by Calculated Risk on 2/27/2023 04:42:00 PM

Monday, February 27, 2023

Freddie Mac Mortgage Serious Delinquency Rate unchanged in January; Fannie Mae Decreased Slightly

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.66%, unchanged from 0.66% December. Freddie's rate is down year-over-year from 1.06% in January 2022.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.64% in January from 0.65% in December. The serious delinquency rate is down from 1.17% in January 2022. This is at the pre-pandemic lows.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

Measures of Shelter in the CPI and PCE price indexes Still Increasing

by Calculated Risk on 2/27/2023 12:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Measures of Shelter in the CPI and PCE price indexes Still Increasing

Brief excerpt:

While asking rents are falling, the measures of shelter in the CPI and PCE price indexes keep rising. This is because these measures include renewals, whereas the various private measures of monthly rents are for new leases.You can subscribe at https://calculatedrisk.substack.com/.

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report (both through January 2023):.

Shelter was up 7.9% year-over-year in January, and housing (PCE) was up 8.0% YoY in January.

However, there is more impacting rents than the normal lag between new leases and renewals.

NAR: Pending Home Sales Increased 8.1% in January; Down 24.1% Year-over-year

by Calculated Risk on 2/27/2023 10:05:00 AM

From the NAR: Pending Home Sales Improved for Second Straight Month, Up 8.1% in January

Pending home sales improved in January for the second consecutive month, according to the National Association of REALTORS®. All four U.S. regions posted monthly gains but saw year-over-year drops in transactions.Expectations had been for a 1.0% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 8.1% to 82.5 in January. Year-over-year, pending transactions dropped by 24.1%. An index of 100 is equal to the level of contract activity in 2001.

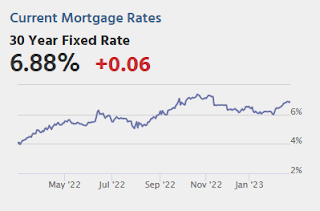

“Buyers responded to better affordability from falling mortgage rates in December and January,” said NAR Chief Economist Lawrence Yun.

...

The Northeast PHSI rose 6.0% from last month to 68.7, a decline of 19.8% from January 2022. The Midwest index grew 7.9% to 83.3 in January, a drop of 21.1% from one year ago.

The South PHSI increased 8.3% to 99.2 in January, dipping 24.7% from the prior year. The West index elevated 10.1% in January to 66.2, diminishing 29.3% from January 2022.

emphasis added

Housing February 27th Weekly Update: Inventory Decreased 1.6% Week-over-week

by Calculated Risk on 2/27/2023 08:34:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, February 26, 2023

Monday: Pending Home Sales, Durable Goods

by Calculated Risk on 2/26/2023 06:23:00 PM

Weekend:

• Schedule for Week of February 26, 2023

Monday:

• At 8:30 AM ET, Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 1.0% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down (fair value).

Oil prices were down over the last week with WTI futures at $76.32 per barrel and Brent at $83.16 per barrel. A year ago, WTI was at $92, and Brent was at $101 - so WTI oil prices are DOWN 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.32 per gallon. A year ago, prices were at $3.59 per gallon, so gasoline prices are down $0.27 per gallon year-over-year.

High Frequency Indicators: Airlines Back to Pre-Pandemic Levels, Movie Tickets Still Down

by Calculated Risk on 2/26/2023 11:24:00 AM

I stopped the weekly updates of high frequency indicators at the end of 2022. Here is a look at two indicators that were still below pre-recession levels as of last December.

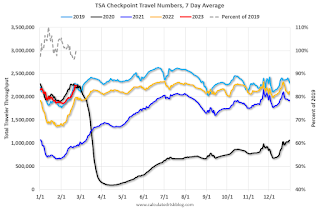

The TSA is providing daily travel numbers.

This data is as of February 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Orange) and 2023 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is at the same level as the same week in 2019 (99.7% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales are running about 30% below the pre-pandemic levels.

Saturday, February 25, 2023

Real Estate Newsletter Articles this Week: "New Home Average Prices Down 5.3% Year-over-year"

by Calculated Risk on 2/25/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increase to 670,000 Annual Rate in January New Home Average Prices Down 5.3% Year-over-year

• NAR: Existing-Home Sales Decreased to 4.00 million SAAR in January

• Final Look at Local Housing Markets in January

• First time ever more "Built-for-Rent" Units started Quarterly than "Built-for-Sale"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of February 26, 2023

by Calculated Risk on 2/25/2023 08:11:00 AM

The key reports this week are Case-Shiller house prices and February vehicle sales.

For manufacturing, the January ISM Index, and the February Dallas and Richmond Fed manufacturing surveys will be released.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.0% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

9:00 AM: FHFA House Price Index for December 2022. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.0% year-over-year increase in the Comp 20 index for December, down from 6.8% in November.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.0, up from 47.4 in January.

10:00 AM: Construction Spending for December. The consensus is for a 0.2% increase in construction spending.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 197 thousand initial claims, up from 192 thousand last week.

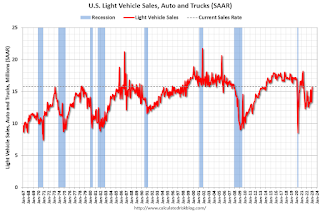

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 15.0 million SAAR in February, down from 15.7 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 15.0 million SAAR in February, down from 15.7 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: the ISM Services Index for February.

Friday, February 24, 2023

COVID Feb 24, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 2/24/2023 09:27:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

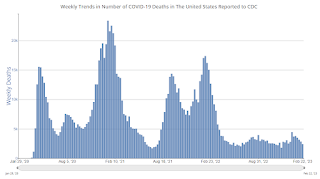

| New Cases per Week2 | 235,131 | 259,947 | ≤35,0001 | |

| Hospitalized2 | 21,731 | 23,050 | ≤3,0001 | |

| Deaths per Week2 | 2,407 | 2,838 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Black Knight: Mortgage Delinquencies Decreased in January

by Calculated Risk on 2/24/2023 04:24:00 PM

• January performance data showed a slight decrease (-10 basis points) in the national delinquency rate month-over-month, which is now down 15.1% year over yearAccording to Black Knight's First Look report, the percent of loans delinquent decreased 2.3% in January compared to December and decreased 15% year-over-year.

• Foreclosure starts saw a fourth straight increase, but remain 37% below pre-pandemic levels; active foreclosures are up 20% since January 2022, but they too remain nearly 20% below pre-pandemic levels

• As purchase and refinance lending continue to face interest rate headwinds, prepayment activity hit yet another record low in January, dating back to at least 2000 when Black Knight began reporting the metric

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.38% in January, down from 3.48% in December.

The percent of loans in the foreclosure process increased slightly in December to 0.45%, from 0.44% in December.

The number of delinquent properties, but not in foreclosure, is down 289,000 properties year-over-year, and the number of properties in the foreclosure process is up 48,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2023 | Dec 2022 | Jan 2022 | Jan 2021 | |

| Delinquent | 3.38% | 3.48% | 3.98% | 7.08% |

| In Foreclosure | 0.45% | 0.44% | 0.37% | 0.41% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,775,000 | 1,827,000 | 2,063,000 | 3,701,000 |

| Number of properties in foreclosure pre-sale inventory: | 238,000 | 232,000 | 190,000 | 212,000 |

| Total Properties | 2,012,000 | 2,058,000 | 2,254,000 | 3,913,000 |