by Calculated Risk on 12/05/2022 08:00:00 PM

Monday, December 05, 2022

Tuesday: Trade Deficit

In addition to Fed anxiety, there was stronger economic data again this morning with a key report on the services sector coming in near the highest levels since earlier this year (a big reversal considering the previous month came in at the lowest levels in more than 2 years).Tuesday:

Strong economic data implies higher rates, all other things being equal. The bond market traded accordingly. By the end of the day, we'd lost enough ground that most mortgage lenders recalled their initial offerings and "re-priced" with higher rates/fees. The net effect was that Monday's rates ended up being close to Friday morning's after having been moderately lower to start the day. [30 year fixed 6.33%]

emphasis added

• At 8:00 AM: Corelogic House Price index for October.

• At 8:30 AM: Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $79.1 billion. The U.S. trade deficit was at $73.3 billion in September.

Q4 GDP Tracking: Around 1.5%

by Calculated Risk on 12/05/2022 02:07:00 PM

From BofA:

Overall, today's data pushed up our 4Q US GDP tracking by one-tenth to 1.4% q/q saar. [Dec 5th estimate]From Goldman:

emphasis added

We left our Q4 GDP tracking estimate unchanged on net at +1.4% (qoq ar). [Dec 5th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 2.8 percent on December 1, down from 4.3 percent on November 23. [Dec 1st estimate]

Black Knight Mortgage Monitor: Home Prices Declined in October; Down 3.2% since June

by Calculated Risk on 12/05/2022 11:06:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Declined in October; Down 3.2% since June

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 9.3% year-over-year but declined for the fourth straight month in October and is now 3.2% off the peak in June.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• While near multi-decade low affordability would suggest home prices should be seeing strong declines, stalling inventory levels are holding home prices higher than current demand levels would suggest they should be

• Home prices fell 0.43% in October (-0.13% on a seasonally-adjusted basis), the smallest such decline – both actual and seasonally adjusted – since home prices peaked in June

• Likewise, home price growth cooled for the seventh consecutive month, to 9.3% in October from 10.6% the prior month, the lowest annual rate in >2 years

• The median home price nationally is now down 3.2% (-1.5% on a seasonally-adjusted basis) from its June peak but tight inventory has slowed the rate of decline in recent months

ISM® Services Index Increased to 56.5% in November

by Calculated Risk on 12/05/2022 10:13:00 AM

(Posted with permission). The ISM® Services index was at 56.5%, up from 54.4% last month. The employment index increased to 51.5%, from 49.1%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.5% November 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in November for the 30th month in a row — with the Services PMI® registering 56.5 percent — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.The PMI was higher than expected and the employment index was above 50.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In November, the Services PMI® registered 56.5 percent, 2.1 percentage points higher than October’s reading of 54.4 percent. The Business Activity Index registered 64.7 percent, a substantial increase of 9 percentage points compared to the reading of 55.7 percent in October. The New Orders Index figure of 56 percent is 0.5 percentage point lower than the October reading of 56.5 percent.

emphasis added

Housing December 5th Weekly Update: Inventory Decreased 2.6% Week-over-week

by Calculated Risk on 12/05/2022 09:03:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 34.1%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/05/2022 08:27:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 4th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 6.9% below the same week in 2019 (93.1% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $115 million last week, down about 57% from the median for the week.

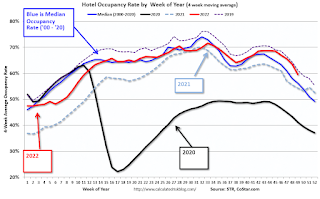

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Nov 26th. The occupancy rate was down 0.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of November 25th, gasoline supplied was down 9.6% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 04, 2022

Sunday Night Futures

by Calculated Risk on 12/04/2022 10:53:00 PM

Weekend:

• Schedule for Week of December 4, 2022

Monday:

• AT 10:00 AM ET, the ISM Services Index for November.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 4 and DOW futures are down 16 (fair value).

Oil prices were up over the last week with WTI futures at $80.89 per barrel and Brent at $86.51 per barrel. A year ago, WTI was at $66, and Brent was at $71 - so WTI oil prices are up 23% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.36 per gallon. A year ago, prices were at $3.34 per gallon, so gasoline prices are up $0.02 per gallon year-over-year.

Heavy Truck Sales Up 11% Year-over-year

by Calculated Risk on 12/04/2022 11:38:00 AM

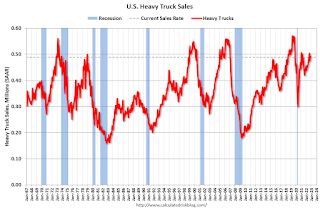

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the November 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Saturday, December 03, 2022

Real Estate Newsletter Articles this Week: Inflation Adjusted House Prices 3.3% Below Peak

by Calculated Risk on 12/03/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Inflation Adjusted House Prices 3.3% Below Peak

• Rents Falling Faster than "Seasonality Alone"

• FHFA Announces Baseline Conforming Loan Limit Will Increase to $726,200

• Case-Shiller: National House Price Index "Continued to Decline" to 10.6% year-over-year increase in September

• Join the CalculatedRisk subscriber chat

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 4, 2022

by Calculated Risk on 12/03/2022 08:11:00 AM

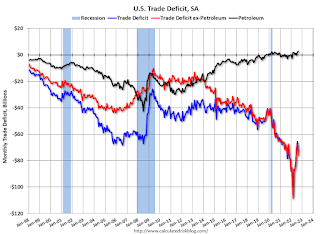

The key economic report this week is the October trade deficit.

10:00 AM: the ISM Services Index for November.

8:00 AM: Corelogic House Price index for October.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $79.1 billion. The U.S. trade deficit was at $73.3 billion in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 225 thousand last week.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).