by Calculated Risk on 12/26/2022 07:05:00 PM

Monday, December 26, 2022

Tuesday: Case-Shiller House Prices

Weekend:

• Schedule for Week of December 25, 2022

Monday:

• At 9:00 AM ET, FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for October. The consensus is for an 8.0% year-over-year increase in the Composite 20 index for October.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for December.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 24, and DOW futures are up 160 (fair value).

Oil prices were up over the last week with WTI futures at $80.31 per barrel and Brent at $83.92 per barrel. A year ago, WTI was at $75, and Brent was at $75 - so WTI oil prices are up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.05 per gallon. A year ago, prices were at $3.25 per gallon, so gasoline prices are down $0.20 per gallon year-over-year.

Review: Ten Economic Questions for 2022

by Calculated Risk on 12/26/2022 02:45:00 PM

At the end of each year, I post Ten Economic Questions for the following year (2022). I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments.

I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March 2020.

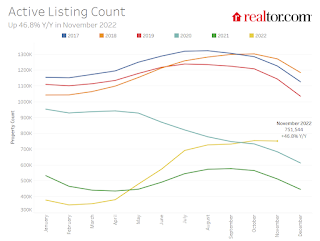

10) Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

"The bottom line is inventory will probably set new record lows over the next couple of months, and then inventory will likely increase YoY later in the year. However, it seems unlikely that inventory will be back up to the 2017 - 2019 levels. Inventory is always something to watch!"

Here is a graph from Realtor.com showing active inventory through November 2022.

As expected, inventory hit new record lows early in 2022, and is finishing the year up significantly year-over-year - but not close to the 2017 - 2019 levels.

Note: The NAR reported inventory was up 2.7% year-over-year in November compared to November 2021. This appears to include some pending sales and doesn’t match some other measures of inventory (Altos and Realtor.com).

9) Question #9 for 2022: What will happen with house prices in 2022?

"[B]ased on my inventory forecast and further progress with the pandemic, my guess is that year-over-year price increases will probably be the strongest early in the year, and then soften towards the end of 2022. Price appreciation will decrease from the unsustainable 2021 pace but seems likely to still be in the mid-to-high single digit range in 2022."

This was mostly correct. The year-over-year change in the Case-Shiller index peaked in March 2022, and then softened as the year progressed.

This was mostly correct. The year-over-year change in the Case-Shiller index peaked in March 2022, and then softened as the year progressed.As of September, the National Case-Shiller index SA was up 10.6% year-over-year. (Case-Shiller for October will be released tomorrow).

House prices are now falling month-to-month, but it appears prices will still be up mid-single digits in December.

8) Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

"Mortgage equity withdrawal will probably decline in 2022, since fewer homeowners will refinance their mortgages. However, there is some concern about banks easing lending standards, and the rapid increase in non-QM loans. This will be something to watch in 2022, but overall lending is still solid (unlike during the housing bubble)."Mortgage equity withdrawal was surprising still solid in 2022 as homeowners switched from refinancing existing mortgages to using home equity loans (2nd loans) to extract equity from their homes.

7) Question #7 for 2022: How much will Residential investment change in 2022? How about housing starts and new home sales in 2022?

"My guess is starts will be down low-to-mid single digits year-over-year in 2022. New home sales could pick up solidly if existing home inventory stays low, supply issues are resolved, and mortgage rates stay low, but my guess is new home sales will be mostly unchanged year-over-year."Through November, total starts, year-to-date, were down 1.2% compared to the same period in 2021. New home sales were down 15.2% compared to the same period in 2021. Starts were as expected, but new home sales were down as mortgage rates increased quicker than expected.

6) Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

"Currently I expect asset purchases to end as planned in March, and the 1st rate hike to happen at the March meeting, and perhaps a 2nd hike in June. Subsequent rate hikes will depend on the course of the pandemic, inflation and employment, but 3 rate hikes in 2022 seem likely."Huge miss. Inflation was much higher than I expected, and the Fed raised rates far more the expected.

5) Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

"The pandemic was the cause of the inflation spike, with supply constraints, a shifting of demand from services to goods, large fiscal transfers, and a smaller labor force pushing up wages. If the pandemic eases, I expect these pressures to ease. My guess is core PCE inflation (year-over-year) will decrease in 2022 (from the current 4.7%), and I think core PCE inflation will be at or below 3% by the end of 2022."According to the November Personal Income and Outlays report, the November PCE price index increased 5.5 percent year-over-year and the November PCE price index, excluding food and energy, increased 4.7 percent year-over-year. Inflation was higher than expected but has been slowing recently.

4) Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

"My guess, based on the impact of the pandemic easing, is that most of these people will return to the labor force. I don't expect that participation rate to increase to pre-pandemic levels (63.4%), but it seems reasonable the participation rate will increase to the mid 62s by year end, before trending down again later in the decade."This was mostly correct. The Labor Force Participation Rate was at 62.1% in November.

3) Question #3 for 2022: What will the unemployment rate be in December 2022?

"Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will decline into the mid 3% range by December 2022 from the current 4.2%."The unemployment rates was at 3.7% in November.

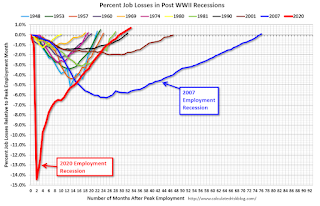

2) Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

"My guess is something like 2.5 to 3.0 million jobs could be added in 2022, but it will depend on the pandemic (and policy). This fits with my view of sluggish labor force growth, an increase in the participation rate, and a decline in the unemployment rate. That would mean there are still fewer jobs at the end of 2022, than before the pandemic."

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

1) Question #1 for 2022: How much will the economy grow in 2022?

"My sense is growth will slow in 2022 noticeably. Some sectors, like vehicle sales, will pick up since vehicle sales were supply constrained in 2021. Other sectors will continue to recover (like travel related) and service sectors. However, some goods sectors will likely decline, and real estate will likely be mostly flat in 2022. Also, fiscal and monetary supply will give less of a boost in 2022. My guess is the real GDP growth will probably be in the 2.5% to 3.5% range in 2022."It now appears GDP growth will be under 1% in 2022.

My biggest misses were on inflation (and Fed policy), GDP (too optimistic) and employment (too pessimistic).

Housing December 26th Weekly Update: Inventory Decreased 2.7% Week-over-week

by Calculated Risk on 12/26/2022 10:50:00 AM

Click on graph for larger image.

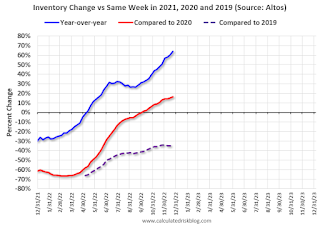

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 35.1%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/26/2022 10:00:00 AM

This will likely be the final weekly update of these high frequency indicators. I've been posting these and more since the beginning of the pandemic. It has been interesting watching these sectors recover as the pandemic impact subsided.

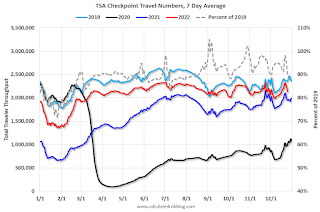

The TSA is providing daily travel numbers.

This data is as of December 25th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 10.1% below the same week in 2019 (89.9% of 2019). (Dashed line)

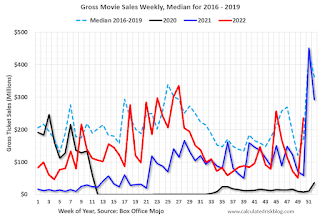

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $236 million last week, up about 37% from the median for the week - thanks to "Avatar: The Way of Water".

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 17th. The occupancy rate was up 9.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

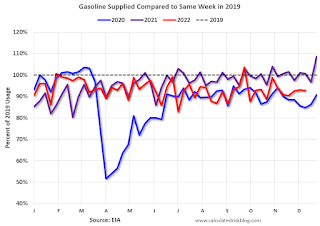

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 16th, gasoline supplied was down 7.4% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 25, 2022

A Very Nerdy Christmas

by Calculated Risk on 12/25/2022 11:25:00 AM

CR Note: This is from Tanta December 25, 2007!

From Mortgage Pig™.

I suppose this requires some explanation. Many years and versions of Excel ago, I was in some interminable conference call--I believe we were discussing general ledger interface mapping for HUD-1 line items regarding undisbursed escrow items on the FHA 203(k) in the servicing system upload, or perhaps we were watching paint dry--when I experienced one of those evolutionary breakthroughs for which the human race is justly famous. I stopped doodling on my legal pad and started defacing my spreadsheet. In a word, Excel Art was born.

An entire running gag developed, centered on the character of Mortgage Pig and his Adventures. The Pig you see above is a newer version; the old Pig didn't wear lipstick (old pig was developed before we started selling loans to Wall Street). You can, of course, print these images, but outside of the context of viewing them in Excel, they simply become primitive, childlike doodles of no particular resonance. Viewing them as a spreadsheet, on the other hand, makes them profoundly amusing. Really. There's just nothing like sending someone a file named "GL Error Recon 071597" and having a pig pop up when the workbook is opened for a knee-slapping good time. If you're a hopeless Nerd with no particular aesthetic sensibilities.

Our own regular commenter bacon dreamz, who is also accomplished with Word Art, has (woe betide his employer) become adept at Excel Art as well, under my provocation, and has developed a way cool variation, Excel Movies. This involves creating a large number of worksheets with tediously copied and edited images that, when you ctrl-page down rapidly, create crude animation. It takes a very long series of conference calls to produce a really good Excel Movie, but it can be done. Unfortunately they're hard to display on a blog post. You'll have to take my word for it that they're hysterical.

I wanted to give you all a little Christmas present. Those of you who spend large portions of your day on conference calls with a spreadsheet in front of you and have no consciences will, I hope, be inspired to create your own Excel Art, so that a drab, utilitarian, sometimes soul-destroying corporate existence may be enlivened with wit, creativity, and expropriation of exploited labor. For those of you who don't use Excel, I hope Santa brought you a new box of crayons.

Happy Holidays to all of you.

UPDATE: Because you wanted to know what was on sheet 3.

Saturday, December 24, 2022

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 4.09 million SAAR in November

by Calculated Risk on 12/24/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.09 million SAAR in November

• November Housing Starts: Record Number of Housing Units Under Construction

• New Home Sales Increased in November; Previous 3 Months Revised Down Sharply

• Lawler: Update on Rent Trends

• 4th Look at Local Housing Markets in November; California Sales off 48% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 25, 2022

by Calculated Risk on 12/24/2022 08:11:00 AM

Happy Holidays and Merry Christmas!

The key indicator this week is Case-Shiller House Prices for October.

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM: FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for an 8.0% year-over-year increase in the Composite 20 index for October.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.5% decrease in the index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 216 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for December.

Friday, December 23, 2022

COVID Dec 23, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/23/2022 09:07:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2🚩 | 487,367 | 455,028 | ≤35,0001 | |

| Hospitalized2🚩 | 33,027 | 31,900 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,952 | 2,699 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Up 9.2% Compared to Same Week in 2019

by Calculated Risk on 12/23/2022 01:39:00 PM

U.S. hotel performance came in lower than the previous week but showed improved comparisons to 2019 in part because of a favorable calendar shift, according to STR‘s latest data through Dec. 17.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Dec. 11-17, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 54.5% (+9.2%)

• Average daily rate (ADR): $135.08 (+23.7%)

• Revenue per available room (RevPAR): $73.65 (+35.1%)

The corresponding week in 2019 ended on 21 December, which brought performance down lower for that period.

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Q4 GDP Tracking

by Calculated Risk on 12/23/2022 01:39:00 PM

From Goldman:

We boosted our Q4 GDP tracking estimate by one tenth to +1.7% (qoq ar), reflecting a larger contribution from inventories but slower consumption growth.And from the Altanta Fed: GDPNow

emphasis added [Dec 23rd estimate]

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.7 percent on December 23, up from 2.7 percent on December 20. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 3.4 percent and -0.2 percent, respectively, to 3.6 percent and 3.8 percent, respectively. [Dec 23rd estimate]