by Calculated Risk on 1/31/2023 04:00:00 PM

Tuesday, January 31, 2023

Las Vegas December 2022: Visitor Traffic Down 4.6% Compared to 2019; Convention Traffic Down 38.2%

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: December 2022 Las Vegas Visitor Statistics

From the initial shadow of the omicron variant to record‐shattering room rates later in the year, Las Vegas enjoyed a robust recovery trajectory across core tourism indicators in 2022. With December 2022 visitation just 4.6% shy of December 2019, the year closed out with 38.8M annual visitors, 20.5% ahead of 2021 and ‐8.7% under 2019's tally.

Convention attendance for the year approached 5.0M attendees, dramatically ahead of pandemic‐suppressed volumes of 2021 and recovering to about three‐quarters of 2019's tally of 6.6M convention attendees.

Overall hotel occupancy reached 79.2% for the year , +12.4 pts YoY and down ‐9.7 pts vs. 2019. For the year, Weekend occupancy reached 89.3%, +8.0 pts over 2021 and ‐5.6 pts vs. 2019, while Midweek occupancy reached 74.7%, up 14.2 pts vs. 2021 but down ‐11.6 pts vs. 2019.

Strong room rates continued throughout 2022 as annual ADR reached $171, +24.5% higher than 2021 and +28.9% ahead of 2019 while RevPAR reached approx. $135 for the year, +47.6% YoY and +14.9% over 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 4.6% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

HVS: Q4 2022 Homeownership and Vacancy Rates

by Calculated Risk on 1/31/2023 01:31:00 PM

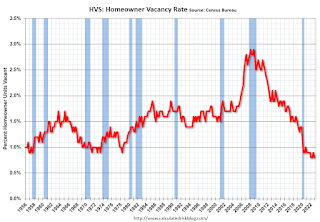

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2022.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

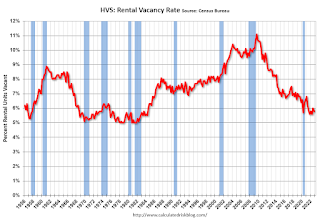

National vacancy rates in the fourth quarter 2022 were 5.8 percent for rental housing and 0.8 percent for homeowner housing. The rental vacancy rate was not statistically different from the rate in the fourth quarter 2021 (5.6 percent) and not statistically different from the rate in the third quarter 2022 (6.0 percent).

The homeowner vacancy rate of 0.8 percent was not statistically different from the rate in the fourth quarter 2021 (0.9 percent) and not statistically different from the rate in the third quarter 2022 (0.9 percent).

The homeownership rate of 65.9 percent was not statistically different from the rate in the fourth quarter 2021 (65.5 percent) and not statistically different from the rate in the third quarter 2022 (66.0 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy decreased to 0.8% in Q4 from 0.9% in Q3.

The HVS homeowner vacancy decreased to 0.8% in Q4 from 0.9% in Q3. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The rental vacancy rate decreased to 5.8% in Q4 from 6.0% in Q3.

The rental vacancy rate decreased to 5.8% in Q4 from 6.0% in Q3. The HVS also has a series on asking rents. This surged following the early stages of the pandemic - like other measures - and is up 9.5% year-over-year in Q4 2022. This was down 0.9% in Q4 compared to Q3.

The quarterly HVS is the timeliest survey on households, but there are many questions about the accuracy of this survey.

Comments on November Case-Shiller and FHFA House Prices

by Calculated Risk on 1/31/2023 11:22:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index "Continued to Decline" to 7.7% year-over-year increase in November

Excerpt:

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for November were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller Home Price Indices for “November” is a 3-month average of September, October and November closing prices. September closing prices include some contracts signed in July, so there is a significant lag to this data.

The MoM decrease in the Case-Shiller National Index was at -0.26% seasonally adjusted. This was the fifth consecutive MoM decrease, and a slightly larger decrease than in October.

On a seasonally adjusted basis, prices declined in 19 of the 20 Case-Shiller cities on a month-to-month basis (Detroit increased 0.1%). The largest monthly declines seasonally adjusted were in San Francisco (-1.4%), Phoenix (-1.4%) and Las Vegas (-1.2%). San Francisco has fallen 11.9% from the peak in May 2022 and is the first Case-Shiller city with a year-over-year decline (-1.6% year-over-year).

...

The November report was mostly for contracts signed in the July through October period - and was likely impacted slightly by the surge in rates in October.

The impact from higher rates in October and November will really show up in the Case-Shiller index over the next several months.

Case-Shiller: National House Price Index "Continued to Decline" to 7.7% year-over-year increase in November

by Calculated Risk on 1/31/2023 09:09:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3-month average of September, October and November closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Continued to Decline in November

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a [7.7%] annual gain in November, down from [9.3%] in the previous month. The 10- City Composite annual increase came in at [6.3%], down from [8.0%] in the previous month. The 20-City Composite posted a [6.8%] year-over-year gain, down from [8.7%] in the previous month.

[Case-Shiller had an error in their text - corrected in brackets]

Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities in November. Miami led the way with a 18.4% year-over-year price increase, followed by Tampa in second with a 16.9% increase, and Atlanta in third with a 12.7% increase. All 20 cities reported lower price increases in the year ending November 2022 versus the year ending October 2022.

...

Before seasonal adjustment, the U.S. National Index posted a -0.6% month-over-month decrease in November, while the 10-City and 20-City Composites posted decreases of -0.7% and -0.8%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.3%, and the 10-City and 20-City Composites both posted decreases of -0.5%.

In November, all 20 cities reported declines before seasonal adjustments. After seasonal adjustments, 19 cities reported declines, with only Detroit increasing 0.1%.

“November 2022 marked the fifth consecutive month of declining home prices in the U.S.,” says Craig J. Lazzara, Managing Director at S&P DJI. “For example, the National Composite Index fell -0.6% for the month, reflecting a -3.6% decline since the market peaked in June 2022. We saw comparable patterns in our 10- and 20-City Composites, both of which stand more than -5.0% below their June peaks. These declines, of course, came after very strong price increases in late 2021 and the first half of 2022. Despite its recent weakness, on a year-over-year basis the National Composite gained 7.7%, which is in the 74th percentile of historical performance levels.

“All 20 cities in our November report showed price declines on a month-over-month basis, with a median decline of -0.8%. Moreover, for all 20 cities, year-over-year gains in November were lower than those of October, with a median year-over-year increase of 6.4%. Interestingly, home prices in San Francisco were down by -1.6% year-over-year, the first negative result for any city since San Francisco’s -0.4% decline in October 2019. This is the worst year-over-year result for San Francisco in more than 10 years (since a -3.0% result in March 2012). West coast weakness was not limited to California, as San Francisco was followed by Seattle (+1.5%) and Portland (+3.9%) at the bottom of the league table.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is down 0.5% in November (SA) and down 4.1% from the recent peak in June 2022.

The Composite 20 index is down 0.5% (SA) in November and down 4.1% from the recent peak in June 2022.

The National index is down 0.3% (SA) in November and is down 2.5% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 6.3% year-over-year. The Composite 20 SA is up 6.8% year-over-year.

The National index SA is up 7.7% year-over-year.

Annual price increases were close to expectations. I'll have more later.

Monday, January 30, 2023

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/30/2023 08:47:00 PM

Unlike last week, the present example offers multiple scheduled economic reports that have consistent track records of causing market movement. Key examples include both ISM reports, ECI, JOLTS, and of course the jobs report on Friday. The Fed announcement lies smack dab in the middle on Wednesday afternoon where it is all but guaranteed that we'll see another downshift in the pace of rate hikes (25bps). [30 year fixed 6.21%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for November. The consensus is for a 6.9% year-over-year increase in the Comp 20 index.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 44.9, down from 45.1 in December.

• At 10:00 AM, The Q4 Housing Vacancies and Homeownership report from the Census Bureau.

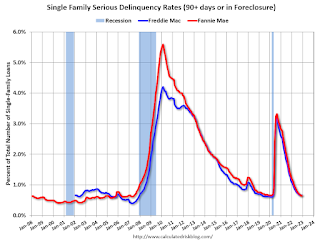

Fannie Mae: Mortgage Serious Delinquency Rate Increased Slightly in December

by Calculated Risk on 1/30/2023 02:13:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased to 0.65% in December from 0.64% in November. The serious delinquency rate is down from 1.25% in December 2021. This is at the pre-pandemic lows.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.16% are seriously delinquent (down from 2.15% in November).

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.

Freddie Mac reported earlier.

Lawler: D.R. Horton (DHI) Net Order Price Declined "Roughly" 10% from Peak

by Calculated Risk on 1/30/2023 10:04:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: D.R. Horton (DHI) Net Order Price Declined "Roughly" 10% from Peak

Brief excerpt:

From housing economist Tom Lawler:You can subscribe at https://calculatedrisk.substack.com/.

DHI’s average net order price last quarter was actually DOWN 4.1% from the comparable quarter of 2021, and was down 7.9% from the previous quarter. While some of this decline may have been related to the mix of sales, it’s worth noting that the average net order price was down YOY in all but one of the regions DHI reports on (the “East” saw no change, while the Southwest saw a 10% drop). In addition, the company on the conference call seemed to suggest that most of the recent price declines have reflected decreased prices and/or increased concessions (see below).

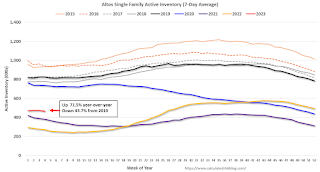

Housing January 30th Weekly Update: Inventory Decreased 1.4% Week-over-week

by Calculated Risk on 1/30/2023 08:41:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, January 29, 2023

Sunday Night Futures

by Calculated Risk on 1/29/2023 06:31:00 PM

Weekend:

• Schedule for Week of January 29, 2023

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed manufacturing surveys for January.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 5 and DOW futures are down 46 (fair value).

Oil prices were down over the last week with WTI futures at $79.68 per barrel and Brent at $86.66 per barrel. A year ago, WTI was at $88, and Brent was at $92 - so WTI oil prices are DOWN 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $3.31 per gallon, so gasoline prices are up $0.19 per gallon year-over-year.

FOMC Preview: 25bp Hike

by Calculated Risk on 1/29/2023 08:11:00 AM

Expectations are the FOMC will announce a 25bp rate increase in the federal funds rate and analysts will be looking for any mention of a possible pause in rate hikes at the March FOMC meeting.

"At the February FOMC meeting, we look for the Fed to raise the target range for the federal funds rate by 25bp to 4.50-4.75%. ... incoming data that points to a broadening of the slowdown and further signs of decelerating price pressures appear to have tipped the balance within the FOMC toward another downshift in the pace of rate hikes next week."

...

We expect Chair Powell to continue to emphasize that a slower pace of rate hikes does not signal the Fed’s job is over. ... the decision may be for a smaller 25bp hike, but the Fed will want to avoid the interpretation that this implies a lower terminal rate or an earlier onset of rate cuts than the committee viewed as appropriate when it last met in December. That means no change in policy rate guidance in the FOMC statement. We think the statement will continue to say that “ongoing increases in the target range [for the federal funds rate] will be appropriate.” A softening in this language could lead to an undesired easing in financial conditions."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 0.4 to 0.5 | 0.4 to 1.0 | 1.3 to 2.0 | 1.6 to 2.0 |

The unemployment rate was at 3.5% in December. This put the Q4 rate at 3.6%, slightly lower than the FOMC projection.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 3.7 | 4.4 to 4.7 | 4.3 to 4.8 | 4.0 to 4.7 |

As of December 2022, PCE inflation was up 5.0% from December 2021. On a Q4-over-Q4 basis PCE inflation was up 5.5% in Q4 2022. This was below the FOMC projection.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 5.6 to 5.8 | 2.9 to 3.5 | 2.3 to 2.7 | 2.0 to 2.2 |

PCE core inflation was up 4.4% in December year-over-year. On a Q4-over-Q4 basis core PCE inflation was up 4.7% in Q4 2022. This was at the bottom of the FOMC projection range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | 2025 |

| Dec 2022 | 4.7 to 4.8 | 3.2 to 3.7 | 2.3 to 2.7 | 2.0 to 2.2 |