by Calculated Risk on 1/12/2023 08:32:00 AM

Thursday, January 12, 2023

BLS: CPI decreased 0.1% in December; Core CPI increased 0.3%

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.CPI was below expectations and core CPI was at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month.

The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November. Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month.

The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months. The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.

emphasis added

Wednesday, January 11, 2023

Thursday: CPI, Unemployment Claims

by Calculated Risk on 1/11/2023 08:39:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 204 thousand last week.

• Also, at 8:30 AM, The Consumer Price Index for December from the BLS. The consensus is for 0.1% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 6.5% year-over-year and core CPI to be up 5.7% YoY.

Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide

by Calculated Risk on 1/11/2023 02:41:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Freddie Mac “National” Home Price Index Down Again in November; Rents Continued to Slide

A brief excerpt:

Freddie Mac recently reported that its “National” Home Price Index (FMNHPI) declined for the fifth straight month on a seasonally adjusted basis in November, putting the FNNHPI down 2.06% from its June 2022 peak. Compared to a year earlier the November FMNHPI was up 6.27%, down from October’s 7.92% YOY gain. The November seasonally adjusted FMHPIs for 29 states plus DC were below their 2022 peaks, with five states showing declines of over 5% from their 2022 peak levels.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

CR Note: This is a repeat sales index using only loans purchased by Fannie and Freddie. Freddie has data for all states and many cities. Idaho is down 8.16% seasonally adjusted compared to the peak in 2022. Arizona is down 7.06%, and California is down 5.88%.

Question #3 for 2023: What will the unemployment rate be in December 2023?

by Calculated Risk on 1/11/2023 12:10:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

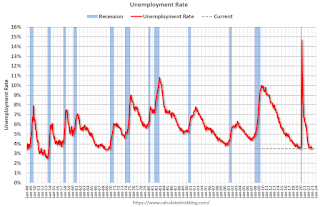

3) Unemployment Rate: The unemployment rate was at 3.5% in December, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will increase to the 4.4% to 4.7% range in Q4 2023. What will the unemployment rate be in December 2023?

Here is a graph of the unemployment rate over time:

Click on graph for larger image.

Click on graph for larger image.The unemployment rate is from the household survey (CPS), and the rate decreased gradually in 2022. The unemployment rate decreased in December to 3.5%, down from 3.9% in December 2021. This tied the lowest unemployment rate since 1969.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate (previous question).

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.8% | -0.1 | 5.6% |

| 2015 | 62.7% | -0.1 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 2018 | 63.0% | 0.3 | 3.9% |

| 2019 | 63.3% | 0.3 | 3.6% |

| 2020 | 61.5% | -1.8 | 6.7% |

| 2021 | 62.0% | 0.5 | 3.9% |

| 2022 | 62.3% | 0.3 | 3.5% |

Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will increase to around 4% in December 2023 from the current 3.5%. (Lower than the FOMC forecast of 4.4% to 4.7%).

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Question #4 for 2023: What will the participation rate be in December 2023?

by Calculated Risk on 1/11/2023 09:21:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

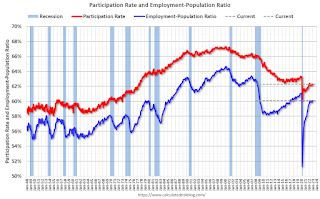

4) Participation Rate: In December 2022, the overall participation rate was at 62.3%, up year-over-year from 62.0% in December 2021, but still below the pre-pandemic level of 63.4%. Long term, the BLS is projecting the overall participation rate will decline to 60.1% by 2031 due to demographics. What will the participation rate be in December 2023?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long-term trends.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 82.4% in December 2022 (Red), down from the pre-pandemic level of 83.0%. This suggests we might see some further increase in the prime participation rate, however most of the prime age workers have returned to the labor force.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 82.4% in December 2022 (Red), down from the pre-pandemic level of 83.0%. This suggests we might see some further increase in the prime participation rate, however most of the prime age workers have returned to the labor force.Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/11/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 6, 2023.

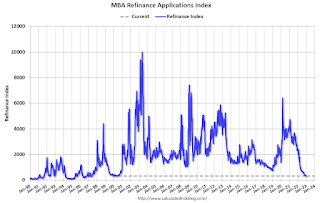

... The Refinance Index increased 5 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 47 percent compared with the previous week and was 44 percent lower than the same week one year ago.

“Mortgage rates declined last week as markets reacted to data showing a weakening economy and slowing wage growth. All loan types in the survey saw a decline in rates, with the 30-year fixed rate falling to 6.42 percent. Purchase applications continued to be hampered by broader weakness in the housing market and declined slightly over the week, with the index slipping to its lowest level since 2014,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “There was an increase in refinance activity as a result of the 16-basis-point decline in rates, as both conventional and government refinance applications increased. However, the overall pace of refinance applications was lower than November and December’s 2022 averages, and over 80 percent lower than a year ago. Refinances were about 30 percent of all applications last week — well below the past decade’s average of 58 percent.”

...

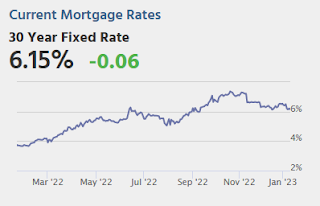

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.42 percent from 6.58 percent, with points remaining at 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 10, 2023

Mortgage Rate Update

by Calculated Risk on 1/10/2023 02:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Rate Update

A brief excerpt:

A year ago, I wrote Mortgage Rates: Moving on Up and 30-year mortgage rates had only increased to 3.625%!There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Now, Mortgage News Daily reports that the most prevalent 30-year fixed rate is now at 6.14% for top tier scenarios. Usually there is a fairly steady spread between the ten-year Treasury yield and 30-year mortgage rates, although - as housing economist Tom Lawler explained in Mortgage/Treasury Spreads, Part I and Part II - the spread has widened due to several factors including volatility and pre-payment speeds.

Second Home Market: South Lake Tahoe in December

by Calculated Risk on 1/10/2023 01:15:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through December 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 2-fold from the record low set in February 2022, and up 6% year-over-year. Prices are up 1.3% YoY (and the YoY change has been trending down).

Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

by Calculated Risk on 1/10/2023 08:51:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was up 4.7% YoY through November. This was down from a peak of 5.4% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 3.2% to 3.7% range in Q4 2023. Will the core inflation rate decrease in 2023, and what will the YoY core inflation rate be in December 2023?

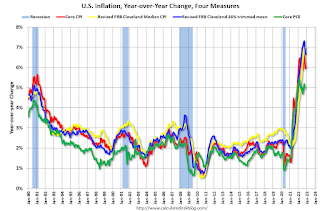

Although there are different measure for inflation, they all show inflation well above the Fed's 2% inflation target.

Note: I follow several measures of inflation, including median CPI and trimmed-mean CPI from the Cleveland Fed. Also core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. The recent spike in inflation is obvious, and inflation appears to have peaked.

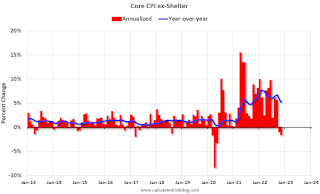

This “dramatic shift” in household formation is leading to Rents Falling Faster than "Seasonality Alone". Since rents are falling - and will likely continue to fall - it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.Here are the Ten Economic Questions for 2023 and a few predictions:

• Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

• Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

• Question #3 for 2023: What will the unemployment rate be in December 2023?

• Question #4 for 2023: What will the participation rate be in December 2023?

• Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?

Monday, January 09, 2023

Tuesday: Fed Chair Powell on "Central Bank Independence"

by Calculated Risk on 1/09/2023 09:05:00 PM

[W]hile there was arguably a small amount of push-back in the overnight session, it was quickly erased, and with minimal volatility to boot. This helps legitimize the levels achieved last Friday--especially with Treasury auctions on deck and another high risk event in the form of the CPI data on Thursday. [30 year fixed 6.14%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 9:00 AM: Discussion, Fed Chair Jerome Powell, Central Bank Independence, At the Sveriges Riksbank International Symposium on Central Bank Independence, Stockholm, Sweden