by Calculated Risk on 2/15/2023 09:22:00 AM

Wednesday, February 15, 2023

Industrial Production Unchanged in January

From the Fed: Industrial Production and Capacity Utilization

Industrial production was unchanged in January after falling 0.6 percent and 1.0 percent in November and December, respectively. In January, manufacturing output moved up 1.0 percent and mining output rose 2.0 percent following two months with substantial decreases for each sector. The output of utilities fell 9.9 percent in January, as a swing from unseasonably cool weather in December to unseasonably warm weather in January depressed the demand for heating. At 103.0 percent of its 2017 average, total industrial production in January was 0.8 percent above its year-earlier level. Capacity utilization declined 0.1 percentage point in January to 78.3 percent, a rate that is 1.3 percentage points below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

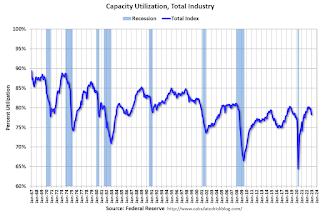

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2021. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

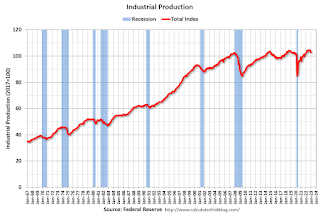

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased slightly in January to 103.0. This is above the pre-pandemic level.

The change in industrial production was below consensus expectations.

Retail Sales Increased 3.0% in January

by Calculated Risk on 2/15/2023 08:39:00 AM

On a monthly basis, retail sales were up 3.0% from December to January (seasonally adjusted), and sales were up 6.4 percent from January 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $697.0 billion, up 3.0 percent from the previous month, and up 6.4 percent above January 2022.

emphasis added

Click on graph for larger image.

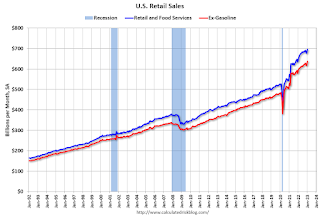

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 3.2% in January.

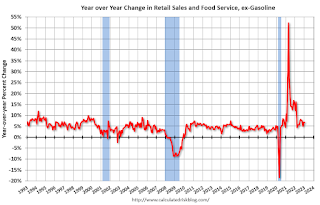

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.

Sales in January were well above expectations, however, sales in November and December were revised down, combined.

Sales in January were well above expectations, however, sales in November and December were revised down, combined.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 2/15/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 10, 2023.

... The Refinance Index decreased 13 percent from the previous week and was 76 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 43 percent lower than the same week one year ago.

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time. After five straight weeks of decreases, the 30-year fixed rate increased by 21 basis points to 6.39 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Mortgage applications decreased for the second time in three weeks because of these higher rates. Refinance borrowers, both rate/term and cash-out, remain on the sidelines as current rates provide little financial incentive to act.”

Added Kan, “Purchase applications dropped to their lowest level since the beginning of this year and were more than 40 percent lower than a year ago. Potential buyers remain quite sensitive to the current level of mortgage rates, which are more than two percentage points above last year’s levels and have significantly reduced buyers’ purchasing power.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.39 percent from 6.18 percent, with points increasing to 0.70 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

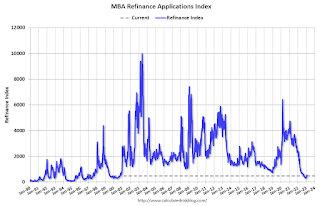

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 43% year-over-year unadjusted. This has increased a little with lower rates but is still near housing bust levels.

According to the MBA, purchase activity is down 43% year-over-year unadjusted. This has increased a little with lower rates but is still near housing bust levels.Tuesday, February 14, 2023

Wednesday: Retail Sales, Industrial Production, Homebuilder Survey, NY Fed Mfg

by Calculated Risk on 2/14/2023 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for January is scheduled to be released. The consensus is for a 1.5% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of -20.0, up from -32.9.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

• At 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 37, up from 35. Any number below 50 indicates that more builders view sales conditions as poor than good.

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.6% in January

by Calculated Risk on 2/14/2023 04:20:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in January. The 16% trimmed-mean Consumer Price Index increased 0.6% in January. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Fuel oil and other fuels" decreased at a 38% annualized rate in January, and "Used Cars" decreased at a 21% annualized rate.

Current State of the Housing Market: Overview for mid-February

by Calculated Risk on 2/14/2023 08:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market: Overview for mid-February

A brief excerpt:

Here is a graph of new listing from Realtor.com’s January Housing Trends Report showing new listings were down about 5% year-over-year in January. Although new listings are at a record low for January, the year-over-year decline was smaller in January than in Q4 2022. From Realtor.com:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/In January, the number of homes newly-listed for sale declined by 5.4% compared to the same time last year. This is a much lower rate of decline than last month’s 21.0% decrease and November’s 17.2% decrease. However, new listings remain 25.0% below pre-pandemic 2017 to 2019 levels.And the local markets I track that have reported so far, show new listings were down less in January than in December.

For these areas, new listings were down 9.2% YoY. … Last month, new listings in these markets were down 21.7% YoY. This is a significantly smaller YoY decline in new listings, and something to watch.

Core CPI ex-Shelter declines to 3.9% YoY

by Calculated Risk on 2/14/2023 08:42:00 AM

The good news is that inflation has clearly peaked. And since rents are falling faster than seasonally normal - due to the pandemic related changes in household formation - it makes sense for the short term to use core CPI ex-shelter.

NOTE: There was a surge in household formation during the pandemic, pushing up rents sharply, and now household formation has slowed sharply just as more supply will be coming on the market.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 3.9% in January, down from 4.5% in December.

BLS: CPI increased 0.5% in January; Core CPI increased 0.4%

by Calculated Risk on 2/14/2023 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5 percent in January on a seasonally adjusted basis, after increasing 0.1 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.4 percent before seasonal adjustment.Both CPI and core CPI were at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for nearly half of the monthly all items increase, with the indexes for food, gasoline, and natural gas also contributing. The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month.

The index for all items less food and energy rose 0.4 percent in January. Categories which increased in January include the shelter, motor vehicle insurance, recreation, apparel, and household furnishing s and operations indexes. The indexes for used cars and trucks, medical care, and airline fares were among those that decreased over the month.

The all items index increased 6.4 percent for the 12 months ending January; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.6 percent over the last 12 months, its smallest 12-month increase since December 2021. The energy index increased 8.7 percent for the 12 months ending January, and the food index increased 10.1 percent over the last year.

emphasis added

Monday, February 13, 2023

Tuesday: CPI

by Calculated Risk on 2/13/2023 08:58:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.5% increase in CPI, and a 0.4% increase in core CPI. The consensus is for CPI to be up 6.2% year-over-year and core CPI to be up 5.5% YoY.

Demographics for Housing are not as Favorable as Projected 3 Years Ago

by Calculated Risk on 2/13/2023 01:15:00 PM

Almost a decade ago, I was positive on household formation and new home sales in the 2020s due to demographics.

Census 2017 materially over-predicted births, materially under-predicted deaths (mainly for non-elderly adults), and somewhat over-predicted net international migration (NIM) for each of the last several years.

In 2020, the Census Bureau had four immigration alternatives: main, low, high - and no immigration.

Using recently released data for 2022 - see Net Immigration and Household Formation - we can compare the various 2020 projections for 2022 with 2022 actuals.

2022 Actual: 333,287,557

2020 Census Main: 337,342,000

2020 Census Low: 334,289,000

2020 Census High: 341,921,000

2020 Census None: 328,183,000

So, the actual was less than the low immigration projections from 3 years ago, although immigration was somewhat above housing economist Tom Lawler's projections last year. It is important to continually adjust our outlook based on updated data!