by Calculated Risk on 1/10/2023 08:51:00 AM

Tuesday, January 10, 2023

Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was up 4.7% YoY through November. This was down from a peak of 5.4% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 3.2% to 3.7% range in Q4 2023. Will the core inflation rate decrease in 2023, and what will the YoY core inflation rate be in December 2023?

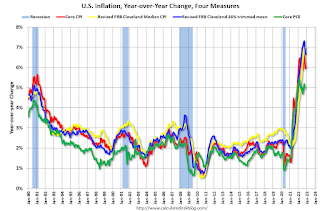

Although there are different measure for inflation, they all show inflation well above the Fed's 2% inflation target.

Note: I follow several measures of inflation, including median CPI and trimmed-mean CPI from the Cleveland Fed. Also core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. The recent spike in inflation is obvious, and inflation appears to have peaked.

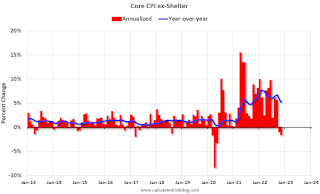

This “dramatic shift” in household formation is leading to Rents Falling Faster than "Seasonality Alone". Since rents are falling - and will likely continue to fall - it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Monday, January 09, 2023

Tuesday: Fed Chair Powell on "Central Bank Independence"

by Calculated Risk on 1/09/2023 09:05:00 PM

[W]hile there was arguably a small amount of push-back in the overnight session, it was quickly erased, and with minimal volatility to boot. This helps legitimize the levels achieved last Friday--especially with Treasury auctions on deck and another high risk event in the form of the CPI data on Thursday. [30 year fixed 6.14%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 9:00 AM: Discussion, Fed Chair Jerome Powell, Central Bank Independence, At the Sveriges Riksbank International Symposium on Central Bank Independence, Stockholm, Sweden

Leading Index for Commercial Real Estate Increases in December

by Calculated Risk on 1/09/2023 04:31:00 PM

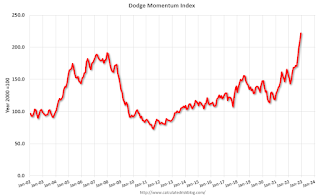

From Dodge Data Analytics: Dodge Momentum Index Wraps up 2022 with December Growth

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 6.6% (2000=100) in December to 222.2 from the revised November reading of 208.3. In December, the commercial component of the DMI rose 8.4%, and the institutional component ticked up 2.7%.

“One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” stated Richard Branch, chief economist for Dodge Construction Network. “While some of that will likely erode in 2023 as economic growth wanes, increased demand for some building types like data centers, labs, and healthcare buildings will provide a solid floor for the construction sector.”

Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning. Meanwhile, institutional growth focused on recreation and public building, with education and healthcare planning activity remaining flat. On a year-over-year basis, the DMI was 40% higher than in December 2021; the commercial component was up 51%, and institutional planning was 20% higher.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 222.2 in December, up from 208.3 in November.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a solid pickup in commercial real estate construction into 2023.

2nd Look at Local Housing Markets in December

by Calculated Risk on 1/09/2023 12:59:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December

A brief excerpt:

This is the second look at local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in December were mostly for contracts signed in October and November. Since 30-year fixed mortgage rates were over 7% for most of October (no points) and averaged 6.8% in November (Freddie PMMS with points) closed sales were probably impacted significantly in December.

...

In the Northwest, median sales prices were down slightly year-over-year. From the Northwest MLS: For Northwest MLS brokers, December ends with a “whimper,” and 2022 was “a tale of two housing markets”The median sales price was $570,000, down $2,900 (-0.51%) from the year-ago figure of $572,900. Last year’s median price overall peaked in May 2022, at $660,000.In Charlotte, the median sales price was $373,625, up 6.8% year-over-year.

...

In December, sales were down 43.5%. In November, these same markets were down 43.7% YoY Not Seasonally Adjusted (NSA).

Note that in December 2022, there were the same number of selling days as in December 2021, so the SA decline will be similar to the NSA decline.

This is a similar YoY decline as in November for these early reporting markets. If national sales decline by the same percent as last month, the NAR will report sales for December under 4.0 million SAAR - below the 4.01 million in May 2020 (pandemic low) and the lowest sales rate since 2010.

Many more local markets to come!

AAR: December Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 1/09/2023 12:04:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

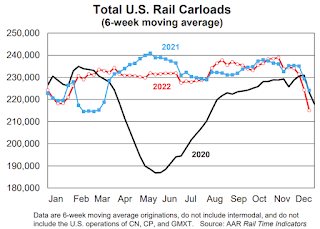

In 2022, U.S. railroads originated 11.98 million total carloads, down 0.3% (34,001 carloads) from 2021 and up 6.2% (697,444 carloads) over 2020. Since 1988, when our U.S. rail data begin, only 2020 had fewer total carloads than 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

December is typically one of the lowest volume months of the year, and 2022 was no exception. Total carloads averaged 210,543 per week in December 2022, the fewest for any month in 2022 and down 4.4% from December 2021. The 4.4% decline in total carloads was the biggest for any month since February 2021.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S. intermodal originations in 2022 were 13.45 million, down 4.9% (686,580 units) from 2021 and down 0.02% (3,131 units) from 2020. U.S. intermodal volume in 2022 was the sixth most ever, but also the lowest since 2016. In 2022, containers accounted 93.7% of U.S. intermodal shipments, a record high.

Wholesale Used Car Prices Down 14.9% Year-over-year; Largest Annual Decline on Record

by Calculated Risk on 1/09/2023 09:15:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in December

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 0.8% in December from November. The Manheim Used Vehicle Value Index (MUVVI) rose to 219.3, down 14.9% from a year ago. This was the largest annualized decline in the series’ history. December’s increase was driven by the seasonal adjustment. The non-adjusted price change in December was a decline of 1.9% compared to November, moving the unadjusted average price down 13.1% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing January 9th Weekly Update: Inventory Decreased 4% Week-over-week

by Calculated Risk on 1/09/2023 08:32:00 AM

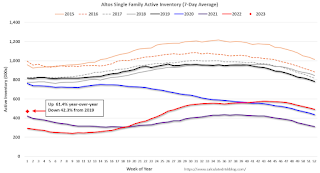

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, January 08, 2023

Sunday Night Futures

by Calculated Risk on 1/08/2023 07:09:00 PM

Weekend:

• Schedule for Week of January 8, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6, and DOW futures are up 39 (fair value).

Oil prices were down over the last week with WTI futures at $73.77 per barrel and Brent at $78.57 per barrel. A year ago, WTI was at $79, and Brent was at $82 - so WTI oil prices are DOWN 6% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.28 per gallon. A year ago, prices were at $3.27 per gallon, so gasoline prices are up $0.01 per gallon year-over-year.

Question #6 for 2023: What will the Fed Funds rate be in December 2023?

by Calculated Risk on 1/08/2023 12:22:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

6) Monetary Policy: In response to the increase in inflation, the FOMC raised the federal funds rate from "0 to 1/4 percent" in January 2022, to "4-1/4 to 4-1/2 percent" in December. A majority of FOMC participants expect three or even four 25 bp rate hikes in 2023. What will the Fed Funds rate be in December 2023?

"In my view, however, it will be appropriate to continue to raise rates at least at the next few meetings until we are confident inflation has peaked.And Wall Street economists are expecting three or more rate hikes this year. From Goldman Sachs on January 6, 2023:

Once we reach that point, then the second step of our inflation fighting process, as I see it, will be pausing to let the tightening we have already done work its way through the economy. I have us pausing at 5.4 percent ..."

"We continue to expect 25bp fed funds rate hikes each in February, March, and May. We continue to expect no rate cuts in 2023."From BofA on Jan 6, 2023:

"We continue to expect the Fed to lift the target range to 5.0-5.25% early this year, a view that the Fed appeared to tentatively endorse. We expect a 50bp rate hike in February and 25bp increase in March."

| 25 bp Rate Hikes | FOMC Members 2023 |

|---|---|

| No Change | 0 |

| One Rate Hike | 0 |

| Two Rate Hikes | 2 |

| Three Rate Hikes | 10 |

| Four Rate Hikes | 5 |

| Five Rate Hikes | 2 |

Clearly the main view of the FOMC is three or even four rate hikes in 2023.

In summary, we find evidence for a shorter lag in the peak response of inflation to a policy shock in the post-2009 period even after we adjust the shock definition to incorporate forward guidance and balance sheet policy.

There are two reasons why we believe the lags from monetary policy to growth are short while many others believe they are long. First, in our framework a tightening in financial conditions starts to affect the economy when financial markets react to expected policy changes instead of when rate hikes are delivered. Second, many commentators confuse lags from monetary policy to GDP growth with lags to GDP levels.However, employment changes still lag policy. How many construction jobs have been lost so far? None. In fact, construction employment is at an all-time high since there are a record number of housing units under construction! These job losses are already in train with a longer than normal lag due to supply chain issues, and this will increase unemployment and slow wage growth.

The next FOMC meeting ends on February 1st, and it appears the Fed is poised to raise rates 25 bp at this meeting (maybe even 50 bp). However, based on slowing wage growth, core inflation ex-shelter already being negative for two consecutive months, and overall inflation slowing quickly, I think there will be fewer increases this year than most analysts currently expect. My guess is there will be around 2 rate hikes in 2023, and if there are more, the FOMC will be under pressure later in 2023 to cut rates putting the Fed Funds rate under 5% at the end of 2023.

Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Question #7 for 2023: How much will wages increase in 2023?

by Calculated Risk on 1/08/2023 09:39:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

7) Wage Growth: Wage growth was strong in 2022 (up 5.1% year-over-year as of November). How much will wages increase in 2023?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. There was a huge increase at the beginning of the pandemic as lower paid employees were let go, and then the pandemic related spike reversed a year later.

Real wage growth has trended down after peaking at 5.6% YoY in March 2022 and was at 4.6% YoY in December 2022.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth increased sharply in 2021 and for most of 2022. In November 2022, the smoothed 3-month average wage growth was at 6.4% year-over-year, down from 6.7% earlier in the year.

This graph from Indeed, shows posted wage growth.

The Wage Tracker shows US posted wages grew in November at a robust 6.5% year-over-year pace, up from 3.1% in November 2019.Clearly wage growth is slowing and I expect to see some further decreases in both the Average hourly earnings from the CES, and in the Atlanta Fed Wage Tracker. My sense is nominal wages will increase in the 3.0% to 3.5% YoY range in 2023 according to the CES. This depends on the Fed (next question) and if the economy slides into a recession.

Nevertheless, year-over-year posted wage growth has declined substantially in recent months, falling from a peak of 9% in March 2022, a signal employers now face less-steep competition for new hires.

The deceleration is broad-based, with wage growth in 82% of job sectors lower in November than six months earlier.

emphasis added

Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?