by Calculated Risk on 1/04/2023 10:35:00 AM

Wednesday, January 04, 2023

ISM® Manufacturing index Declined to 48.4% in December, Price Index Lowest Since April 2020

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 48.4% in December, down from 49.0% in November. The employment index was at 51.4%, up from 48.4% last month, and the new orders index was at 45.2%, down from 47.2%.

From ISM: Manufacturing PMI® at 48.4% December 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December for the second consecutive month following a 29-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in December. This was close to the consensus forecast. Note that prices are falling quickly.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The December Manufacturing PMI® registered 48.4 percent, 0.6 percentage point lower than the 49 percent recorded in November. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 45.2 percent, 2 percentage points lower than the 47.2 percent recorded in November. The Production Index reading of 48.5 percent is a 3-percentage point decrease compared to November’s figure of 51.5 percent. The Prices Index registered 39.4 percent, down 3.6 percentage points compared to the November figure of 43 percent; this is the index’s lowest reading since April 2020 (35.3 percent). The Backlog of Orders Index registered 41.4 percent, 1.4 percentage points higher than the November reading of 40 percent. The Employment Index returned to expansion territory (51.4 percent, up 3 percentage points) after contracting in November (48.4 percent). The Supplier Deliveries Index reading of 45.1 percent is 2.1 percentage points lower than the November figure of 47.2 percent; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index registered 51.8 percent, 0.9 percentage point higher than the November reading of 50.9 percent. The New Export Orders Index reading of 46.2 percent is down 2.2 percentage points compared to November’s figure of 48.4 percent. The Imports Index continued in contraction territory at 45.1 percent, 1.5 percentage points below the November reading of 46.6 percent.”

emphasis added

BLS: Job Openings "Little Changed" at 10.5 million in November

by Calculated Risk on 1/04/2023 10:24:00 AM

From the BLS: Job Openings and Labor Turnover Summary

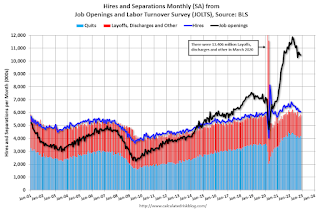

The number of job openings was little changed at 10.5 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.4 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November the employment report this Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in November to 10.458 million from 10.512 million in October.

The number of job openings (black) were down 4% year-over-year.

Quits were down 7% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Moody's: National Multifamily Supply and Demand at Lowest Levels since 2009

by Calculated Risk on 1/04/2023 08:27:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: National Multifamily Supply and Demand at Lowest Levels since 2009

A brief excerpt:

The big story here is that demand for apartments fell off a cliff in Q4 2022, but that new supply was also very low, even though there are a large number of apartments currently under construction.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

First, from Moody’s Analytics Senior Economist Lu Chen and economist Xiaodi Li: Apartment struck a balance, Office demand plummeted, and Retail remains flatNational multifamily supply and demand both cooled to their lowest levels since 2009. Net absorption and new construction leveled off at just around 10,000 units in Q4, keeping the national multifamily vacancy flat at 4.4%. … Total construction delivery and net absorption only reached 100,470 units and 135,472 units for the year respectively, the weakest record over the past decade....Moody’s Analytics (Reis) reported that the apartment vacancy rate was at 4.4% in Q4 2022, unchanged from 4.4% in Q3, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Moody’s Analytics is just for large cities.

MBA: Mortgage Applications Decreased Over Last Two Weeks

by Calculated Risk on 1/04/2023 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest

MBA Weekly Survey

Mortgage applications decreased 13.2 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 30, 2022. The results include adjustments to account for the holidays.

... The holiday adjusted Refinance Index decreased 16.3 percent from the two weeks ago and was 87 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 12.2 percent from two weeks earlier. The unadjusted Purchase Index decreased 38.5 percent compared with the two weeks ago and was 42 percent lower than the same week one year ago.

“The end of the year is typically a slower time for the housing market, and with mortgage rates still well above 6 percent and the threat of a recession looming, mortgage applications continued to decline over the past two weeks to the lowest level since 1996,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications have been impacted by slowing home sales in both the new and existing segments of the market. Even as home-price growth slows in many parts of the country, elevated mortgage rates continue to put a strain on affordability and are keeping prospective homebuyers out of the market.”

Added Kan, “Refinance applications remain less than a third of the market and were 87 percent lower than a year ago as rates remained close to double what they were in 2021. Mortgage rates are lower than October 2022 highs, but would have to decline substantially to generate additional refinance activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.58 percent from 6.42 percent, with points increasing to 0.73 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 03, 2023

Wednesday: Job Openings, ISM Mfg, Vehicle Sales, FOMC Minutes

by Calculated Risk on 1/03/2023 08:45:00 PM

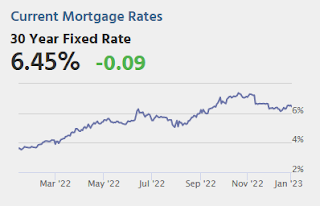

For now, the average lender is moving back down below the 6.5% threshold for top tier 30yr fixed rates, but just barely. That number was getting close to 6.0% in early December and was more than half a point higher as of last week. [30 year fixed 6.45%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

• At 10:00, ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.5, down from 49.0 in November.

• At 2:00 PM: FOMC Minutes, Meeting of December 13-14, 2022

• All day, Light vehicle sales for December. The Wards forecast is for 13.0 million SAAR in December, down from the BEA estimate of 14.1 million SAAR in November (Seasonally Adjusted Annual Rate).

Update: Framing Lumber Prices Down 67% YoY, Slightly Below Pre-Pandemic Levels

by Calculated Risk on 1/03/2023 02:51:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through January 3rd.

Prices are slightly below the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a significant runup in prices this Spring due to the housing slowdown.

Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

by Calculated Risk on 1/03/2023 11:48:00 AM

Today, in the Real Estate Newsletter: Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) was a drag on growth in 2022 as the housing market slowed sharply. Through November, starts were down 1.2% year-to-date compared to the same period in 2021. New home sales were down 15.2% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2023? How about housing starts and new home sales in 2023?

...

Here is a table showing housing starts and new home sales since 2005. Note that starts and new home sales declined sharply for several years following the housing bubble. Since I don’t expect significant distressed sales in this downturn, I don’t think the decline in starts and new home sales will be anywhere near as persistent as during the housing bust.

...

The outlook for 2023 depends on several factors: the Fed, mortgage rates, whether or not there is a recession in 2023, and inventory levels (both existing and new home inventory). My sense is this downturn will be more like each of the downturns in the 1980 period, as opposed to the six years of declining new home sales during the housing bust (there were two recessions in the 1980 period so new home sales did decline for several years). ...

Construction Spending Increased 0.2% in November

by Calculated Risk on 1/03/2023 10:37:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during November 2022 was estimated at a seasonally adjusted annual rate of $1,807.5 billion, 0.2 percent above the revised October estimate of $1,803.2 billion. The November figure is 8.5 percent above the November 2021 estimate of $1,665.2 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,426.4 billion, 0.3 percent above the revised October estimate of $1,421.6 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $381.1 billion, 0.1 percent below the revised October estimate of $381.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 8.2% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is close to the recent peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5.3%. Non-residential spending is up 12.6% year-over-year. Public spending is up 10.4% year-over-year.

CoreLogic: House Prices up 8.6% YoY in November; Declined 0.2% MoM in November NSA

by Calculated Risk on 1/03/2023 08:33:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Annual Home Price Growth Slows to Two-Year Low in November, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2022.

Year-over-year home price growth ended its 21-month streak of double-digit momentum in November, posting an 8.6% gain, the lowest rate of appreciation in exactly two years. Although 16 states bucked the national trend and saw annual double-digit increases, appreciation is decelerating in many popular housing markets across the country. Southeastern states still led the country for price growth in November but also saw some of the most pronounced cooling. Similarly, relatively more expensive Western areas also posted substantial combined declines in recent months since spring’s peak.

“Although home price growth has been slowing rapidly and will continue to do so in 2023, strong gains in the first half of last year suggest that total 2022 appreciation was only slightly lower than that recorded in 2021,” said Selma Hepp, executive, deputy chief economist at CoreLogic. “However, 2023 will present its own challenges, as consumers remain wary of both the housing market and the overall economic outlook.”

...

U.S. home prices (including distressed sales) increased 8.6% year over year in November 2022 compared to November 2021. On a month-over-month basis, home prices declined by 0.2% compared to October 2022.

emphasis added

Monday, January 02, 2023

Tuesday: Construction Spending

by Calculated Risk on 1/02/2023 07:08:00 PM

Weekend:

• Schedule for Week of January 1, 2023

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for November.

• At 10:00 AM: Construction Spending for November. The consensus is for a 0.4% decrease in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8, and DOW futures are up 75 (fair value).

Oil prices were mixed over the last week with WTI futures at $80.26 per barrel and Brent at $85.91 per barrel. A year ago, WTI was at $76, and Brent was at $78 - so WTI oil prices are up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago, prices were at $3.26 per gallon, so gasoline prices are down $0.08 per gallon year-over-year.