by Calculated Risk on 11/22/2022 08:50:00 PM

Tuesday, November 22, 2022

Wednesday: Unemployment Claims, Durable Goods, New Home Sales, FOMC Minutes

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 222 thousand last week.

• At 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

• At 10:00 AM, New Home Sales for October from the Census Bureau. The consensus is for 570 thousand SAAR, down from 603 thousand in September.

• At 2:00 PM, FOMC Minutes, Meeting of November 1-2, 2022

November Vehicle Sales Forecast: Down slightly from October; Up 11% Year-over-year

by Calculated Risk on 11/22/2022 02:58:00 PM

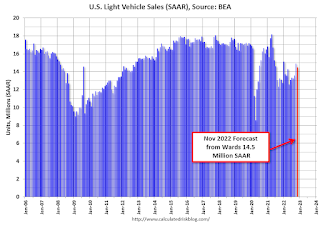

From WardsAuto: November U.S. Light-Vehicle Sales to Slow from Prior Month; Still Point to Stronger Q4 (pay content). Brief excerpt:

Although heavily laden with pickups, inventory will rise again in November, lifting the prospects that the year ends on a strong note by overcoming challenges including myriad economy-related headwinds, high prices, potential railroad labor strike and others.

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for November (Red).

The Wards forecast of 14.5 million SAAR, would be down 3% from last month, but up 11% from a year ago (sales weakened in the second half of 2021, due to supply chain issues).

Black Knight: Mortgage Delinquency Rate Increased in October, Impacted by Hurricane

by Calculated Risk on 11/22/2022 12:43:00 PM

From Black Knight: Black Knight’s First Look: Prepayment Activity Hit Record Low in October as Rates Topped 7%; Mortgage Delinquencies Up 4.5% in First Signs of Hurricane Ian Impact

• Prepayments fell 16.5% to a single-month mortality (SMM) rate of 0.48%, well below the previous record of 0.55% and the lowest recorded since at least 2000 when Black Knight began reporting the metricAccording to Black Knight's First Look report, the percent of loans delinquent increased 4.5% in October compared to September and decreased 22% year-over-year.

• The national delinquency rate rose 4.5% in October to 2.91% – up 12 basis points since September – driven by a sharp 9.4% rise in 30-day delinquencies

• Florida led the jump in new early delinquencies (+19K) – with the state delinquency rate rising 53 basis points to 3.42% -- giving an initial indication of Hurricane Ian impact

• Loans 60 days past due ticked up 2.9% nationally, while those 90 or more days delinquent saw continued – if modest – improvement, inching down another 1.5% in October

• October’s 19.6K foreclosure starts represented a 7% increase that partly reversed September’s decline, but are still 55% below pre-pandemic levels

• Foreclosure starts were initiated on 4% of existing serious delinquencies in October, up slightly from September but still less than half the rate seen in the years leading up to the pandemic

• Active foreclosure inventory held steady as volumes have remained subdued in 2022 due to still historically low foreclosure start levels

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.91% in October, down from 2.78% in September.

The percent of loans in the foreclosure process increased slightly in October at 0.35%, from 0.35% in September.

The number of delinquent properties, but not in foreclosure, is down 555,000 properties year-over-year, and the number of properties in the foreclosure process is up 48,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2022 | Sept 2022 | Oct 2021 | Oct 2020 | |

| Delinquent | 2.91% | 2.78% | 3.74% | 6.44% |

| In Foreclosure | 0.35% | 0.35% | 0.26% | 0.33% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,557,000 | 1,491,000 | 1,986,000 | 3,437,000 |

| Number of properties in foreclosure pre-sale inventory: | 186,000 | 185,000 | 138,000 | 178,000 |

| Total Properties | 1,743,000 | 1,677,000 | 2,125,000 | 3,616,000 |

Lawler: Likely "Dramatic shift" in Household Formation has "Major implications" for 2023

by Calculated Risk on 11/22/2022 09:17:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Likely "Dramatic shift" in Household Formation has "Major implications" for 2023

A brief excerpt:

Below is a chart showing the CPS/ASEC estimates of the % of 25-34 year olds living alone.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

According to CPS/ASEC estimates, the % of adults (18+) living alone jumped to 14.9% in March 2022 from 14.4% in March 2021, and the % of households with just one member climbed to 28.9% from 28.2%. Both “living alone” measures (share of population and share of households) were at the highest levels ever recorded by the CPS/ASEC. The jump in one-person households was the major reason why the average household size as measured by the CPS/ASEC plunged to 2.50 in March 2022 (the lowest ever recorded) from 2.54 in March 2021. (Unrounded the average household size fell by .0341). In terms of share of total households, the one-person share increased the most for young adults (up to 39 years) and for 65-74 year olds. ...

... there is strong reason to believe that household growth is no longer getting the “boost” from behavioral changes as that suggested from March 2021 to March 2021. If that turns out to be true, then household growth is or will return back to growth more consistent with underlying population changes by age group, a development that would imply household growth over the next year of about half that apparently experienced from early 2021 to early 2022. Such a dramatic shift has major implications for projections of rent growth and home price growth next year.

Monday, November 21, 2022

Tuesday: Richmond Fed Mfg

by Calculated Risk on 11/21/2022 08:41:00 PM

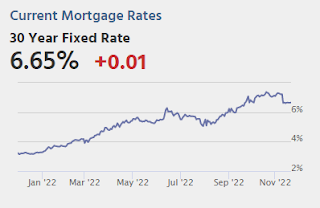

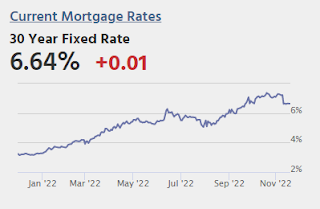

Mortgage rates made their biggest recent move (and their biggest single day move ever) 2 Thursday's ago after a key report showed inflation was lower than expected in October. There has been some jockeying for position among various mortgage lenders since then, but remarkably little change to the average 30yr fixed rate which is once again in the mid 6% range. ... [30 year fixed 6.64%]Tuesday:

emphasis added

• At 8:30 AM ET, Richmond Fed Survey of Manufacturing Activity for November.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 0.70% in October"

by Calculated Risk on 11/21/2022 04:12:00 PM

Note: This is as of October 31st.

From the MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 0.70% in October

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased by 1 basis point from 0.69% of servicers’ portfolio volume in the prior month to 0.70% as of October 31, 2022. According to MBA’s estimate, 350,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance increased 1 basis point to 0.31%. Ginnie Mae loans in forbearance increased 8 basis points to 1.41%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 11 basis points to 1.03%.

“The overall share of loans in forbearance increased slightly in October, but it was a mixed bag by investor type. The forbearance rate for Ginnie Mae, Fannie Mae, and Freddie Mac loans increased, and there was a decline in portfolio and PLS loans in forbearance,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Several factors were behind the first monthly increase in forbearances in 29 months, including the effects of Hurricane Ian in the Southeast, the diminishing number of loans bought out of Ginnie Mae pools and placed in portfolio, and the fact that new forbearance requests have closely matched forbearance exits for the past three months.”

...

Added Walsh, “The overall share of loans that were current last month decreased 15 basis points to 95.70%, with 44 states reporting declines (not delinquent or in foreclosure). Florida, which was hit the hardest by Hurricane Ian, experienced a 49-basis-point drop in the share of loans that were current – the biggest decline of all states.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans had been decreasing, although there was a slight increase in October. At the end of October, there were about 350,000 homeowners in forbearance plans.

Final Look at Local Housing Markets in October

by Calculated Risk on 11/21/2022 12:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in October

A brief excerpt:

The big story for October existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down further YoY in October as many potential sellers are locked into their current home (low mortgage rate). And active inventory increased sharply YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in October. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.

Important: Closed sales in October were mostly for contracts signed in August and September. Rates increased to around 6% in September and that impacted closed sales in October. In October 30-year mortgage rates jumped to over 7%, and that will negatively impact closed sales in November and December.

...

And a table of October sales. In October, sales were down 28.6% YoY Not Seasonally Adjusted (NSA) for these markets. ... The NAR reported sales were down 29.5% NSA YoY in October.

Sales in some of the hottest markets are down around 40% YoY (all of California was down 37%), whereas in other markets, sales are only down in around 20% YoY.

...

More local data coming in December for activity in November! We should expect an even larger YoY sales decline in November and December due to the increase in mortgage rates in September and October.

Housing November 21st Weekly Update: Inventory Decreased Slightly Week-over-week

by Calculated Risk on 11/21/2022 08:57:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 35.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 11/21/2022 08:32:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of November 20th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 2.6% below the same week in 2019 (97.4% of 2019). (Dashed line)

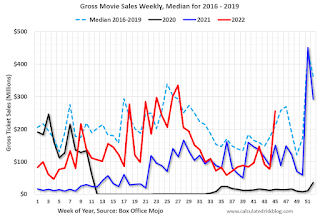

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $255 million last week - almost entirely due to Black Panther: Wakanda Forever - up about 21% from the median for the week.

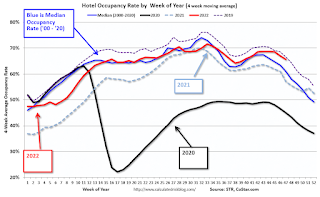

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Nov 12th. The occupancy rate was up 0.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

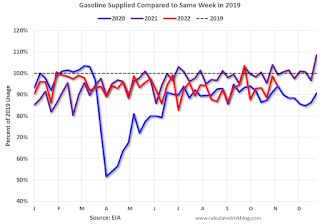

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of November 11th, gasoline supplied was down 6.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, November 20, 2022

Sunday Night Futures

by Calculated Risk on 11/20/2022 07:02:00 PM

Weekend:

• Schedule for Week of November 20, 2022

Monday:

• AT 8:30 AM ET, Chicago Fed National Activity Index for October. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 40 (fair value).

Oil prices were down over the last week with WTI futures at $80.08 per barrel and Brent at $87.62 per barrel. A year ago, WTI was at $77, and Brent was at $81 - so WTI oil prices are up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.67 per gallon. A year ago, prices were at $3.41 per gallon, so gasoline prices are up $0.26 per gallon year-over-year.