by Calculated Risk on 3/02/2023 11:57:00 AM

Thursday, March 02, 2023

Hotels: Occupancy Rate Down 1.5% Compared to Same Week in 2019

U.S. hotel performance increased from the previous week, according to STR‘s latest data through Feb. 25.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 19-25, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 64.2% (-1.5%)

• Average daily rate (ADR): US$156.51 (+22.2%)

• Revenue per available room (RevPAR): US$100.43 (+20.3%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after Q1.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Year-over-year Rent Growth Continues to Decelerate

by Calculated Risk on 3/02/2023 09:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Year-over-year Rent Growth Continues to Decelerate

A brief excerpt:

The rental market has changed significantly from 2021 and the first half of 2022.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through January 2023, except CoreLogic is through December and Apartment List is through February 2023.

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

The CoreLogic measure is up 6.4% YoY in December, down from 7.5% in November, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 6.9% YoY in January, down from 7.5% YoY in December, and down from a peak of 17.0% YoY in February 2022.

The ApartmentList measure is up 3.0% YoY as of February, down from 3.3% in January, and down from a peak of 18.0% YoY November 2021.

...

Rents are still increasing YoY, and we should expect this to continue to spill over into measures of inflation. The Owners’ Equivalent Rent (OER) was up 7.8% YoY in January, from 7.5% YoY in November - and might increase further in the coming months even as rents slow.

Weekly Initial Unemployment Claims decrease to 190,000

by Calculated Risk on 3/02/2023 08:35:00 AM

The DOL reported:

In the week ending February 25, the advance figure for seasonally adjusted initial claims was 190,000, a decrease of 2,000 from the previous week's unrevised level of 192,000. The 4-week moving average was 193,000, an increase of 1,750 from the previous week's unrevised average of 191,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 193,000.

The previous week was unrevised.

Weekly claims were below the consensus forecast.

Wednesday, March 01, 2023

Thursday: Unemployment Claims

by Calculated Risk on 3/01/2023 08:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 197 thousand initial claims, up from 192 thousand last week.

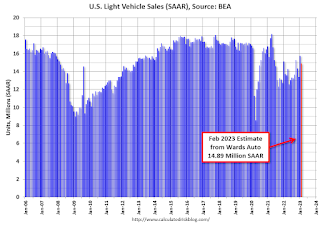

Vehicles Sales at 14.89 million SAAR in February

by Calculated Risk on 3/01/2023 06:04:00 PM

Wards Auto released their estimate of light vehicle sales for February: U.S. Light-Vehicle Sales Record Another Gain in February, Beating Expectations (pay site).

Wards Auto estimates sales of 14.89 million SAAR in February 2023 (Seasonally Adjusted Annual Rate), down 5.4% from the January sales rate, and up 8.6% from February 2022.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for February (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased late last year due to supply issues. It appears the "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Freddie Mac House Price Index Declines for 7th Consecutive Month in January

by Calculated Risk on 3/01/2023 10:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Declines for 7th Consecutive Month in January

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) declined for the seventh consecutive month on a seasonally adjusted basis in January, putting the National FMHPI down 2.7% from its June 2022 peak, and down 5.3% Not Seasonally Adjusted (NSA) from the peak.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

On a year-over-year basis, the National FMHPI was up 2.4% in January, down from 4.4% YoY in December. The YoY increase peaked at 19.2% in July 2021.

In January, 37 states and D.C. were below their 2022 peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-9.6%), Arizona (-8.3%), D.C. (-7.3%), Washington (-7.2%), Nevada (-7.2%), California (-6.6%), Utah (-6.5%), and Colorado (-5.8%).

...

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller, and based on the recent trend, the FMHPI will be negative year-over-year in March (reported at the end of April) - and Case-Shiller will follow soon after.

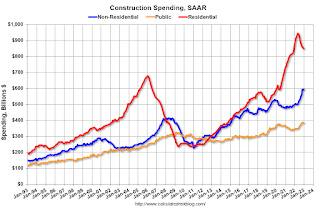

Construction Spending Decreased 0.1% in January

by Calculated Risk on 3/01/2023 10:17:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during January 2023 was estimated at a seasonally adjusted annual rate of $1,825.7 billion, 0.1 percent below the revised December estimate of $1,827.5 billion. The January figure is 5.7 percent above the January 2022 estimate of $1,726.6 billion.Private spending was "virtually unchanged" and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,442.6 billion, virtually unchanged from the revised December estimate of $1,442.0 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $383.1 billion, 0.6 percent below the revised December estimate of $385.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 9.4% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is close to the recent peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 3.9%. Non-residential spending is up 19.1% year-over-year. Public spending is up 11.1% year-over-year.

ISM® Manufacturing index Increased to 47.7% in February

by Calculated Risk on 3/01/2023 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 47.7% in February, up from 47.4% in January. The employment index was at 49.1%, down from 50.6% last month, and the new orders index was at 47.0%, up from 42.5%.

From ISM: Manufacturing PMI® at 47.7%

February 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in February for the fourth consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in February. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The February Manufacturing PMI® registered 47.7 percent, 0.3 percentage point higher than the 47.4 percent recorded in January. Regarding the overall economy, this figure indicates a third month of contraction after a 30-month period of expansion. In the last two months, the Manufacturing PMI® has been at its lowest levels since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 47 percent, 4.5 percentage points higher than the figure of 42.5 percent recorded in January. The Production Index reading of 47.3 percent is a 0.7-percentage point decrease compared to January’s figure of 48 percent. The Prices Index registered 51.3 percent, up 6.8 percentage points compared to the January figure of 44.5 percent. The Backlog of Orders Index registered 45.1 percent, 1.7 percentage points higher than the January reading of 43.4 percent. The Employment Index dropped into contraction territory, registering 49.1 percent, down 1.5 percentage points from January’s 50.6 percent. The Supplier Deliveries Index figure of 45.2 percent is 0.4 percentage point lower than the 45.6 percent recorded in January; readings from the last three months are the index’s lowest since March 2009 (43.2 percent). The Inventories Index registered 50.1 percent, 0.1 percentage point lower than the January reading of 50.2 percent. The New Export Orders Index reading of 49.9 percent is 0.5 percentage point higher than January’s figure of 49.4 percent. The Imports Index continued in contraction territory at 49.9 percent, 2.1 percentage points above the January reading of 47.8 percent.”

emphasis added

MBA: Mortgage Purchase Applications Decreased, Lowest Level Since 1995

by Calculated Risk on 3/01/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 24, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 6 percent from the previous week and was 74 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 44 percent lower than the same week one year ago.

“The 30-year fixed rate increased to 6.71 percent last week, the highest rate since November 2022, which drove a 6 percent drop in applications. After a brief revival in application activity in January when mortgage rates dropped down to 6.2 percent, there has now been three straight weeks of declines in applications as mortgage rates have jumped 50 basis points over the past month,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Data on inflation, employment, and economic activity have signaled that inflation may not be cooling as quickly as anticipated, which continues to put upward pressure on rates.”

Added Kan, “Both purchase and refinance applications declined last week, with purchase index at a 28- year low for a second consecutive week. Purchase applications were 44 percent lower than a year ago, as homebuyers again retreat to the sidelines as higher rates crimp affordability. Refinance applications account for less than a third of all applications and remained more than 70 percent behind last year’s pace, as a majority of homeowners are already locked into lower rates.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Tuesday, February 28, 2023

Wednesday: ISM Mfg, Construction Spending

by Calculated Risk on 2/28/2023 08:39:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.0, up from 47.4 in January.

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.2% increase in construction spending.