by Calculated Risk on 2/24/2023 10:07:00 AM

Friday, February 24, 2023

New Home Sales at 670,000 Annual Rate in January

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 670 thousand.

The previous three months were revised down, combined.

Sales of new single‐family houses in January 2023 were at a seasonally adjusted annual rate of 670,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.2 percent above the revised December rate of 625,000, but is 19.4 percent below the January 2022 estimate of 831,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are close to pre-pandemic levels.

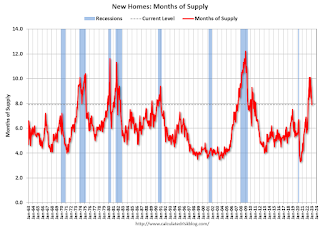

The second graph shows New Home Months of Supply.

The months of supply decreased in January to 7.9 months from 8.7 months in December.

The months of supply decreased in January to 7.9 months from 8.7 months in December. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of January was 439,000. This represents a supply of 7.9 months at the current sales rate."Sales were well above expectations of 620 thousand SAAR, however sales in the three previous months were revised down, combined. I'll have more later today.

Personal Income increased 0.6% in January; Spending increased 1.8%

by Calculated Risk on 2/24/2023 08:40:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $131.1 billion (0.6 percent) in January, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $387.4 billion (2.0 percent) and personal consumption expenditures (PCE) increased $312.5 billion (1.8 percent).The January PCE price index increased 5.4 percent year-over-year (YoY), up from 5.3 percent YoY in December, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.6 percent in January. Excluding food and energy, the PCE price index also increased 0.6 percent. Real DPI increased 1.4 percent and Real PCE increased 1.1 percent; goods increased 2.2 percent and services increased 0.6 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through January 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was below expectations, and the increase in PCE was above expectations.

Thursday, February 23, 2023

Friday: Personal Income & Outlays, New Home Sales

by Calculated Risk on 2/23/2023 08:47:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 0.9% increase in personal income, and for a 1.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 4.9% YoY, and core PCE prices up 4.3% YoY.

• At 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is that new home sales increased to 620 thousand SAAR, down from 616 thousand in December.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 66.4.

Realtor.com Reports Weekly Active Inventory Up 67% YoY; New Listings Down 18% YoY

by Calculated Risk on 2/23/2023 02:57:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending Feb 18, 2023

• Active inventory growth continued to climb with for-sale homes up 67% above one year ago. Inventories of for-sale homes rose again, on par with the yearly gains we saw last week. With new listings declining, the growing number of homes for sale reflects still-low buyer interest amid high costs rather than an influx of sellers is driving this increase. Even after these huge gains, January data show that nationwide there are still more than 40% fewer homes for sale than were available pre-pandemic, helping to explain why neither sellers nor buyers feel particularly excited about this current housing market.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 18% from one year ago. . For 33 weeks now, fewer homeowners put their homes on the market for sale than at this time last year. After smaller declines in the first few weeks of the year, the gap has widened for a fourth week, indicating lower seller interest than we saw one year ago.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year; however, the increase has slowed recently.

Hotels: Occupancy Rate Down 5.5% Compared to Same Week in 2019

by Calculated Risk on 2/23/2023 12:23:00 PM

U.S. hotel performance increased from the previous week, according to STR‘s latest data through Feb. 18.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 12-18, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 60.8% (-5.5%)

• Average daily rate (ADR): $156.10 (+19.5%)

• Revenue per available room (RevPAR): $94.94 (+12.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after the first quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Q4 GDP Growth Revised Down to 2.7% Annual Rate

by Calculated Risk on 2/23/2023 08:42:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2022 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.7 percent in the fourth quarter of 2022, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 2.1% to 1.4%. Residential investment was revised up from -26.7% to -25.9%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected a downward revision to consumer spending that was partly offset by an upward revision to nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, were revised up.

emphasis added

Weekly Initial Unemployment Claims decrease to 192,000

by Calculated Risk on 2/23/2023 08:34:00 AM

The DOL reported:

In the week ending February 18, the advance figure for seasonally adjusted initial claims was 192,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 194,000 to 195,000. The 4-week moving average was 191,250, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 189,500 to 189,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 191,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, February 22, 2023

Thursday: GDP, Unemployment Claims

by Calculated Risk on 2/22/2023 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 194 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 4th quarter 2022 (Second estimate). The consensus is that real GDP increased 2.9% annualized in Q4, unchanged from the advance estimate of 2.9%.

• Alsot at 8:30 AM, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February.

Vehicle Sales Forecast: Vehicle Sales to be up Year-over-year in February

by Calculated Risk on 2/22/2023 05:38:00 PM

From WardsAuto: U.S. Light-Vehicle Sales, Inventory Continue Upward Climb in February (pay content). Brief excerpt:

With inventory expected to record big gains by the end of the first quarter, consumers could be on the verge of seeing an easing up in pricing through a combination of greater availability of more affordable vehicles and increased incentives, especially when the industry gets into the spring selling season.

emphasis added

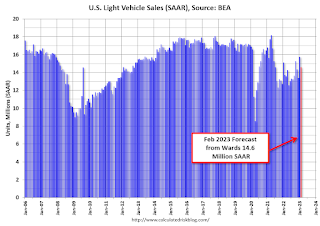

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for February (Red).

The Wards forecast of 14.6 million SAAR, would be down 7% from last month, and up 6.5% from a year ago.

FOMC Minutes: All participants continued to anticipate ongoing rate increases

by Calculated Risk on 2/22/2023 03:20:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 31–February 1, 2023. Excerpt:

In their consideration of appropriate monetary policy actions at this meeting, participants concurred that the Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy. Even so, participants agreed that, while there were recent signs that the cumulative effect of the Committee's tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee's longer-run goal of 2 percent and the labor market remained very tight, contributing to continuing upward pressures on wages and prices. Against this backdrop, and in consideration of the lags with which monetary policy affects economic activity and inflation, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting. Many of these participants observed that a further slowing in the pace of rate increases would better allow them to assess the economy's progress toward the Committee's goals of maximum employment and price stability as they determine the extent of future policy tightening that will be required to attain a stance that is sufficiently restrictive to achieve these goals. A few participants stated that they favored raising the target range for the federal funds rate 50 basis points at this meeting or that they could have supported raising the target by that amount. The participants favoring a 50-basis point increase noted that a larger increase would more quickly bring the target range close to the levels they believed would achieve a sufficiently restrictive stance, taking into account their views of the risks to achieving price stability in a timely way. All participants agreed that it was appropriate to continue the process of reducing the Federal Reserve's securities holdings, as described in its previously announced Plans for Reducing the Size of the Federal Reserve's Balance Sheet.

In discussing the policy outlook, with inflation still well above the Committee's 2 percent goal and the labor market remaining very tight, all participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee's objectives. Participants affirmed their strong commitment to returning inflation to the Committee's 2 percent objective. In determining the extent of future increases in the target range, participants judged that it would be appropriate to take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. Participants observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time.

emphasis added