by Calculated Risk on 12/12/2022 08:08:00 PM

Monday, December 12, 2022

Tuesday: CPI

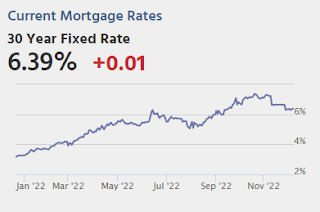

It's been more than a month since the last CPI report sent mortgage rates lower at the fastest single-day pace on record. Since then, apart from one interesting reaction to Powell's speech two weeks ago, the main order of business has been to wait for the next CPI report and the Fed announcement that would follow a day later. As the new week begins, we're a mere 24 hours away. That makes today a placeholder of the highest order. Volatility is possible, especially after the 1pm 10yr Treasury auction, but it pales in comparison to what tomorrow may bring. [30 year fixed 6.39%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

Second Home Market: South Lake Tahoe in November

by Calculated Risk on 12/12/2022 02:18:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

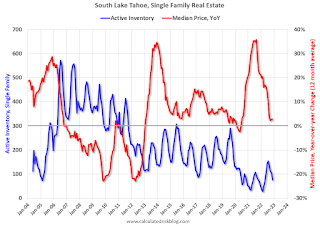

This graph is for South Lake Tahoe since 2004 through November 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 3-fold from the record low set in February 2022, and up 12% year-over-year. Prices are up 2.9% YoY (and the YoY change has been mostly trending down).

2nd Look at Local Housing Markets in November; Another step down in sales in November

by Calculated Risk on 12/12/2022 11:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in November

A brief excerpt:

This is the second look at local markets in November. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in November were mostly for contracts signed in September and October. Mortgage rates moved higher in September, and 30-year mortgage rates were over 7% for most of October (no points), and that likely impacted closed sales in November and December.

...

Here is a summary of active listings for these housing markets in November.

Inventory in these markets were down 35% YoY in January and are now up 87% YoY! So, this is a significant change from earlier this year, and a larger YoY inventory increase than in October (up 75% YoY).

...

Many more local markets to come!

Housing December 12th Weekly Update: Inventory Decreased 2.5% Week-over-week

by Calculated Risk on 12/12/2022 09:19:00 AM

Click on graph for larger image.

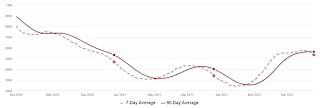

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 34.1%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/12/2022 08:56:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 11th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 5.3% below the same week in 2019 (94.7% of 2019). (Dashed line)

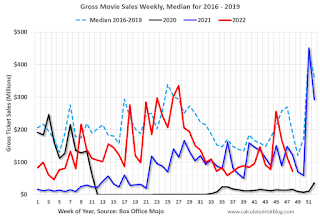

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $72 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 3rd. The occupancy rate was down 7.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 2nd, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 11, 2022

Sunday Night Futures

by Calculated Risk on 12/11/2022 06:13:00 PM

Weekend:

• Schedule for Week of December 11, 2022

• FOMC Preview: 50bp Hike, Increase "Terminal Rate"

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $71.02 per barrel and Brent at $76.10 per barrel. A year ago, WTI was at $71, and Brent was at $74 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.21 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.12 per gallon year-over-year.

FOMC Preview: 50bp Hike, Increase "Terminal Rate"

by Calculated Risk on 12/11/2022 10:21:00 AM

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and increase the "terminal rate" to 5-5.25%.

"A relatively soft November inflation report is unlikely to affect the Fed’s decision. It has clearly telegraphed a 50bp hike in December, which would take the federal funds rate to 4.25-4.5%. The big question is where the Fed goes next. We expect another 50bp rate hike in February and then a 25bp hike in March for a terminal rate of 5.0-5.25%. We think the Fed will need to see material weakening in the labor market to stop hiking."From Goldman Sachs:

emphasis added

"Aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023. We expect the median dot to rise 50bp to a new peak of 5-5.25% ... We continue to expect three 25bp hikes in 2023 to a peak of 5-5.25%, though the risks are tilted toward 50bp in February."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | |

The unemployment rate was at 3.7% in November. So far, the economic slowdown has barely pushed up the unemployment rate, and the FOMC will likely revised down the 2022 projection but might revise 2023 up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | |

As of October 2022, PCE inflation was up 6.0% from October 2021. This was below the cycle high of 7.0% YoY in June. There was a surge of inflation in Q4 2021, so with less inflation in Q4 this year, it is possible inflation will decline to the top of the projected year-over-year range in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | |

PCE core inflation was up 5.0% in October year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and will likely be above the September Q4 projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | |

Saturday, December 10, 2022

Real Estate Newsletter Articles this Week: Mortgage Equity Withdrawal Still Solid in Q3

by Calculated Risk on 12/10/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Mortgage Equity Withdrawal Still Solid in Q3

• 2023 Housing Forecasts

• 1st Look at Local Housing Markets in November

• Q3 Update: Delinquencies, Foreclosures and REO

• Black Knight Mortgage Monitor: Home Prices Declined in October; Down 3.2% since June

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 11, 2022

by Calculated Risk on 12/10/2022 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November Industrial Production, and the December New York and Philly Fed surveys, will be released this week.

The FOMC meets this week, and the FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a 50 bp hike in the Fed Funds rate.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.2% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, unchanged from 230 thousand last week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of -1.0, down from 4.5.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of -12.0, up from -19.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 79.8%.

No major economic releases scheduled.

Friday, December 09, 2022

COVID Dec 9, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/09/2022 09:16:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 458,986 | 306,773 | ≤35,0001 | |

| Hospitalized2🚩 | 29,598 | 26,015 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,981 | 1,844 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

NOTE: The data is probably catching up from the low levels during the holiday week, but this is the most cases since September, and the most deaths since early October.