by Calculated Risk on 2/10/2023 10:10:00 AM

Friday, February 10, 2023

Net Immigration and Household Formation

Today, in the Calculated Risk Real Estate Newsletter:

Net Immigration and Household Formation

An excerpt:

A key theme has been that household formation surged during the pandemic and has slowed recently. This surge in household formation increased demand for homeownership and for rental units - pushing up both house prices and rents.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

The recent slowdown in household formation has lowered demand, and we are already seeing this with falling asking rents.

This brief note provides an update on immigration.

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 2/10/2023 08:43:00 AM

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through January 2023. Note: This is an update to a post from a few years ago.

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.0% in January, and highest for those without a high school degree at 4.5% in January.

All four groups were generally trending down prior to the pandemic. And all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college" has been steady (and trending down lately), and both "high school" and "less than high school" have been trending down.

Based on current trends, probably half the labor force will have at least a bachelor's degree sometime next decade (2030s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, rising educational attainment is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in lower weekly claims.

A more educated labor force is a positive for the future.

Thursday, February 09, 2023

Realtor.com Reports Weekly Active Inventory Up 70% YoY; New Listings Down 11% YoY

by Calculated Risk on 2/09/2023 03:56:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Feb 4, 2023

• Active inventory growth continued to climb with for-sale homes up 70% above one year ago. Inventories of for-sale homes rose again, but climbed at a slightly slower yearly pace than last week.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 11% from one year ago. For 31 weeks now, fewer homeowners put their homes on the market for sale than at this time last year. After smaller declines in the first few weeks of the year, the gap has widened for a second week. High costs and mortgage rates can significantly up the ante for homeowners hoping to trade-up and remain in their current area.

Here is a graph of the year-over-year change in inventory according to realtor.com. NOTE: The release says active inventory is up 70% YoY, but the data shows up 79% (graph based on data).

Here is a graph of the year-over-year change in inventory according to realtor.com. NOTE: The release says active inventory is up 70% YoY, but the data shows up 79% (graph based on data).In early 2022, inventory was declining rapidly, so the year-over-year change is up sharply.

Energy expenditures as a percentage of PCE

by Calculated Risk on 2/09/2023 02:11:00 PM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Then energy expenditures increased to 2018 levels by the end of 2021.

This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures. This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

Hotels: Occupancy Rate Down 7.3% Compared to Same Week in 2019

by Calculated Risk on 2/09/2023 11:29:00 AM

U.S. hotel performance fell slightly from the previous week, according to STR‘s latest data through Feb. 4.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 29 to Feb. 4, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 55.3% (-7.3%)

• Average daily rate (ADR): $145.35 (+13.9%)

• Revenue per available room (RevPAR): $80.45 (+5.6%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after Q1.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Weekly Initial Unemployment Claims increase to 196,000

by Calculated Risk on 2/09/2023 08:33:00 AM

The DOL reported:

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 196,000, an increase of 13,000 from the previous week's unrevised level of 183,000. The 4-week moving average was 189,250, a decrease of 2,500 from the previous week's unrevised average of 191,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 189,250.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.

Wednesday, February 08, 2023

Thursday: Unemployment Claims

by Calculated Risk on 2/08/2023 08:12:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 194 thousand initial claims, up from 183 thousand last week.

U.S. Courts: Bankruptcy Filings Decline 6 Percent in 2022

by Calculated Risk on 2/08/2023 04:25:00 PM

From the U.S. Courts: Bankruptcy Filings Drop 6.3 Percent

Bankruptcy filings fell 6.3 percent for the 12-month period ending Dec. 31, 2022, continuing a fall that coincided with the start of the COVID-19 pandemic. But individual filings under Chapter 13 increased significantly.

Annual bankruptcy filings in calendar year 2022 totaled 387,721, compared with 413,616 cases in 2021, according to statistics released by the Administrative Office of the U.S. Courts.

Business filings fell 6 percent, from 14,347 to 13,481 in the year ending Dec. 31, 2022. Non-business bankruptcy filings fell 6.3 percent, to 374,240, compared with 399,269 in the previous year.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Second Home Market: South Lake Tahoe in January

by Calculated Risk on 2/08/2023 01:39:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through January 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up over 50% from the record low set in February 2022, and up 24% year-over-year. Prices are up 1.1% YoY (and the YoY change has been trending down).

1st Look at Local Housing Markets in January

by Calculated Risk on 2/08/2023 09:36:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

1st Look at Local Housing Markets in January

A brief excerpt:

This is the first look at local markets in January. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

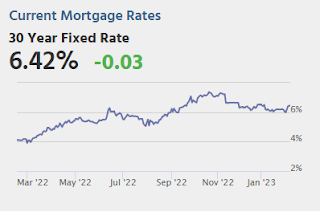

Closed sales in January were mostly for contracts signed in November and December. Since 30-year fixed mortgage rates were over 6% for all of November and December closed sales were down significantly year-over-year in January, however, the impact was probably not as severe as for closed sales in December (rates were the highest in October and November 2022 when contracts were signed for closing in December)..

...

Median sales prices for single family homes were down 2.3% year-over year (YoY) in Las Vegas, and down 3.5% YoY in San Diego and up 0.4% YoY in the Northwest (Seattle).

...

In January, sales were down 35.9%. In December, these same markets were down 42.1% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline than in December for these early reporting markets. The early data suggests NAR reported sales will rebound in January to the mid-4 million range (Seasonally adjusted annual rate) from 4.02 million SAAR in December.

This will still be a significant YoY decline, and the 17th consecutive month with a YoY decline.

Note: Even if existing home sales activity bottomed in December, there are usually two bottoms for housing - the first for activity and the second for prices. See Has Housing "Bottomed"?

Many more local markets to come!