% from 7.25% yesterday (average top tier scenarios with zero points).

...

My current view is inflation will ease quicker than the Fed currently expects.

MBA: "Mortgage Delinquencies Decrease to New Survey Low in the Third Quarter of 2022"

by Calculated Risk on 11/10/2022 11:33:00 AM

From the MBA: Mortgage Delinquencies Decrease to New Survey Low in the Third Quarter of 2022

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.45 percent of all loans outstanding at the end of the third quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 19 basis points from the second quarter of 2022 and down 143 basis points from one year ago.

“For the second quarter in a row, the mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979 – declining to 3.45 percent. Foreclosure starts and loans in the process of foreclosure also dropped in the third quarter to levels further below their historical averages,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The relatively small number of seriously delinquent homeowners are working with their mortgage servicers to find foreclosure alternatives, including loan workouts that allow for home retention.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3 to a record low.

From the MBA:

Compared to second-quarter 2022, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to 3.45 percent, the lowest level in the history of the survey dating back to 1979. By stage, the 30-day delinquency rate remained unchanged at 1.66 percent, the 60-day delinquency rate increased 4 basis points to 0.53 percent, and the 90-day delinquency bucket decreased 22 basis points to 1.27 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. For much of the last two years, foreclosure moratoria were in place, which kept these numbers artificially low. ... The percentage of loans in the foreclosure process at the end of the third quarter of 2022 was 0.56 percent, down 3 basis points from the second quarter of 2022, and 10 basis points higher than one year ago.

The percent of loans in the foreclosure process increased year-over-year in Q3 with the end of the foreclosure moratoriums.

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.4% in October

by Calculated Risk on 11/10/2022 11:18:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in October. The 16% trimmed-mean Consumer Price Index increased 0.4% in October. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details here: "Fuel oil and other fuels" increased at a 232% annualized rate in October.

Weekly Initial Unemployment Claims increase to 225,000

by Calculated Risk on 11/10/2022 08:38:00 AM

The DOL reported:

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 217,000 to 218,000. The 4-week moving average was 218,750, a decrease of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 218,750 to 219,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

BLS: CPI increased 0.4% in October; Core CPI increased 0.3%

by Calculated Risk on 11/10/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.7 percent before seasonal adjustment.Both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. The energy index increased 1.8 percent over the month as the gasoline index and the electricity index rose, but the natural gas index decreased. The food index increased 0.6 percent over the month with the food at home index rising 0.4 percent.

The index for all items less food and energy rose 0.3 percent in October, after rising 0.6 percent in September. The indexes for shelter, motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Indexes which declined in October included the used cars and trucks, medical care, apparel, and airline fares indexes.

The all items index increased 7.7 percent for the 12 months ending October, this was the smallest 12-month increase since the period ending January 2022. The all items less food and energy index rose 6.3 percent over the last 12 months. The energy index increased 17.6 percent for the 12 months ending October, and the food index increased 10.9 percent over the last year; all of these increases were smaller than for the period ending September.

emphasis added

Wednesday, November 09, 2022

Thursday: CPI, Unemployment Claims

by Calculated Risk on 11/09/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, The Consumer Price Index for October from the BLS. The consensus is for a 0.7% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.0% year-over-year and core CPI to be up 6.6% YoY.

• Also at 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 217 thousand last week.

Second Home Market: South Lake Tahoe in October

by Calculated Risk on 11/09/2022 01:25:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through October 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 4-fold from the record low set in February 2022, and up 37% year-over-year. Prices are up 2.6% YoY (and the YoY change has been trending down).

New Home Cancellations increased Sharply in Q3

by Calculated Risk on 11/09/2022 10:29:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Cancellations increased Sharply in Q3

A brief excerpt:

First, a few quotes from some homebuilders:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/"During most of the year, demand for our homes was strong. Beginning in June and continuing through today, we have seen a moderation in housing demand caused by significant increases in mortgage interest rates and general economic uncertainty.” [Donald R. Horton, Chairman of the Board, said] …The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the fourth quarter of fiscal 2022 was 32% compared to 19% in the prior year quarter. D.R. Horton

“In response to the significant shift in market conditions in 2022, we have slowed the pace of our housing starts, have increased sales incentives, and are taking additional pricing actions in many of our communities.” Pulte Group

New Orders decreased 15%, while the average sales price of New Orders increased 3% in the third quarter of 2022 compared to the third quarter of 2021. New Orders were negatively impacted in each of our reportable segments by the significant increase in mortgage interest rates during the quarter, which resulted in a decline in affordability and in turn, led to lower absorption rates and to an increase in the cancellation rate quarter over quarter. NVR

emphasis addedHere is a table of selected public builders and the currently reported cancellation rate (I’m still gathering data).

Disclaimer: the cancellation rates are from SEC filings only, and while deemed to be reliable is not guaranteed.

In general, cancellation rates doubled or tripled in the most recent quarter compared to 2021.

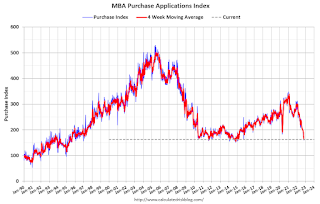

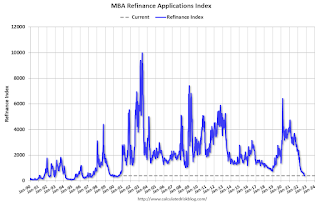

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/09/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 4, 2022.

... The Refinance Index decreased 4 percent from the previous week and was 87 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 41 percent lower than the same week one year ago.

“Mortgage rates edged higher last week following news that the Federal Reserve will continue raising short-term rates to combat high inflation. The 30-year fixed rate remained above 7 percent for the third consecutive week, with increases for most loan types,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications increased for the first time after six weeks of declines but remained close to 2015 lows, as homebuyers remained sidelined by higher rates and ongoing economic uncertainty. Refinances continued to fall, with the index hitting its lowest level since August 2000.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 7.14 percent from 7.06 percent, with points increasing to 0.77 from 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).